Highlights:

- Bittensor price has shown a strong bullish grip, spiking 17% to $385.

- This rally comes as Yuma’s CEO, Barry Silbert, unveiled the two flagship funds on Bittensor’s subnet tokens.

- CoinGlass data reveals positive sentiment as retail interest soars, with bulls targeting $494 ATH.

The Bittensor price is showing a steady bullish momentum, skyrocketing 17% to $385%. The daily trading volume has notably soared 105% indicating intense trading activity. Bittensor has emerged as a progressive decentralized ML provider, including reinforcement learning and cryptographic block storage.

According to Joseph Jacks, Bittensor is a critical component of the future decentralized AI ecosystem. Bittensor is the first-ever mining-based decentralized, open-source cryptocurrency backed by real-world machine learning efforts through trial and error. Bittensor has been in production for four years and has positioned itself as the foremost decentralized AI provider within the marketplace.

Bittensor learns from real-world mining experience. Trial & error, cryptographically verifiable blocks storing weight matrices. Real, permissionless reinforcement learning. In production for 4 years. There is no other technology to do this in existence. Bitcoin comes closest.

— JJ (@JosephJacks_) October 9, 2025

Further, Barry Silbert, CEO of Digital Coin Group (DCG) and Yuma, announced on Thursday that Digital Coin Group has made a $10 million investment in Yuma Asset Management. Yuma Asset Management will now make it easier for institutional and accredited investors to gain exposure to the deAI ecosystem of subnet tokens within Bittensor.

The two core funds are the Yuma Subnet Composite Fund, which will provide market-cap-based exposure comprising all active subnets. On the other hand, the Yuma Large Cap Subnet Fund will provide more targeted exposure.

Bittensor Derivatives Market Outlook

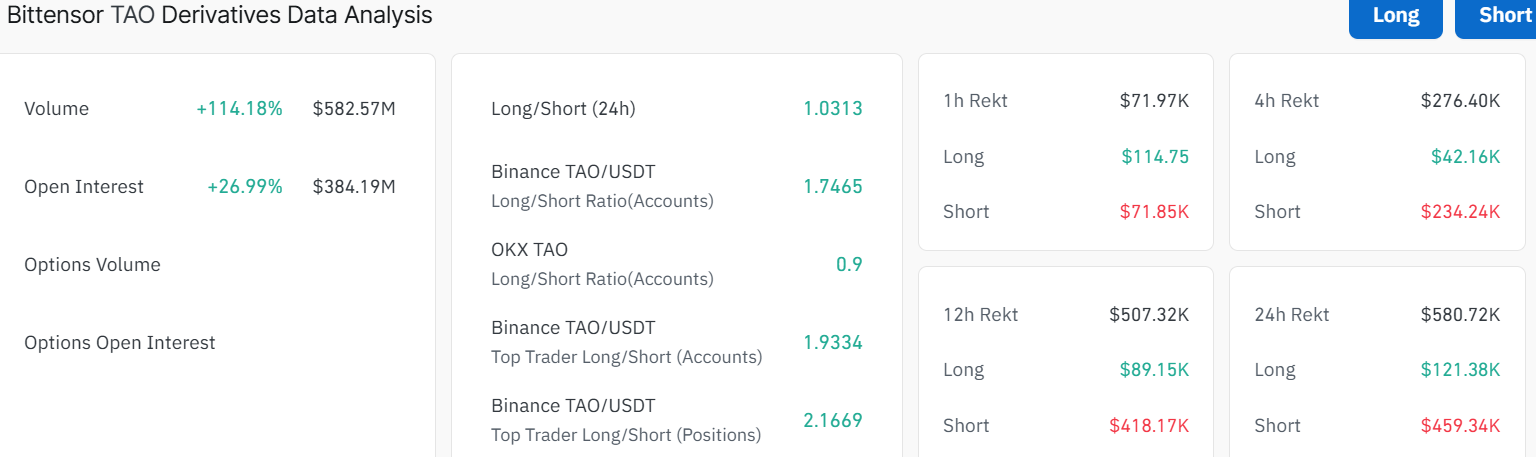

According to Coinglass data, Bittensor’s derivatives have made significant progress lately. Derivative volume within the TAO realm has surged by more than 114.82%, reaching $582.57 million. With a 26.99% increase in open interest and a current value of $384.19 million, these developments represent the growing market interest, through increased investment and involvement.

TAO’s Long/Short ratio within the last 24 hours reads at 1.03, depicting a bullish sentiment surrounding the TAO market. Notably, the liquidation data reflects tremendous liquidation activity as the Bittensor price recently hit $350 amidst positive momentum. This indicates that traders are more optimistic about driving prices upwards in the coming weeks.

Bittensor Price Breaks Above a Falling Channel

Looking at the TAO/USDT daily chart reveals Bittensor price action over the past couple of months. After a prolonged downward move, Bittensor price has broken out of a falling channel to $385 from the $344 lows, marking a 17% gain.

That 17% gain today indicates increased hype in the TAO market, as the bulls aim to reclaim the $494 ATH. The 50-day Simple Moving Average (SMA) at $332 and the 200-day SMA at $349 are below the price action, acting like a solid and dynamic support zone. If this trend holds, Bittensor price could see a potential run to the upper resistance at $460, marking an additional 19% gain from current levels.

Digging into the indicators, the Relative Strength Index (RSI) sits at 68.04, creeping toward overbought territory but still in the green zone. This suggests momentum is strong, though a breather could be due if it hits over 70.

Bittensor price recently bounced off $344 zone, signalling strong buying pressure. If it clears the overhead resistance at $460, the token may reclaim its recent ATH at $494. Conversely, a rejection here might send the Bittensor price back to $350 or even $344 support zones. In the short term, TAO has a bullish momentum on its side. The recent breakout and today’s spike could draw more FOMO from the traders.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.