Highlights:

- The BNB price has climbed back above $ 1,000, currently at $ 1,004, marking a 3% surge.

- The AFSA-licensed institutional investment platform has chosen Binance Kazakhstan as its partner and BNB as its first asset.

- The technical outlook suggests a potential bullish continuation towards $1200 soon.

The BNB price is in the green zone, trading above the $ 1,000 mark at $ 1,004, marking a 3% gain. An all-time high aids this rebound in the stablecoin market cap. Meanwhile, Kazakhstan and Binance have collaborated to develop the ALEM Crypto Fund, which will make Kazakhstan a key global player in the digital money arena.

This AFSA-licensed platform offers a range of institutional investments and state digital reserves as Kazakhstan aims to reshape the digital assets landscape. The partnership also reinforces Binance’s strategic importance to the country’s digital asset strategy, with BNB (Binance Coin) being picked as the first investment asset.

Kazakhstan is setting the pace in digital finance! 🇰🇿

This AFSA-licensed platform for institutional investment & state digital reserves has chosen Binance Kazakhstan as a partner and $BNB as its first asset.

Read more 👉 https://t.co/ro7Y0qvaBm pic.twitter.com/fD2jrQfY1V

— Richard Teng (@_RichardTeng) September 29, 2025

The government of Kazakhstan is planning to offer reliable, long-term opportunities for institutional and retail investors in crypto assets, given the increasing demand in the sector. Kazakhstan’s participation in the initiative strengthens its cryptocurrency standing while making it a safe and regulated environment for blockchain investments.

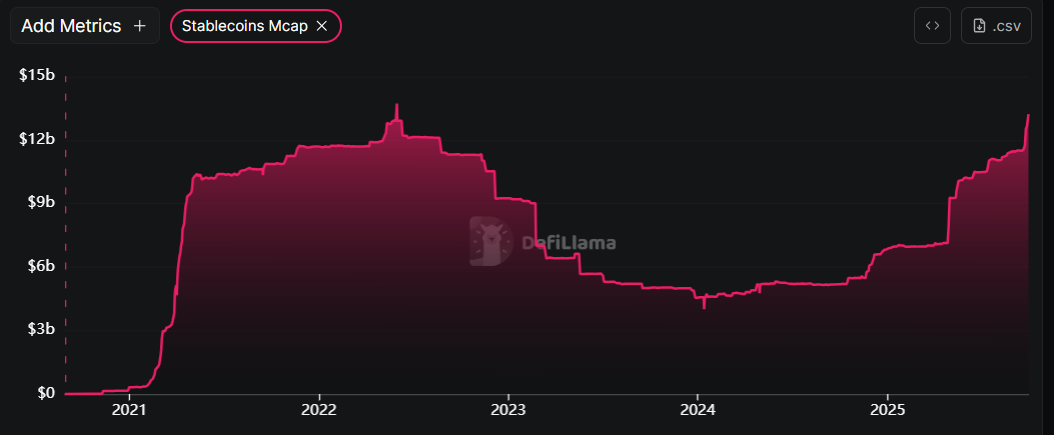

BNB Stablecoin MarketCap Hits Record Highs

On the other hand, the BNB stablecoin market cap has surged to $13.22 billion. The positive influences of stablecoin activity and value rise on the BNB project suggest a bullish outlook for the digital asset. Besides its price activity, the stablecoin benefit boosts the network and creates more usage. This can also attract more users into the ecosystem.

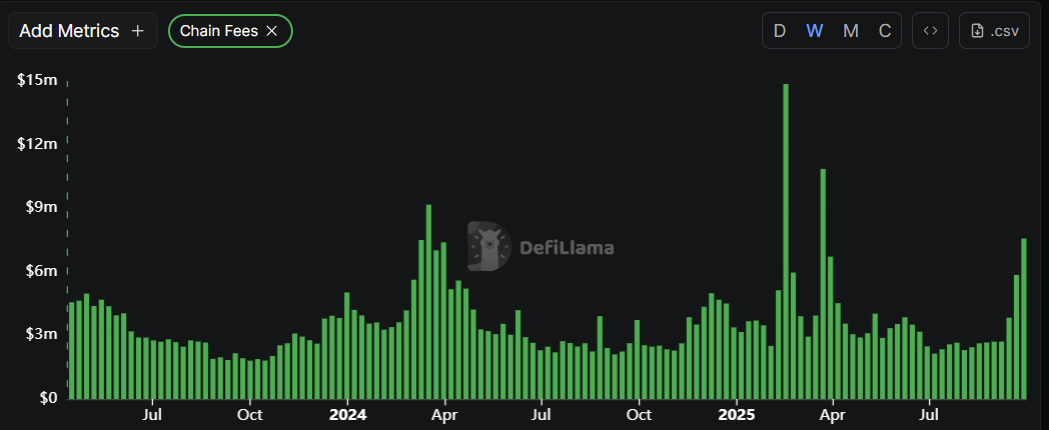

Notably, BNB’s weekly fee collection reached a peak of $7.58 million last week, according to DefiLlama data. This marks the highest weekly collection since April, indicating that traders and liquidity on the BNB chain are on the rise.

The BNB price has rebounded above the $1,000 mark, trading well within a rising parallel channel. Often, a parallel channel signals a potential bullish continuation. Meanwhile, the bulls have established a strong support zone around the $885 and $712 marks, giving them wings for further upside.

The Relative Strength Index (RSI) of 61.58 further affirms the positive outlook for the BNB price. However, the Moving Average Convergence Divergence (MACD) indicator, which stands firmly below the signal line, shows a bearish divergence. This cautions traders and investors of a potential selling pressure if the MACD doesn’t change.

Is a Rally to $1,200 Plausible for BNB Price?

The 3% surge could signal the start of a rally, especially if social media hype intensifies. A break above $ 1,045 might send the BNB price to $ 1,200 or higher. Meanwhile, with the MACD indicator suggesting a sell signal, a drop below $958 could trigger a retreat to $885.

Trading volume is spiking too, with a 15% surge in the last 24 hours, suggesting strong buying pressure that confirms bulls are in the order books. In the short term, the BNB price may continue its rally to $ 1,200 if momentum holds, but traders will want to watch those support levels around $958. If the price closes below this level, the token may drop lower to $885, erasing all the gains as a safety net.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.