Highlights:

- BitMine added 46,255 Ethereum, worth $201 million, to its company treasury.

- If confirmed, BitMine now holds 2,126,018 ETH, the world’s largest corporate stash.

- BitMine’s stock rose 500% in six months, showing strong investor confidence.

BitMine Immersion Technologies has expanded its crypto holdings, adding 46,255 Ethereum (ETH), valued at $201 million, to its ETH treasury. Blockchain analytics platform Onchain Lens, referencing Arkham data, tracked the transaction. Onchain Lens reported that the funds came from a BitGo wallet across three addresses. One of the addresses was confirmed as BitMine’s, while the other two remain unmarked.

Bitmine (@BitMNR) has received 46,255 $ETH, valued at $201M, from #Bitgo.

They now hold a total of 2,126,018 $ETH, worth $9.24B.https://t.co/1fruGR1zWxhttps://t.co/YoyQAmK0Duhttps://t.co/1vbYSuHbap pic.twitter.com/3FeJD1QoFD

— Onchain Lens (@OnchainLens) September 11, 2025

BitMine Strengthens Ethereum Holdings and Expands Digital Asset Investments

The analytics firm said it linked the other addresses to BitMine using forensic analysis and internal algorithms. BitMine has not officially confirmed the purchase. If the unmarked wallets belong to the company, its total Ethereum holdings would rise to 2,126,018 ETH, worth nearly $9.3 billion. This aligns with BitMine’s goal of controlling 5% of Ethereum’s total supply, making it the world’s largest corporate holder of ETH currently.

Just two days earlier, BitMine reported holding 2.069 million ETH. This latest addition further strengthens its leading position in the Ethereum treasury race. BitMine reported on Monday that its total Ethereum holdings have now reached 2.069 million tokens, reinforcing its position as the world’s leading corporate Ethereum treasury.

Bitmine(@BitMNR) bought another 10,320 $ETH($44.57M) in the past 12 hours and currently holds 2,079,763 $ETH($8.94B).https://t.co/P684j5YQaGhttps://t.co/TxVScoexql pic.twitter.com/QTqzQdvJML

— Lookonchain (@lookonchain) September 9, 2025

On the same day, the company also announced a $20 million strategic investment into Eightco Holdings (OCTO) as part of Eightco’s $270 million PIPE, supporting Eightco’s plan to acquire Worldcoin’s WLD as its primary treasury asset and showing BitMine’s growing interest in expanding digital asset treasuries.

BitMine’s aggressive crypto strategy has boosted investor confidence. On Wednesday, its shares (BMNR) closed up 2.24% at $45.6 on the NYSE. Over the past six months, the stock has surged 500%, reflecting strong faith in its treasury expansion and bold market moves. With a focus on leading in Ethereum, BitMine remains one of the most influential players in the cryptocurrency treasury market.

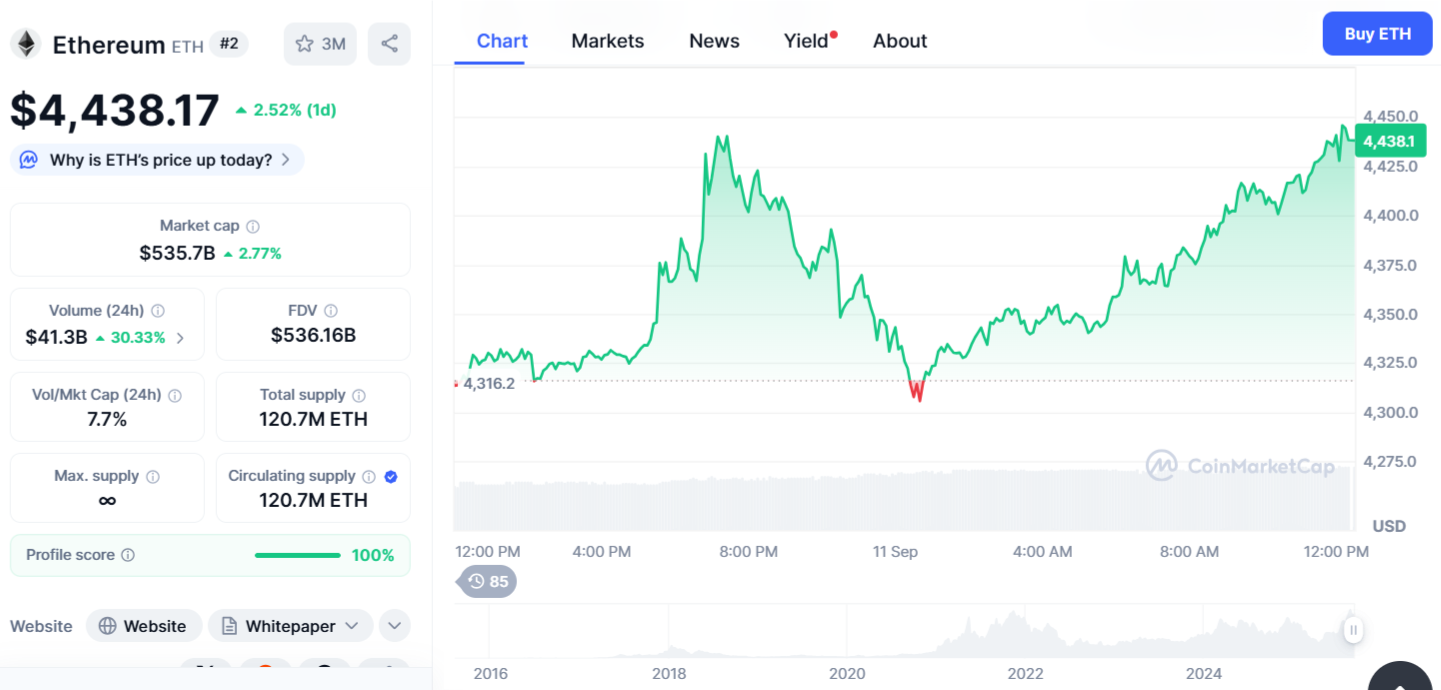

Ethereum Shows Modest Strength Amid Whale Accumulation

News of the transfer came as Ethereum was trading in the mid-$4,000s. The crypto market did not react with a sharp spike, but accumulation by large holders and whales is often seen as a bullish sign for the medium term. Analysts note that steady corporate buying can support prices by removing coins from circulation and reducing selling pressure. Currently, Ethereum is trading at $4,375, up 1.39% over 24 hours, with a market cap of around $528 billion and a 24-hour trading volume of $39 billion.

The token has been moving between $4,200 and $4,500 since last week, experiencing a mild decline after hitting its all-time high. Short-term volatility may continue, and traders are advised to closely monitor ETF updates, regulatory news, and whale activity. BitMine bought $201M in Ethereum, signaling a big buyer in the market. More firms could push demand above supply and lift prices. If institutional buying continues and conditions stay stable, Ether may reach the next resistance levels.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.