Highlights:

- The BNB price is eyeing the $1,000 mark, as it has hit $955, marking 3% rise.

- The surging open interest shows growing investor confidence.

- The overbought RSI cautions traders not to be greedy, as a pullback or consolidation may occur.

The BNB price is upholding a strong bullish muscle, soaring 3% to $955 mark. Its daily trading volume has notably surged 36% to $3.31 billion, showing growing investor confidence. Meanwhile, the last three months of Binance Coin (BNB) market sentiment have been highly positive. This has been characterized by significant price growth and increased open interest.

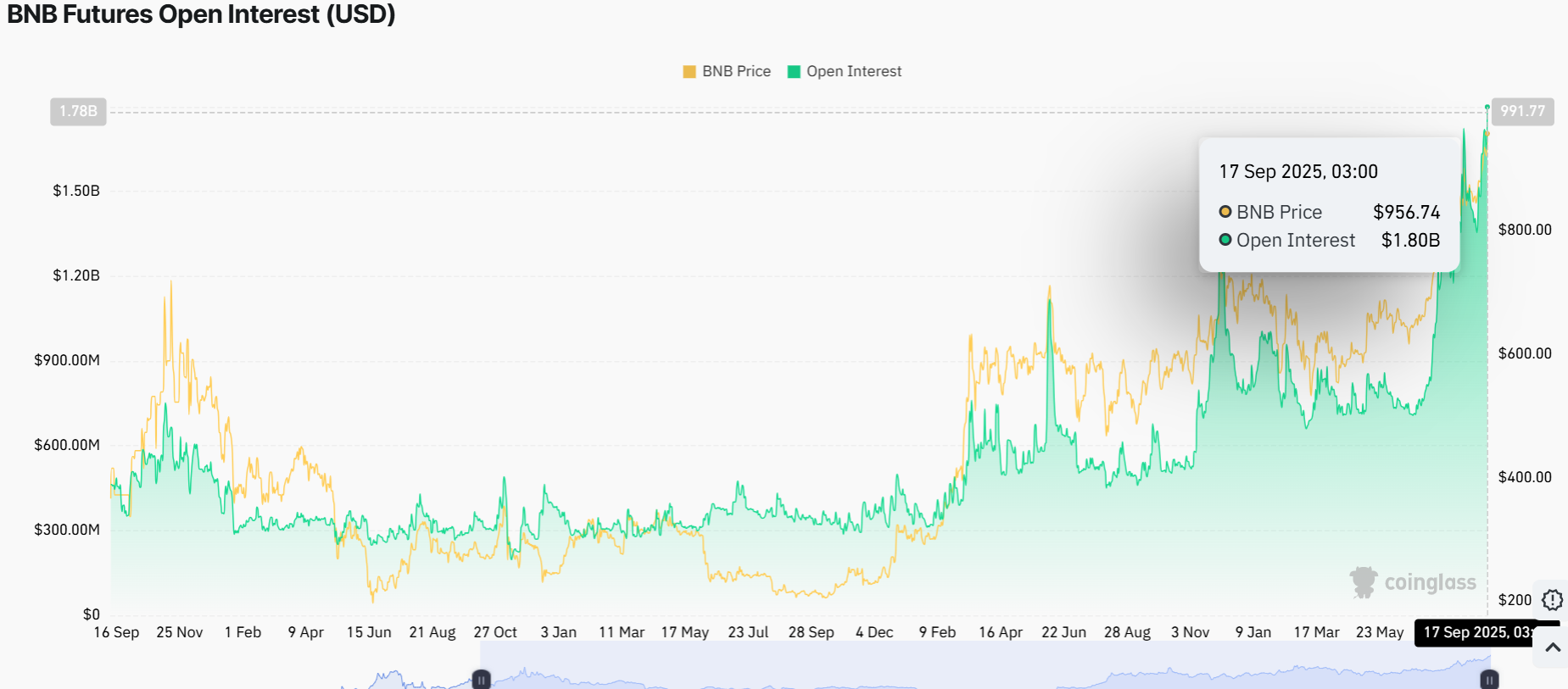

In the first chart, the price and open interest dynamics of BNB futures show that over the last few months, BNB’s price has steadily increased, as of September 17, 2025, hovering around $956.74. At the same time, open interest (as reflected by the green line) has increased to $1.8 billion.

The most important thing to note from this chart is how positively open interest correlates with BNB’s price growth. We can also see that as BNB prices surge, the open interest spikes in popularity nearly simultaneously. This means that many current traders are suddenly taking long positions. This is a good sign in the sense that BNB will continue to grow based on expectations. When traders go long with futures contracts, it indicates their confidence that the BNB price will continue to surge.

BNB Derivatives Long/Short Ratio Outlook

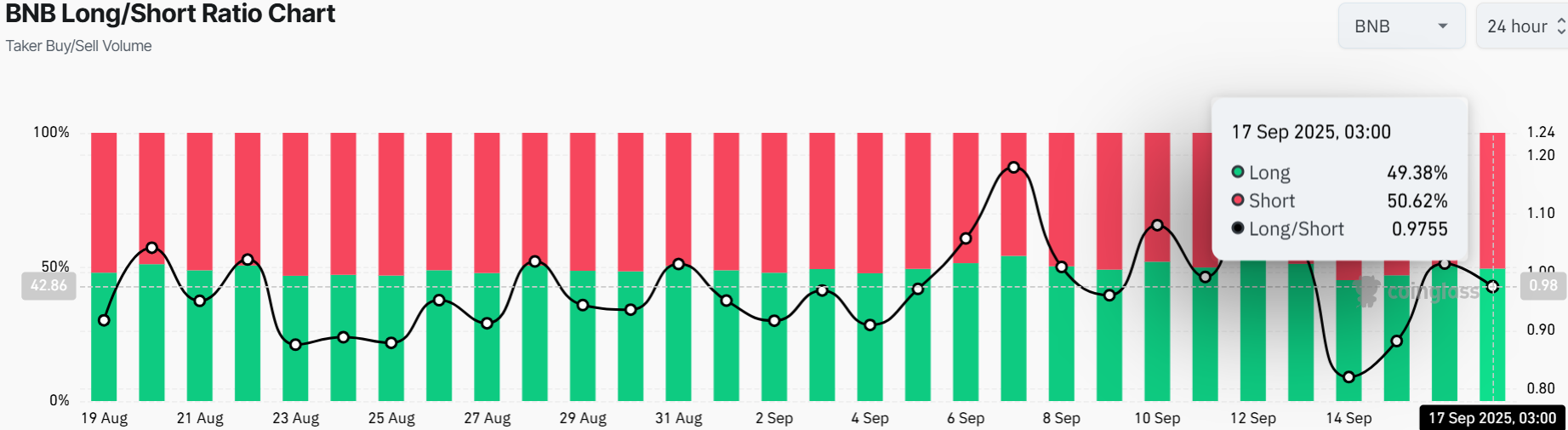

The BNB long-to-short ratio indicates a relatively close-to-balanced market with only a slight edge going toward short positions. The short position has garnered 50.62% of the trades, while the long position has 49.38%, marking a 1:1 ratio. In other words, there are almost equal numbers of traders betting on price increases or decreases.

The edge goes to shorts as the market sentiment is cautious. There is a lot on the line for traders right now as green bars (long positions) and red bars (short positions) are packed together throughout September without much wiggle room and separation. These short position percentages likely reflect traders’ awareness that the downward corrective move could take them off guard if they aren’t prepared now to hedge.

BNB Price Prediction: Is $1000 Plausible?

The BNB price is showing strength within a rising channel, at $954, as the bulls inch toward $1000 mark. Further, the strong support zones at $847 and $693 paint the market bullish as they give bulls strength for more upside.

At the same time, the Relative Strength Index (RSI) stands at 70.95, indicating overbought conditions. This suggests that while strong bullish momentum has got investors excited for price gains, there may be some resistance or consolidation at these levels. Meanwhile, the RSI-based moving average stands at 62.71, which is not as heated. This signals there’s room for growth without overextension immediately.

There are several supports at $847 (50-day SMA) and $693 (200-day SMA), which have held strong. In the short term, BNB price might test the $1000 all-time high (ATH), especially if volume spikes. Long-term, if it breaks past the ATH, the crypto might soar to the $2,000 target by the end of the year. However, an overextension could pull the BNB price back to $900. The RS hitting 70 is a heads-up to stay sharp.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.