Highlights:

- BNB Chain now has more active USDT addresses than TRON, with almost 12 million wallets.

- Ethereum users are shifting to faster alternatives like BNB and TRON due to high fees.

- BNB Chain stands out in USDT usage and holds $7.12 billion in liquidity despite smaller supply.

Binance BNB Chain is now the top network for active USDT addresses, surpassing TRON. According to the latest data from CryptoRank around 31.1 million wallets interacted with USDT across various blockchains in the past month. BNB Chain reached over 12 million active addresses, rising from 11.6 million in February. This surge in activity highlights BNB Chain’s growing appeal for everyday transactions.

TRON has 11.2 million active addresses, while Ethereum has 1.8 million. USDT users favor BNB for its fast, low-cost transactions that offer financial benefits not found with other networks. As BNB Chain’s adoption grows, it is poised to become a dominant force in the stablecoin market.

BNB Chain is growing in stablecoin use with more active addresses this quarter. Its zero-fee trading on BNB Wallet until September is helping. USDT use stays strong on Binance, even after EU pair removals. Binance Pay and other transfers fill the gap from EU traders. The increasing USDT turnover shows the chain is active, not dead.

BNB Chain hits 12M active USDT addresses

In the last 30 days, @BNBCHAIN recorded 12M active $USDT addresses, while the total number of unique active $USDT addresses across all chains reached 31.1M.

Together, @BNBCHAIN and @trondao account for 74% (23.2M) of all active $USDT… pic.twitter.com/gtmnTjywKg

— CryptoRank.io (@CryptoRank_io) April 20, 2025

BNB Chain Strengthens Its Position in Southeast Asia as USDT Leads Stablecoin Market

BNB Chain and TRON are seeing strong stablecoin use in Southeast Asia, especially for $100–$1,000 transfers. This demand shows the region is growing with active users and app development. BNB Chain, part of the Binance ecosystem, stayed active despite a slight outflow of stablecoins. It holds $7.12 billion in stablecoin liquidity, still behind Ethereum and TRON. However, it leads in active USDT usage, showing strong user engagement.

USDT continues to play a crucial role in transfers to Binance’s centralized exchange. It is also in high demand on PancakeSwap, the ecosystem’s busiest decentralized exchange. USDT facilitates WBNB trading and various swap pairs involving other stablecoins. It remains the leading stablecoin, with a total supply of 141 billion tokens as of April. It surpasses USDC in activity, although both stablecoins have seen growth over the past year. Stablecoins are increasingly replacing BTC and ETH as preferred payment methods.

BNB Surges as 1.57M Tokens Burned Amid Rising USDT Activity

As USDT activity continues to grow on BNB Chain, the network has also completed its 31st token burn. In the latest burn event, around 1.57 million BNB tokens were taken out of circulation, with a total estimated value of $916 million.

Understanding BNB's deflationary mechanism: @BNBChain has already burned over 61M tokens through its Auto-Burn process! @Binance continues to execute one of crypto's most consistent token burn programs. pic.twitter.com/JL76hkI4NS

— CoinMarketCap (@CoinMarketCap) April 16, 2025

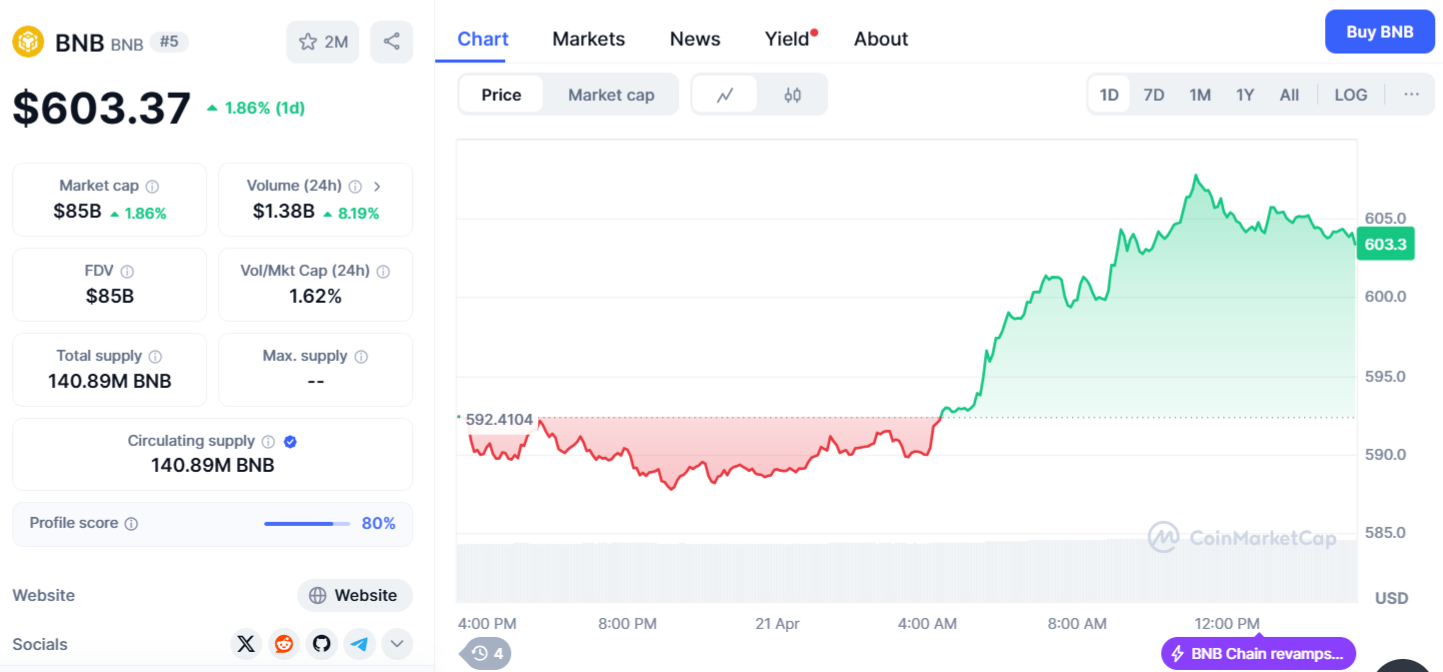

The burn is part of BNB’s plan to reduce its supply and boost value over time. Currently, BNB’s total supply is about 140.89 million, with over 40 million more tokens set for future burns. BNB is trading at around $603, with a 1.86% rise in the last 24 hours.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.