Highlights:

- Brazil has become the first nation to debut a spot XRP ETF, ahead of the United States.

- Hashdex’s XRP ETF (XRPH11) follows the spot price of XRP, with a net worth of $40M.

- U.S. market could follow Brazil’s lead as XRP ETF approval nears.

Brazil has emerged as the first country to launch a spot XRP Exchange Traded Fund (ETF), ahead of the United States. The ETF, which reflects the spot price of XRP, debuted on Brazil’s B3 exchange on April 25, as reported by Valor Econômico. The ETF, named Hashdex Nasdaq XRP Fundo de Índice (FI), is managed by the Brazilian asset manager Hashdex. It is administered by Genial Investments Securities Brokerage SA, with Genial Bank SA serving as the custodian.

🚀 XRPH11 – The world's first XRP ETF. Another crypto milestone on the Brazilian stock exchange! 🇧🇷

Hashdex just launched XRPH11, giving investors secure and regulated access to $XRP — one of the leading #crypto assets focused on fast, low-cost international payments. pic.twitter.com/kpokQP5NM4

— Hashdex (@hashdex) April 25, 2025

Hashdex gained approval from Brazil’s Securities and Exchange Commission (CVM) in February to launch the XRP-linked fund. After receiving regulatory approval, the fund entered a pre-operational phase, where it wasn’t yet trading but was preparing for launch.

The ETF, which is now listed on B3 with the ticker XRPH11, follows the XRP Reference Price Index (NQXRP). This index follows XRP’s spot price across major crypto exchanges, as stated in the fund’s documents.

The fund plans to allocate a minimum of 95% of its net assets to XRP, related digital assets, and index-linked securities or futures contracts. XRPH11’s current net worth stands close to $40 million. Investors are charged a 0.8% annual management fee, alongside a 0.7% maximum global fee and a 0.1% custodian fee. The fund does not include any structuring fee.

Hashdex Launches Ninth ETF on B3 Exchange

The launch of the Hashdex Nasdaq XRP Fund de Índice makes it the ninth exchange-traded fund managed by Hashdex on the B3 exchange. Samir Kerbage, Chief Investment Officer at Hashdex, mentioned that XRPH11 joins the company’s range of single-asset ETFs, which also includes Bitcoin (BITH11), Solana (SOLH11), and Ethereum (ETHE11). Institutional investors seeking digital asset exposure through Brazil’s regulated markets will invest in these funds.

Brazil XRP Spot ETF Boosts Hope for US Approval

XRP originated in the United States, but there is still no spot ETF available for U.S. investors. This is despite the recent launch of a leveraged XRP ETF product last week. Ripple has made progress in resolving its legal issues with the U.S. Securities and Exchange Commission (SEC).

The SEC has dropped its appeal in the case, and both parties are now negotiating a settlement. Ripple will pay a $50 million fine under the proposed agreement, significantly reduced from the original $125 million penalty. This development has increased optimism that the SEC may soon approve a spot XRP ETF.

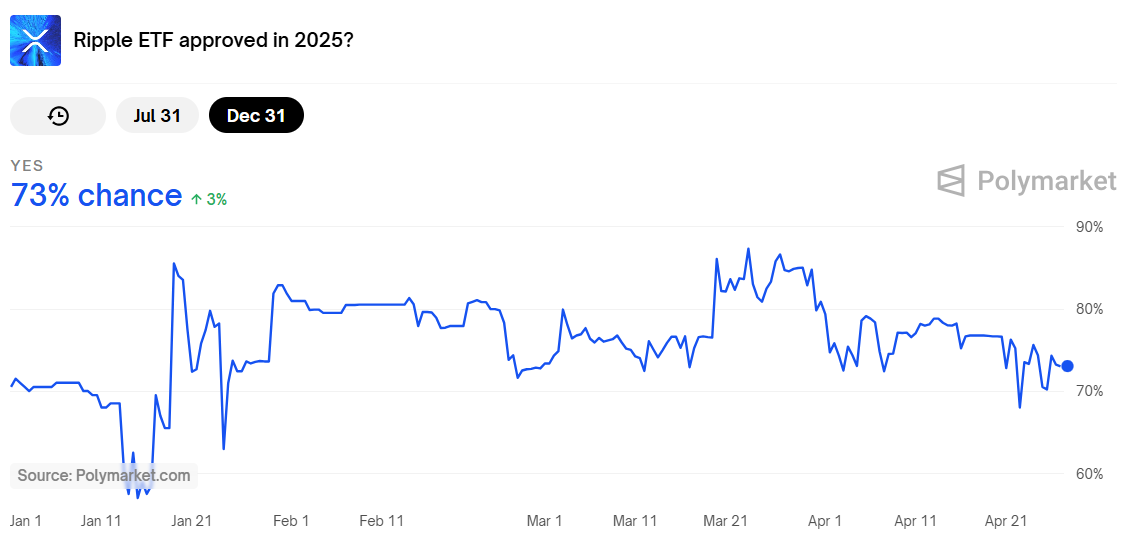

For context, firms like Grayscale and Franklin Templeton have applied for XRP spot ETFs as the regulatory environment improves. With Brazil leading the way, the United States may soon follow suit to meet the demand from investors seeking exposure to this product. Market predictions suggest a 73% chance of approval in the U.S. shortly.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.