Highlights:

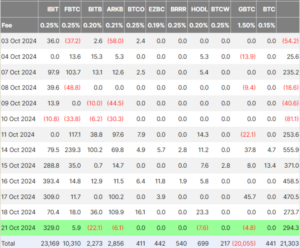

- U.S. spot Bitcoin ETFs saw $294.3 million in inflows, marking seven days of gains.

- BlackRock’s iShares Bitcoin Trust attracted $332.3 million, remaining the top Bitcoin ETF choice.

- Institutional interest in Bitcoin ETFs is rising amid Trump’s increasing election odds.

On October 21, U.S. spot Bitcoin Exchange-Traded Funds (ETFs) saw a total net inflow of $294.3 million, marking the seventh consecutive day of gains, according to data from Farside Investors. This increase in investment activity shows strong market sentiment and rising institutional interest, even though Bitcoin’s value fell below $67,000 on Monday.

BlackRock’s iShares Bitcoin Trust (IBIT) is the main recipient of net inflows, attracting $329 million. According to data, it was the third time in four trading days that BlackRock’s spot Bitcoin ETF recorded over $300 million in inflows.

The Fidelity Wise Origin Bitcoin Fund (FBTC) also recorded an inflow of $5.9 million on October 21. In contrast, competing ETFs from Bitwise, ARK Invest/21Shares, VanEck, and Grayscale (GBTC) faced redemptions exceeding $40 million. The other ETFs did not see any inflows.

BlackRock’s IBIT Remains the Top Choice for Bitcoin ETF Investors

BlackRock’s IBIT continues to be a favored option for investors looking to gain Bitcoin exposure. Last week, the fund attracted over $1 billion in net capital, making up half of the U.S. spot Bitcoin ETF inflows.

IBIT remains at the forefront of all spot Bitcoin ETFs, surpassing $23 billion in total net inflows on October 21. Bloomberg ETF analyst Eric Balchunas highlighted that IBIT has recorded the third-largest ETF inflows in 2024, following only Vanguard and BlackRock’s S&P 500 index funds, VOO and IVV.

$IBIT had one hell of a week, +$1.1b in new cash, best week since March, passed $VTI for 3rd place overall in YTD flows (insane for new launch, esp late in year, the rest of the top 5 is each over 20yrs and old and over $300b. $IBIT's aum is $26b which is in top 2% of all ETFs. pic.twitter.com/KX7eD3EzFP

— Eric Balchunas (@EricBalchunas) October 21, 2024

As of October 18, IBIT’s Bitcoin holdings were valued at $26.5 billion, according to BlackRock’s latest data. Despite recent price fluctuations, the ongoing interest in Bitcoin ETFs indicates strong institutional engagement.

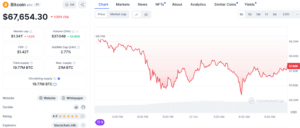

However, upcoming U.S. elections and global tensions may affect market stability. Bitcoin reached a high of $69,500 on Monday but has since dropped below $67,000. It is currently trading at $67,654, reflecting a 1.52% decline in the past 24 hours, according to CoinMaarketCap.

Institutional Interest in Bitcoin ETFs Grows Amid Trump’s Rising Odds

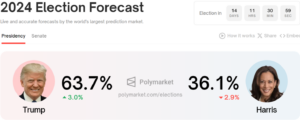

With the odds of Donald Trump’s victory increasing, market analysts suggest that the significant Bitcoin ETF inflows indicate that the Trump trade is gaining traction. According to Polymarket data, Trump’s chances of winning have risen to 63.7% compared to Kamala Harris.

REWEITRE. Ryan Lee, Chief Analyst at Bitget Research, said:

“The main drivers are Trump’s rising odds of winning the election and a technical rebound in Bitcoin’s price. Trump is a known supporter of Bitcoin, and his increasing odds of winning are seen as a positive signal for the market”.

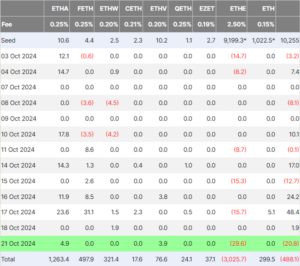

Ethereum ETFs Struggle as Grayscale Sees Major Outflows

Spot Ethereum ETFs faced challenges, experiencing a net outflow of $20.8 million on October 21, according to preliminary data from Farside Investors. Grayscale’s ETHE fund saw significant losses, with outflows of $29.6 million, offsetting gains from BlackRock (ETHA) and VanEck (ETHV).

Grayscale has lost over $3 billion in total, impacting all Ethereum funds. This trend may persist until investors move away from the high-fee ETHE fund and allocate their assets to other options.