Highlights:

- BlackRock’s Bitcoin ETF IBIT saw a $13.5M outflow on August 29, its second since January.

- US spot Bitcoin ETFs have seen net outflows for three consecutive days.

- Bitcoin’s price fell below $59,000, failing to hold above $61,000 during trading.

On August 29, BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), recorded a net outflow of $13.5 million. This is the second day of outflows since the fund’s debut in January, according to Farside Investors. The fund previously saw a $36.9 million net outflow on May 1.

Since its trading debut, IBIT has experienced steady net capital inflows almost daily. As of August 29, IBIT attracted nearly $21 billion in net inflows and holds over 350,000 Bitcoin. BlackRock’s spot Bitcoin ETF reported gains only on Monday this week, with $224 million in new investments. Thursday’s decline followed two days of no flows.

BlackRock's IBIT saw second largest net outflows since its launch

BlackRock's spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), recorded a net outflow of $13.88 million on Aug. 29, marking the second largest net outflows since its launch and the largest one since May 2, according…

— CoinNess Global (@CoinnessGL) August 30, 2024

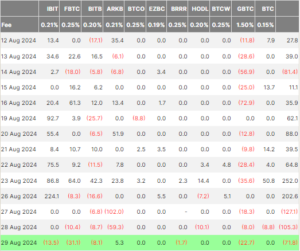

Only Ark and 21Shares’ ARKB See Inflows on August 29

On Thursday, US Bitcoin ETFs faced net outflows totaling $71.8 million. BlackRock’s fund had the third-largest outflow, following Fidelity Wise Origin Bitcoin Fund (FBTC) with $31.1 million and Grayscale Bitcoin Trust (GBTC) with $22.7 million. Only Cathie Wood’s ARK 21Shares Bitcoin ETF (ARKB) saw net inflows totaling $5.3 million. On Thursday, the total daily trading volume for the 12 spot BTC ETFs fell to $1.64 billion, down from $2.18 billion on Wednesday.

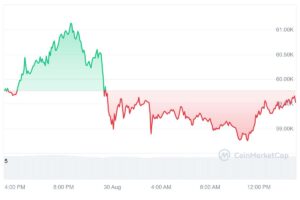

Bitcoin Fails to Hold $61,000

The decline in US spot Bitcoin ETFs comes amid Bitcoin’s continued price stagnation. CoinMarketCap data shows that Bitcoin’s recent attempt to secure a stable position above $61,000 faltered, as the price fell below $59,000 during Thursday’s US trading session. Despite a brief increase, Bitcoin was up only 0.2% over the past 24 hours. At press time, BTC is trading at around $59,500, down approximately 10% over the past month.

Spot Ether ETFs Experience Modest Outflows

Meanwhile, US spot Ethereum (ETH) ETFs saw negative flows return on Thursday, with $1.7 million in net outflows, following modest positive flows the day before. The Grayscale Ethereum Trust (ETHE) was the sole spot Ether ETF to report outflows totaling $5.3 million. This was offset by $3.6 million in net inflows into the Grayscale Ethereum Mini Trust (ETH). The seven other spot ETH funds saw no flows on August 29. The total trading volume for the nine ETFs fell to $95.91 million on Thursday, down from $151.57 million on Wednesday.

According to a JPMorgan research report released on Wednesday, Ether spot ETFs have faced net outflows since their US launch last month, unlike spot Bitcoin ETFs. Ether ETFs started trading on July 23, about six months after Bitcoin funds launched. In the first five weeks, Ether ETFs faced net outflows of around $500 million, while Bitcoin ETFs saw inflows exceeding $5 billion.

The bank attributed the weak performance of ether ETFs to Bitcoin’s “first mover advantage,” the lack of staking options, and lower liquidity, which made ether ETFs less appealing to institutional investors. Unexpectedly, Grayscale’s Ethereum Trust saw $2.5 billion in outflows. JPMorgan had anticipated only around $1 billion in outflows as the trust shifted from a closed-end fund to a spot ETF.

To address the outflows from ETHE, Grayscale launched a mini ether ETF, which attracted only $240 million in inflows. JPMorgan’s team, led by Nikolaos Panigirtzoglou, suggested that the weaker demand for Ether ETFs compared to Bitcoin is boosting interest in a combined ETF offering exposure to both assets.