Highlights:

- Blockchain Group plans to expand its Bitcoin holdings, using €63.3 million realized from one of its most recent bond issuances.

- The AI company will use 5% of the raised capital to offset operational expenses and management costs.

- Blockchain Group now owns 1,437 BTC after completing its Bitcoin expansion exercise.

European Strategy, Blockchain Group has increased its Bitcoin (BTC) holdings with proceeds from a recent bond issuance. The data intelligence and artificial intelligence (AI) firm announced the move in a May 26 press release, sparking widespread reactions amid soaring institutional interest in BTC.

🇪🇺 EUROPE’S MICROSTRATEGY, THE BLOCKCHAIN GROUP JUST RAISED €63.3 MILLION TO BUY MORE #BITCOIN

THIS IS WILD!!! 🚀 pic.twitter.com/JDtkFwutrw

— Vivek⚡️ (@Vivek4real_) May 26, 2025

Blockchain Group’s Bonds Issuance Details

In its press release, Blockchain Group noted that it has issued convertible bonds worth €63.3 million, targeting some selected individuals. The estimated issuance amount was fixed at €5,000,000 based on BTC’s market value of €100,000. The bonds will attract zero interest rates with a nominal or subscription rate of EUR 1.

The AI company said investors should anticipate bond maturation after five years of subscribing to it. Blockchain group also made provisions for bond conversion. Notably, the conversion will cost 3,809€ per action. The OCAs (Convertible Bonds into Shares) can be freely transferred and share the same rights as the company’s ordinary shares, with no collateral.

Meanwhile, the data intelligence firm specified conditions for only bondholders’ conversion, which must be on or before May 25, 2028. For conversions involving the bondholder or the issuer, the Blockchain group highlighted similar conditions with a modified timeframe.

The AI company stated:

“By the bondholder or by the issuer, at any time between May 26, 2028, and May 25, 2030, provided that the volume-weighted average price of the Company’s shares over 20 consecutive trading days during the conversion period reaches at least 130% of the conversion price, i.e., €4.9517.”

According to the Blockchain Group’s publication, redemptions for shareholders who fail to convert their bonds will be based on BTC’s price. Redemption payments will be via BTC or EUR. However, in the absence of any expressible choice by the bondholder, the issuer could go with any of the two available options.

Some leading companies and individuals that participated in the bond issuance include Fulgur Ventures, Moonlight Capital, UTXO Management, Adam Back, etc. Notably, Adam contributed significantly to H100 Group AB’s fundraising, valued at about $2.2 million.

Plans for the Realized Funds

Blockchain Group spent €59.85 million, which represents 95% of the realized €63.3 million on BTC, expanding its holdings to about 1,437 BTC. The company will use the remaining capital to fund other management costs.

🟠The Blockchain Group announces a convertible bond issuance of ~€63.3M to pursue its Bitcoin Treasury Company strategy, bringing its total potential holdings to ~1,437 BTC after completion⚡️

Full Press Release (EN): https://t.co/Vw2mGH84Dt

Full Press Release (FR):… pic.twitter.com/xDky2hrU4s

— The Blockchain Group (@_ALTBG) May 26, 2025

Aside from the AI company, several other companies have shown strong commitment to BTC portfolio expansions. On May 26, Crypto2Community reported that Remixpoint bought ¥1 billion worth of Bitcoin. The move increased the firm’s total BTC holdings valuation to about ¥12 billion ($84 million). In related news, Trump Media and Technology Group (TMTG) is planning a $3 billion fundraiser. The company said $2 billion will come from new share issuances, while the remaining $1 billion will come from convertible bonds.

Bitcoin’s Price Dips Slightly

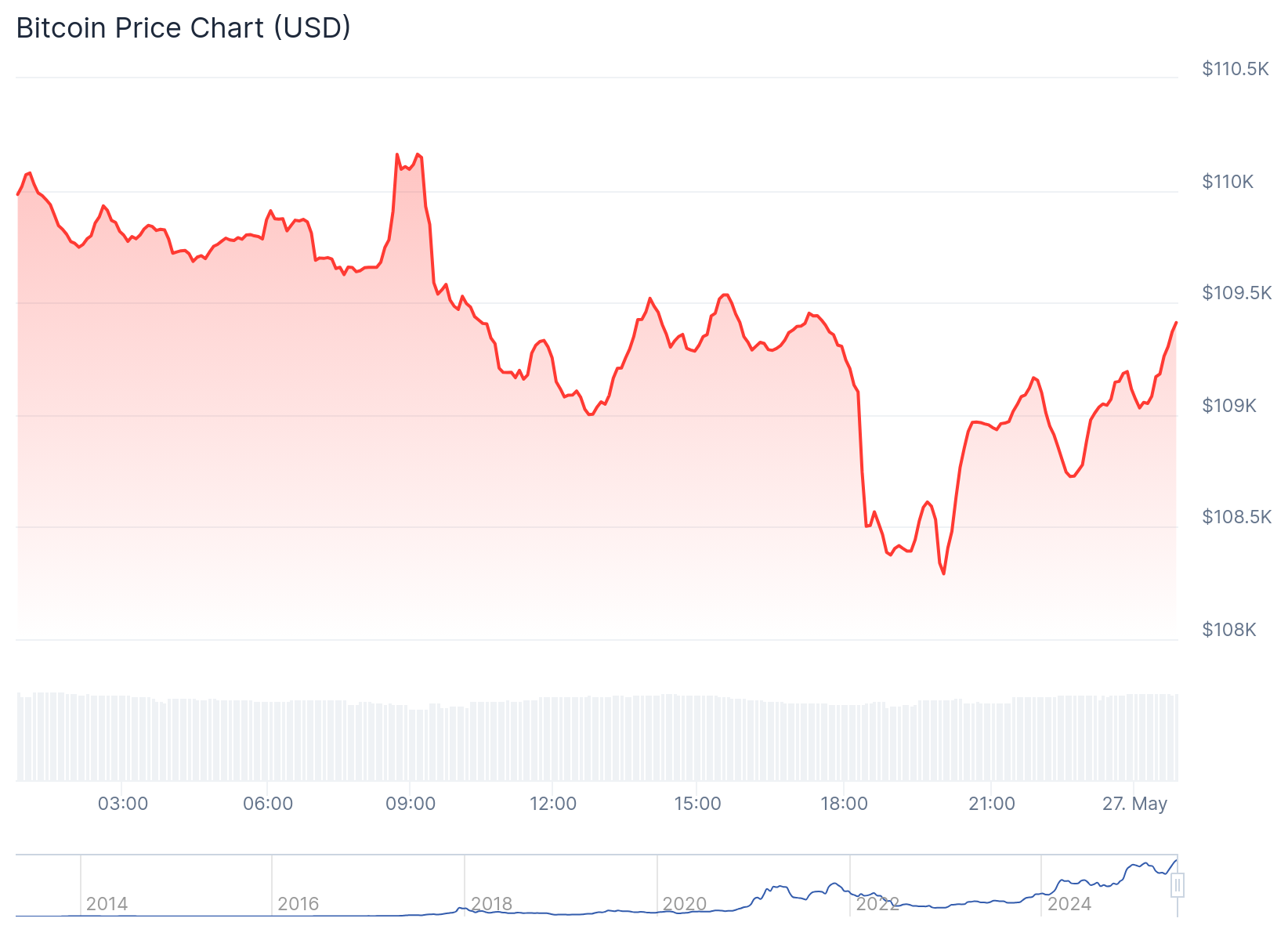

Bitcoin’s price dropped 0.6% in the past 24 hours, trading at approximately $109,000 and oscillating between $108,292 and $110,162. Despite the slight decline, BTC’s market capitalization and fully diluted valuation remained above $2 trillion, with a $30.55 billion 24-hour trading volume. Bitcoin’s other extended-period price change statistics reflected upswings, which invariably imply that the slight price drop might be transient.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.