Highlights:

- Eric Balchunas asserts that BlackRock and Bitcoin ETFs have played a crucial role in stabilizing Bitcoin’s price.

- He argues that Bitcoin’s recent declines are due to Bitcoin natives, not traditional investors.

- Institutional interest is likely to mitigate September’s typical bearish trend.

In a recent post on X, Bloomberg analyst Eric Balchunas claimed that BlackRock and the Bitcoin (BTC) Exchange-Traded Funds (ETFs) repeatedly saved the BTC price from a massive decline. The analyst’s statement countered claims that traditional investors were responsible for every decline in the coin’s value.

He explained that he understands why these ideas are floating around—people tend to blame the ETFs because they find it hard to believe that long-term Bitcoin holders (HODLers) are the ones selling. However, Balchunas argued that these Bitcoin natives are actually the ones selling. He noted that they, not traditional investors, are driving down the price of Bitcoin.

I get why these theories exist and ppl want to scepegoat the ETFs. Bc it is too unthinkable that the native HODLers could be the sellers. But they are. The call is coming from inside the house. All the ETFs and BlackRock have done is save btc’s price from the abyss repeatedly.

— Eric Balchunas (@EricBalchunas) September 14, 2024

Bitcoin Spot ETFs Saw a Weekly Net Inflow of Over $400M

Spot Bitcoin ETFs ended a two-week streak of outflows with over $403.8 million in weekly inflows. Analysts anticipate that the rise in institutional interest this year will enable Bitcoin to counter the typically bearish trend observed in September.

On Friday, U.S. spot Bitcoin ETFs saw a sharp rise in inflows, with net purchases reaching $263 million. Fidelity’s Bitcoin ETF (FBTC) led the charge, drawing in approximately $102 million in new capital and bringing its total weekly inflows to $218 million. ARK Invest and 21Shares’ Bitcoin ETF (ARKB) ranked second, ending the day with approximately $99 million in net inflows.

Other Bitcoin ETFs, including those managed by Bitwise, Franklin Templeton, Valkyrie, VanEck, and Grayscale, also saw positive inflows, highlighting a widespread resurgence of interest in the spot Bitcoin ETF market.

WisdomTree’s Bitcoin Fund (BTCW) and BlackRock’s iShares Bitcoin Trust (IBIT) recorded no inflows on Friday. IBIT, in particular, has faced challenges recently, with several trading days of no inflows and net outflows on August 29 and September 9. Since its launch, IBIT has seen net outflows on just three occasions, making it a relatively rare event among Bitcoin ETFs.

NEW: 🇺🇸 #Bitcoin ETFs saw $263 million in inflows yesterday, the highest in almost 2 months.

Tides are turning 🚀 pic.twitter.com/YolvWlpLKg

— Bitcoin Magazine (@BitcoinMagazine) September 14, 2024

Institutional Adoption Behind Price Recovery

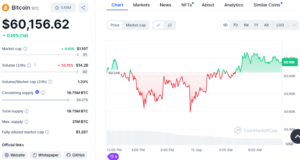

This year, Bitcoin ETFs boosted the crypto market, attracting traditional investors and driving several assets to new highs. Bitcoin surged above $73,000 in Q1 2024 but later corrected to below $60,000.

Outflows from the previous week caused Bitcoin’s price to fall below $55,000, negatively impacting the broader market. However, renewed institutional interest helped the price climb back to $60,000. At the time of writing, Bitcoin was trading at $60,156, reflecting a 0.10% increase over the past 24 hours. Analyst Van de Poppe suggested on X that Bitcoin could potentially break out and stay above the $60k level.

A key driver behind the upward movement of assets is the declining inflation in the United States and the anticipated reduction in policy rates. This is expected to boost inflows into riskier assets, with crypto likely benefiting significantly.

Analyst Predicts Institutional Interest Will Reverse September’s Bearish Trend

Historically, September has been a challenging month for Bitcoin, with CoinGlass data showing an average monthly decline of 4.69% over the past 11 years. However, analyst Rajat Soni believes rising institutional interest, fueled by the approval of spot Bitcoin ETFs, could shift this trend.

Soni highlighted that BTC has been consolidating above $50,000 for the past six months, a level it last maintained in 2021. At that time, the market was primarily driven by retail investors, who are more prone to emotional decisions, leading to heightened volatility. Soni believes that the presence of institutional investors this time could offer a more stable foundation, decreasing the chances of Bitcoin falling below this key level.

While most people were sidelined because they thought #Bitcoin is going to $30K…

Bitcoin's price has jumped back up to $60K

Bitcoin has been consolidating above $50K for more than 6 months

The last time Bitcoin was above $50K was in 2021

The price struggled to maintain… pic.twitter.com/3psdL7hkyC

— Rajat Soni, CFA (@rajatsonifnance) September 13, 2024