Highlights:

- BitMine’s Ethereum holdings exceed 3 million ETH worth $12.9 billion.

- The company now owns 2.5% of Ethereum’s total supply.

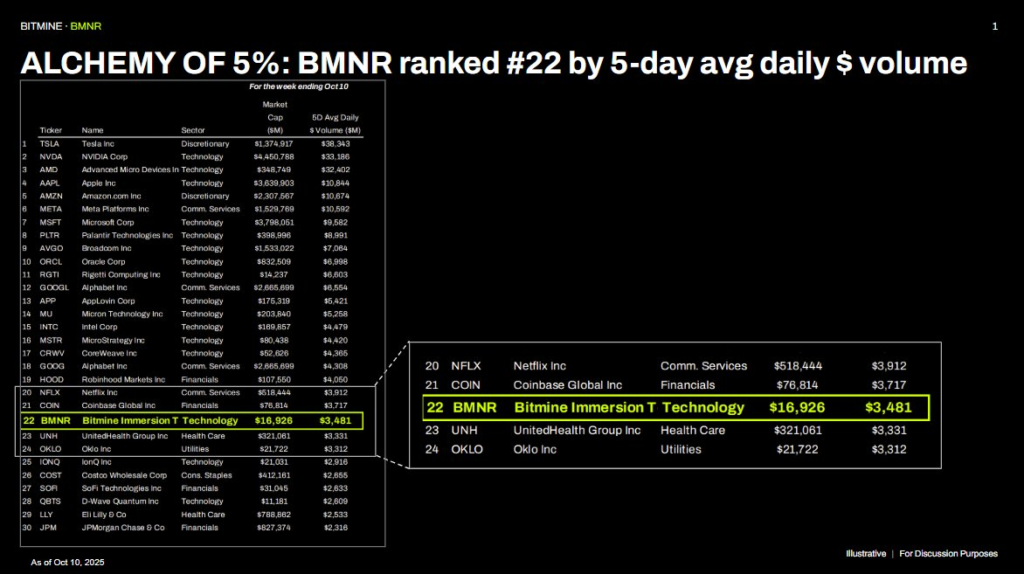

- BitMine ranks among the top 25 most-traded U.S. stocks by volume.

BitMine Immersion Technologies, the largest corporate Ether holder in the world, added more than 202,000 ETH during the sharp dip in the crypto market over the weekend. This move pushed BitMine’s Ethereum holdings to over 3.03 million ETH. These assets have a total value of over $12.9 billion, as per the press release.

Chairman Thomas Lee affirmed that the company used more than $827 million to purchase Ether during the crash. The purchasing frenzy occurred with Ethereum falling 12%, which offered what BitMine considered a buying opportunity. Lee remarked that this move pushed the company halfway towards its goal of holding 5% of the total ETH supply.

At the moment, BitMine manages about 2.5% of the Ethereum supply, which is 120.7 million tokens. This is a huge step forward compared to other ETH treasury holders such as SharpLink and The Ether Machine. The second largest holder owns less than 850,000 ETH.

🧵

BitMine provided its latest holdings update for Oct 13, 2025:

$12.9 billion in total crypto + "moonshots":

– 3,032,188 ETH at $4,154 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $135 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 13, 2025

BitMine’s Ethereum Expansion Amid Market Volatility

BitMine is now the largest holder of the Ethereum treasury in the world. The recent acquisition follows a liquidation across the market that wiped out more than $19 billion of crypto positions. Leveraged altcoin positions were liquidated by many investors in a cascading sell-off. Regardless of the downturn, BitMine saw the volatility as an opportunity to purchase Ethereum at a discount.

Chairman Lee noted:

“The company is confident that ETH is in a supercycle, partly propelled by AI and increased use of blockchain technology by Wall Street.”

The average cost of purchase in this recent acquisition was $4,154 purchase price per ETH. These tokens are now part of the growing crypto holdings of BitMine, consisting of 192 BTC and a $135 million investment in Eightco Holdings. BitMine also possesses $104 million in unencumbered cash.

Institutional Support and Trading Surge

BitMine has attracted some of the leading institutional investors, such as ARK Invest, Founders Fund, Pantera, and Galaxy Digital. These backers promote the company toward the long-term target of owning 5% of Ethereum’s total supply. This amounts to approximately 6 million ETH based on the current circulation.

BMNR, the share of BitMine, is now the 22nd most traded stock in the United States in dollar volume. Fundstrat data show that the five-day average daily trading volume stands at $3.5 billion. This positions BMNR right below Coinbase and above UnitedHealth.

Overall, the crypto and cash assets of BitMine have reached $13.4 billion. This amounts to $12.9 billion of ETH and other crypto holdings, in addition to other moonshot investments. The company is second only to Strategy Inc. (MSTR), the largest public crypto treasury of more than 640,000 BTC, following its recent purchase.

Lee stressed that volatility brings about deleveraging and that in this period, the assets tend to be underfundamentally priced. He further added that this mispricing provides investor benefits and aligns with the accumulation strategy of BitMine.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.