Highlights:

- The BNB price has dived below $870, as the crypto market tumbles.

- The recent dip comes in reaction to the hawkish rate cut offered by the Federal Reserve (Fed).

- The technical outlook shows potential downside if the $865 support breaks.

The Binance Coin(BNB) price is continuing to decline, trading at $868, marking a 2.29% drop in the past 24 hours. This comes as the risk mood across the crypto market started to decline in reaction to the hawkish rate cut offered by the Federal Reserve (Fed). The negative on-chain and derivatives data is also an indicator of a downward tone, and this could mean that BNB will experience further downward movements in the next few days.

The wider crypto market toned down following the Federal Open Market Committee (FOMC) meeting on Wednesday. As was widely anticipated, the US Federal Reserve (Fed) reduced interest rates by 25 basis points to 3.50%-3.75% at the conclusion of its two-day policy meeting. However, it indicated that it is likely to pause in January.

🚨JUST ANNOUNCED: The Federal Reserve just cut interest rates by 0.25 points, lowering interest rates to 3.5%-3.75% #FOMC

The Fed Chair Jerome Powell: "Today, the interest rate will be lowered by 25 basis points (0.25%)." pic.twitter.com/NSDafcaMNy

— AJ Huber (@Huberton) December 10, 2025

This aggressive reduction in the rate and the reserved nature of the Fed stimulated a minor risk-off mood, which was intensified by poor post-US market performances of Oracle. All these riskier assets, and key cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and BNB plunged, causing a bearish stance in the market.

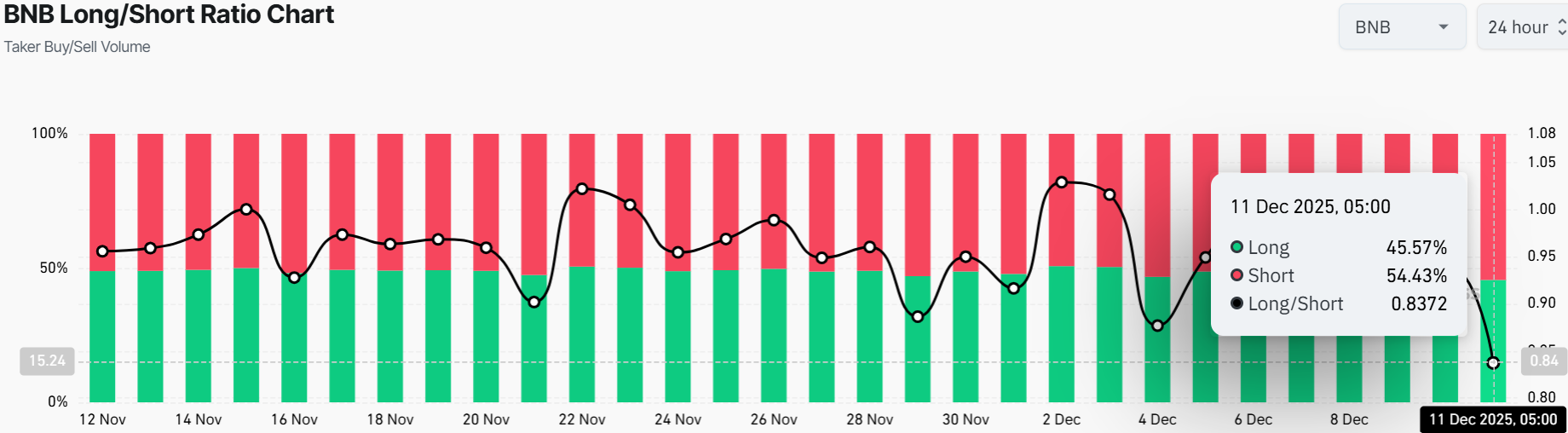

Meanwhile, CoinGlass data indicates that BNB has a long-to-short ratio of 0.84 on Thursday. This is a ratio that is less than one, and it indicates negative sentiment in the markets since the majority of traders are betting on the price of the assets to decline.

BNB Price Risk Further Downside if $865 Support Cracks

Technically, BNB price action has been choppy after the recent Federal rate cut. The daily chart shows the price currently at $868, down 4% over the past seven days and sitting under the 50-day Simple Moving Average (SMA) at $952.

Mostly, the moving averages are important for traders and investors, as they help signal the overall direction of the market. BNB’s price is currently sandwiched between the SMAs, showing a tug-of-war in the market. However, the bulls still have some strength, reinforced by the 200-day SMA at $865. If this area holds firm, the path may open to $930 and possibly even a retest of the $952 level, which is the short-term 50-day SMA.

The momentum indicators are still bearish. The RSI is under 50 (currently 42.37), showing that bears hold the edge. On the downside, if the $865 support zone cracks, the BNB price could be poised for further downside towards $825-$728 zones.

In summary, the Binance Coin could stay volatile. If buyers hold the $865 zone and push past the immediate resistance at $930, the price may recover toward $952 quickly. However, the negative sentiment reinforced by the Fed rate cut has shaken the crypto market. The next move could decide whether BNB rebounds or dives toward further lows.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.