Highlights:

- BlackRock’s Bitcoin ETF surpassed its gold ETF, reflecting growing Bitcoin investor demand.

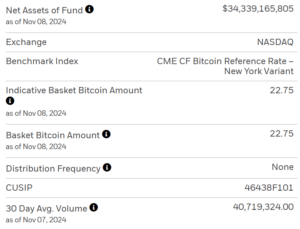

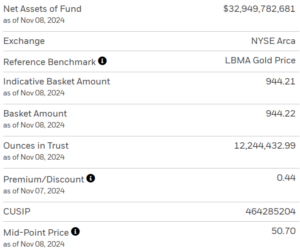

- IBIT reached $34.3B in assets, surpassing IAU’s long-established $32.9B.

- Bitcoin ETFs led the 2024 market, with record inflows and surpassing gold ETFs by 10x.

BlackRock’s Bitcoin BTC exchange-traded fund (ETF) officially surpassed the firm’s gold ETF in assets under management (AUM) two days after Americans elected the crypto-friendly Donald Trump to the White House. As of Thursday’s market close, the iShares Bitcoin Trust (IBIT) surged to $33.1 billion in assets, surpassing the iShares Gold Trust (IAU), which held $32.9 billion in net assets.

According to BlackRock, IBIT’s net assets rose to $34.3 billion by Friday’s close, while IAU’s assets remained the same. BlackRock’s Bitcoin ETF accumulated over $10 billion in assets within its first two months of trading, a milestone the first gold ETF took nearly two years to reach.

The shift shows the fast-growing investor demand for Bitcoin. IBIT was introduced in January 2024, whereas IAU has been around since January 2005—years before Satoshi Nakamoto released the original Bitcoin whitepaper. “Absolutely wild,” said ETF Store President Nate Geraci in a post on X on November 8.

BlackRock’s Bitcoin ETF Set Record Trading Volume and Inflows Following Trump’s Victory

The Bitcoin market saw increased activity after Donald Trump’s victory in the U.S. presidential election. Some investors speculated his administration might adopt more favorable Bitcoin and crypto policies. BTC hit a new all-time high (ATH) of $77,239 yesterday, according to the data from CoinGecko. Moreover, Trump’s presidential win has cleared the way for over half a dozen proposed crypto ETFs awaiting regulatory approval to list in the US.

On November 6, IBIT reached its highest-ever daily trading volume of $4.1 billion. This surpassed the daily volume of major stocks like Netflix, Visa, and Berkshire Hathaway during the same period. This coincided with the rise in investor interest following the election results, according to Bloomberg ETF analyst Eric Balchunas.

$IBIT just had its biggest volume day ever with $4.1b traded.. For context that's more volume than stocks like Berkshire, Netflix or Visa saw today. It was also up 10%, its second best day since launching. Some of this will convert into inflows likely hitting Tue, Wed night pic.twitter.com/vy2zJBwaHd

— Eric Balchunas (@EricBalchunas) November 6, 2024

According to data from Farside Investors, IBIT has accumulated over $27 billion in net inflows since its launch. On November 7, BlackRock reported its largest-ever net inflow for the iShares spot Bitcoin ETF, totaling $1.12 billion. Lead market analyst at crypto exchange Swyftx Pav Hundal called the current market conditions a “goldilocks scenario,” citing monetary easing, political stability, and strong U.S. economic data.

🔥 The 11 US BTC ETFs just recorded a new biggest inflow of $1.372B after 167 days!

This was backed by #BlackRock (IBIT) which saw a massive inflow of $1.169B yesterday – its largest BTC inflow since launch.

In the past 3 weeks, BlackRock has added a net 77,649 $BTC ($5.48B),… pic.twitter.com/cLvGdJ9CRZ

— Spot On Chain (@spotonchain) November 8, 2024

Bitcoin ETFs Lead the Market in 2024

Throughout 2024, Bitcoin ETFs have led the market, with six of the top ten ETF launches this year linked to the asset, according to Geraci. Of nearly 400 new ETFs launched in 2024, the four largest in terms of inflows have all been spot Bitcoin ETFs, as Geraci highlighted earlier.

575 ETFs have now launched in 2024…

*14 of top 30* by inflows are either spot btc or eth ETFs.

Includes 6 of top 10.

There are also 2 MSTR-related ETFs in top 30.

Crypto appetite from tradfi is real. pic.twitter.com/DmD6f5zJ1P

— Nate Geraci (@NateGeraci) October 23, 2024

The success of Bitcoin ETFs over gold ETFs is significant, as gold has long been a safe-haven asset. The growing interest in Bitcoin indicates a shift in sentiment, with more individuals and institutions viewing it as an alternative or complement to traditional assets like gold. André Dragosch, Bitwise’s European head of research, noted on X Thursday that Bitcoin ETF inflows have significantly outpaced Gold’s in Year 1, surpassing them by more than 10 times since launch.

Gold vs Bitcoin.

ETF inflows into Bitcoin are literally off the chart since trading launch and more than 10 x times bigger than Gold in Year 1.

Bitcoin plays in a totally different league imo. pic.twitter.com/JoyR5779Lq

— André Dragosch, PhD | Bitcoin & Macro ⚡ (@Andre_Dragosch) November 8, 2024