Highlights:

- Asset management firm Bitwise has taken a significant step in its Dogecoin ETF approval push by presenting an S-1 filing to the US SEC.

- The filing document does not contain information about the ETF ticker symbol and possible exchange for launch.

- The fund will hold Dogecoin and establish its net asset value.

Crypto asset management firm Bitwise has officially presented its S-1 filing for a Dogecoin (DOGE) Exchange Traded Funds (ETF) with the United States Securities and Exchange Commission (SEC). The filing details, which appeared in a January 28 prospectus, noted that the ETF termed “The Bitwise Dogecoin ETF (“Trust”)” is an exchange-traded product that will offer common shares of beneficial interest.

It is worth noting that Bitwise is moving to present an S-1 filing a few days after completing the registration of the Dogecoin ETF. For context, Crypto2Community covered the initial filing story on January 23, noting that DOGE could hit $15 if the SEC approves the ETF. The S-1 filing application highlights the urgency with which Bitwise is moving to ensure it lands a Dogecoin ETF approval.

Bitwise Dogecoin ETF officially filed pic.twitter.com/OvJqDIyAOP

— Eric Balchunas (@EricBalchunas) January 28, 2025

Dogecoin ETF S-1 Filing Details

Unlike most S-1 filing, the filing document did not specify the ticker under which the new ETF will trade. Additionally, no information about the exchange where Bitwise hopes to launch the commodity was revealed. However, the asset management firm highlighted the objectives of its fund. They include seeking means of exposing to customers the value of Dogecoin held by the Trust.

In addition, the ETF aims to lower the costs incurred from the Trust’s operations and other liabilities. According to the prospectus, Bitwise hopes to achieve the spotlighted objectives by holding Dogecoin and establishing its net asset value (NAV). Notedly, the NAV will be based on the CF Dogecoin-Dollar Settlement Price (the “Pricing Benchmark”).

Bitwise noted that such value will be calculated by aggregating the executed trade flow of major platforms that offer Dogecoin tradings when estimating the pricing benchmark. Like the ticker and possible exchange for listing details, the filing also failed to disclose the amount that will serve as the unitary management fee for the Trust’s sponsor.

DOGE ETF Approval Odds

Unlike most cryptocurrencies like Solana (SOL), Litecoin (LTC), and Ripple’s XRP, Dogecoin’s ETF push started gaining prominence recently, especially with Bitwise’s influence. However, the odds for its approval have seemingly grown stronger as market participants and top crypto chiefs are envisaging a potential approval happening this year.

The world’s largest prediction and betting platform, Polymarket, corroborated the assertion above in one of its most recent tweets. It noted that the odds for Dogecoin’s ETF approval in 2025 soared to about 56%. The figure appears significantly high for an entity that recently started gaining traction.

NEW: Bitwise just filed for a spot Dogecoin ETF.

Odds a $DOGE ETF is approved this year shot up to 56%. pic.twitter.com/Rg8rI3cNw7

— Polymarket (@Polymarket) January 28, 2025

Moreover, the crypto market regulatory landscape is seemingly more friendly with Mark Uyeda as the current US SEC acting chairman. Market participants have speculated that the usual practice of requiring up to six months before approving ETFs might become obsolete. Therefore, it gives hope for several ETF endorsements in the coming months of 2025.

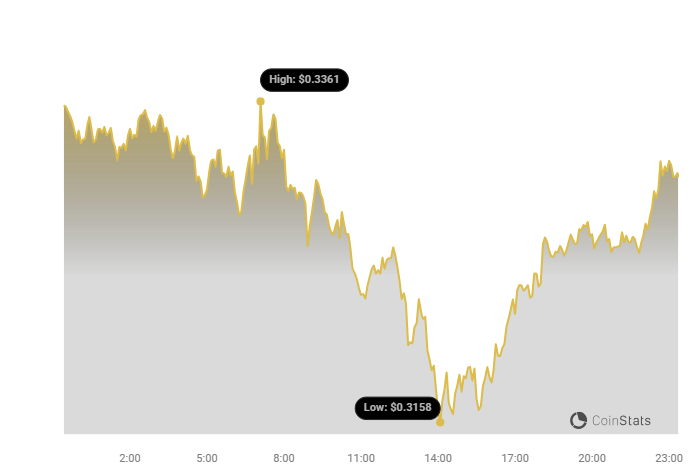

DOGE’s Price Reaction to the S-1 Filing News

At the time of press, Dogecoin is up by about $0.33, reflecting a 1.5% decline in the past 24 hours. Aside from its short-term interval price change data, other extended period data reflected decrements of about 10.3% and 8.4% in its 7-day-to-date and 14-day-to-date statistics. DOGE has a market cap of about $48.83 billion, while its 24-hour trading volume is $1.8 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.