Highlights:

- BlackRock’s Bitcoin ETF saw a record $4.1 billion in trading volume post-election.

- IBIT hit $1 billion in volume within 20 minutes of market opening on Nov. 6.

- Trump’s election win boosts crypto market confidence and drives Bitcoin ETF growth.

After Donald Trump’s presidential election victory, BlackRock’s Bitcoin exchange-traded fund (ETF) hit a record-high daily trading volume. On November 6, BlackRock’s iShares Bitcoin Trust ETF (IBIT) saw over $4.1 billion in daily trading volume, according to ETF analyst Eric Balchunas.

$IBIT just had its biggest volume day ever with $4.1b traded.. For context that's more volume than stocks like Berkshire, Netflix or Visa saw today. It was also up 10%, its second best day since launching. Some of this will convert into inflows likely hitting Tue, Wed night pic.twitter.com/vy2zJBwaHd

— Eric Balchunas (@EricBalchunas) November 6, 2024

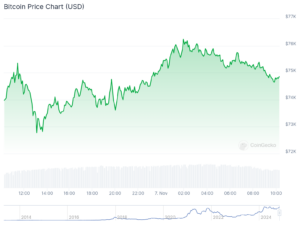

IBIT had a record trading day amid bullish signals for Bitcoin. On Nov. 6, Bitcoin hit a new all-time high of $76,243. This surge came less than a day after crypto-friendly Trump was elected US president.

Balchunas wrote:

“For context that’s more volume than stocks like Berkshire, Netflix, or Visa saw today. It was also up 10%, its second-best day since launching.“

Several analysts and traders predict that Bitcoin’s price will continue to rise with Trump. Bitcoin’s price has since pulled back slightly to $74,835, according to CoinGecko data at the time of publication.

BlackRock’s IBIT Trades Over $1B in First 20 Minutes Post-Election Day

According to Eric Balchunas, IBIT experienced $1 billion in trading volume within the first 20 minutes of market opening on November 6. This surge matched its usual full-day volume, setting up its strongest trading session since its January 11 launch.

Damn, $IBIT has seen $1b in volume in the first 20min- that's about what it does in full day. Other bitcoin ETFs in same boat, crazy volume. Set for a record-breaking volume day (and given price is up so much, this is likely feeding frenzy volume vs crisis volume = look for… pic.twitter.com/1gSvV5Lwzo

— Eric Balchunas (@EricBalchunas) November 6, 2024

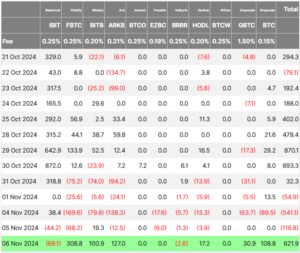

Other Bitcoin ETFs also had one of their best days since their launch in January, with most funds doubling their average volume, according to Balchunas. Grayscale Bitcoin Trust ETF (GBTC) saw around $448 million in volume, followed by Grayscale’s GBTC, according to data from Coinglass.

BlackRock Bitcoin ETF Bleeds Over $69M

Trading volume, which includes both buying and selling, doesn’t directly reflect net inflows. For example, of the $4.5 billion in first-day Bitcoin ETF volume, only about $600 million was actual inflows. According to Farside Investors data, IBIT lost over $69.1 million yesterday. US spot BTC ETFs saw around $621.9 million in net inflows.

Trump’s Victory Boosts Crypto Market Confidence and ETF Growth

The election pitted Trump, who wants to make America “the crypto capital of the world,” against Kamala Harris, who has been quieter on crypto. Under President Biden, the SEC has taken a strong regulatory approach, filing over 100 actions against crypto companies.

Trump won the election with over 270 Electoral College votes and a majority of the popular vote. His campaign promises, such as creating a national Bitcoin reserve, supporting crypto miners, and forming an advisory committee for favorable regulation, have boosted market confidence. He also pledged to pardon Silk Road founder Ross Ulbricht and dismiss SEC Chair Gary Gensler.

Bitcoin has dominated the ETF market this year, making up six of the top 10 successful launches in 2024, according to ETF Store president Nate Geraci on X. Analysts also believe that Trump’s pro-crypto policies could benefit assets beyond Bitcoin. In 2024, asset managers filed numerous regulatory submissions to list ETFs holding altcoins like Solana, XRP, and Litecoin, among others. Issuers are waiting for approval of multiple crypto index ETFs that will include diverse token baskets.