Highlights:

- BlackRock’s Strategic Global Bond Fund added 4,000 more IBIT shares.

- Increased Bitcoin ETF stake reflects growing institutional interest.

- Spot Bitcoin ETFs saw $202.51M in inflows on Monday, led by BlackRock’s IBIT.

A recent filing with the United States Securities and Exchange Commission (SEC) reveals that BlackRock’s Strategic Global Bond Fund boosted its Bitcoin exposure by acquiring 4,000 iShares Bitcoin Trust (IBIT) shares. The updated portfolio shows the fund holding 16,000 shares as of June 30, 2024, up from 12,000 shares in May.

BlackRock’s move to increase its stake in the iShares Bitcoin Trust reflects global momentum for Bitcoin ETFs, as institutions aim to diversify and meet rising demand. With Bitcoin nearing $60,000, many financial firms aim to capitalize on the market’s potential.

BlackRock today filed an updated portfolio disclosure for its Strategic Global Bond Fund: 16,000 shares of iShares Bitcoin Trust held as of June 30, up from 12,000 shares reported in May.

Filing:https://t.co/ADSbiWyZdF

— MacroScope (@MacroScope17) August 26, 2024

This trend extends beyond the US markets like Hong Kong, which have also experienced significant growth in Bitcoin ETF assets, showing global demand for regulated crypto products. Moreover, BlackRock’s rising allocation of Bitcoin in its Strategic Global Bond Fund indicates that major financial institutions see cryptocurrencies as a way to diversify portfolios and hedge against market volatility.

Comparison with Other BTC ETF Inflows

The Bitcoin ETF market has seen significant inflows across various issuers. Farside Investors reports increased holdings in multiple Bitcoin ETFs, reflecting strong investor demand. BlackRock has now surpassed Grayscale in total cryptocurrency holdings, with approximately $22.14 billion compared to Grayscale’s $21.99 billion.

Hong Kong’s recent approval of spot Bitcoin ETFs and the rise in assets under management to over HK$2 billion underscore growing institutional adoption. The steady increase in these regulated products highlights the expanding role of cryptocurrency in traditional investment portfolios.

Hong Kong’s Spot Bitcoin ETFs have surpassed HK$2B ($280M) for the first time. BlackRock’s increase in Bitcoin ETF holdings aligns with renewed optimism in the cryptocurrency market. Bitcoin’s recent rally to $63,000 has fueled interest in Bitcoin and altcoins, especially those linked to major investors like BlackRock.

Spot Bitcoin ETFs See Eighth Day of Inflows, Led by BlackRock’s $224M

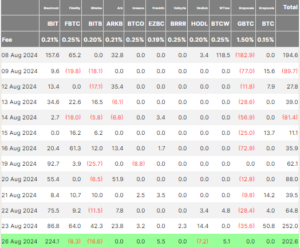

Spot Bitcoin ETFs in the U.S. recorded $202 million in net inflows on Monday, marking their eighth straight day of positive flows. The 12 Bitcoin funds have attracted $756 million over the past eight days. BlackRock’s IBIT fund led with $224.1 million in net inflows, its largest daily total since July 22, according to Farside Investors. Franklin Templeton’s EZBC saw $5.5 million in net inflows, and WisdomTree’s BTCW recorded $5.1 million.

On Monday, Bitwise’s BITB experienced the largest outflows at $16.6 million, followed by $8.3 million from Fidelity’s FBTC. VanEck’s HODL saw $7.2 million in outflows. The six other funds, including Grayscale’s GBTC, had no flows for the day. The trading volume for spot Bitcoin funds fell to $1.2 billion yesterday from $3.12 billion last Friday, returning to normal levels. Since their January launch, the funds have gained total net inflows of $18.08 billion.

BlackRock’s BUIDL Tops the Surge as Tokenized Treasury Funds Exceed $2 Billion

Just five months after reaching a $1 billion market cap, tokenized Treasury notes have doubled to over $2 billion. These digital US government bonds are traded on blockchains like Ethereum, Stellar, and Solana. While $2 billion is impressive for a newcomer, it’s small compared to the $27 trillion U.S. Treasury market.

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) is leading the way. Launched in late March, it quickly became the largest tokenized Treasury fund with a market cap of $375 million. Now, it sits at $503 million. Franklin Templeton’s OnChain US Government Money Fund (FOBXX) and Ondo’s US Dollar Yield (USDY) are also gaining attention.

🚨 TOKENIZED TREASURIES HITS $2 BILLION MILESTONE.

Getting to $1 billion: 452+ days

Getting to $2 billion: 151 days🤔 Seems bullish. pic.twitter.com/pXtRpGGFLq

— RWA.xyz (@RWA_xyz) August 24, 2024