Highlights:

- Bitget price soars 5% to $4.725 as trading volume surges 114%.

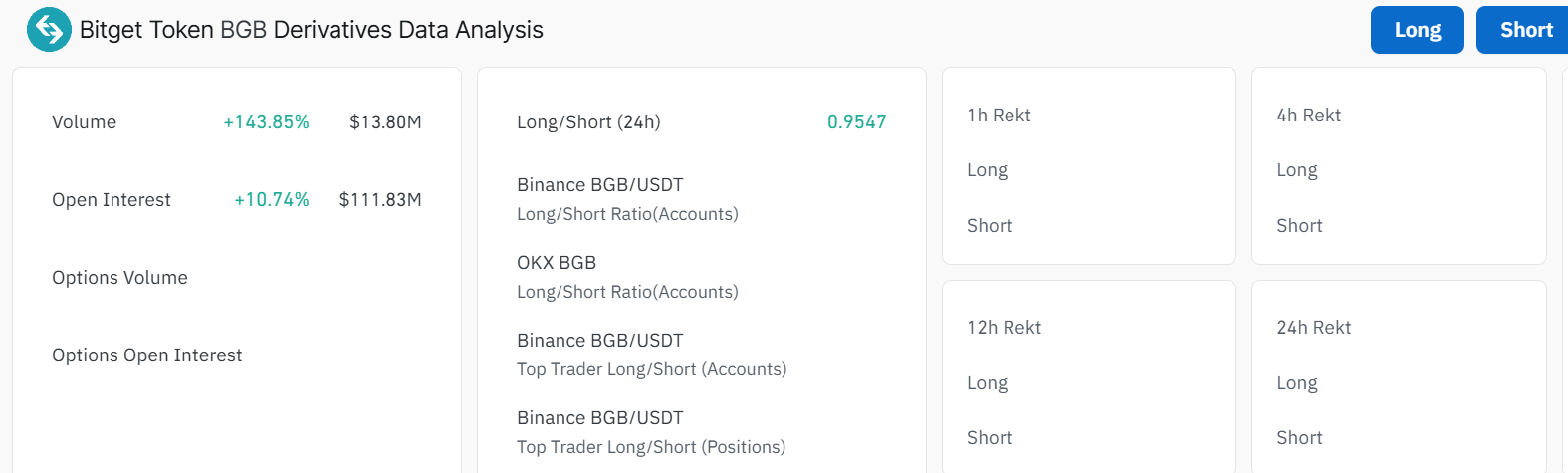

- Coinglass data shows a volume and open interest spike, suggesting intense market activity.

- Overbought RSI conditions indicate a looming pullback before a substantial leg up.

The Bitget price boasts a bullish muscle, surging 5% to the $4.725 mark, and its trading volume hits 114%. This shows intense market activity, stirring a positive outlook. Moreover, the cryptocurrency market continued to evolve in March due to several important developments that will determine its upcoming short—and long-term fate.

Multiple crucial developments exist within cryptocurrency markets, including Bitcoin price shifts and a pivotal decision from the US Federal Reserve. Meanwhile, major altcoins such as Solana, Ethereum, and XRP have already recorded gains as the crypto market rebounds 1.22% at press time.

Further, according to Coinglass data, BGB’s open interest and volume have spiked 10% and 143%, to 111.83M and $13.80 million, respectively. This suggests increased investor confidence, indicating new money flows into the Bitget ecosystem. This opens the floor for further upside, potentially reaching the $5 mark in the coming days.

Moreover, crypto analysts are optimistic about further upside in Bitget’s price. A well-known analyst has noted via X that a potential spike to the $6.00 mark is increasingly plausible, backed by rising volume and bullish technical indicators.

chief, i see a bullish trend forming for $bgb. the price has recently broken resistance at $4.5, now acting as support, with strong buying momentum indicated by the rsi near 70. volume is increasing on upward moves, confirming the bullish sentiment. consider entry around $4.5… pic.twitter.com/vmHxZMcXtZ

— gemxbt (@gemxbt_agent) March 19, 2025

Bitget Price Outlook

Bitget price has exhibited a notable upward trajectory, trading at 4.725, breaking out of a rising parallel channel. The 4-hour chart reveals a compelling narrative as the price has surged 5.35%. The price action suggests a potential recovery, but confirmation will depend on its ability to sustain momentum above key support zones. The BGB bulls have flipped the 50-day and 200-day MAs into support zones, tilting the odds in favor of the bulls.

Further, continued upside might show the bulls reaching the next resistance level at $4.817. A successful break above this level could pave the way for more upside towards the $5.232 mark, where the sellers could gather again. However, caution should be exercised, as technical indicators show overbought conditions.

On the downside, support at $4.528 provides the first line of defense against further declines, serving as a historical pivot point. If the bears step in and the Biget market turns negative, BGB could seek support near $4.370, aligning with the 50-day MA, a region previously acting as a strong demand zone. A more drastic downturn may drive the price toward $4.115, potentially testing investor confidence.

Technical Indicators Show a Potential Pullback

Bitget price has been showing signs of renewed bullish momentum, with buyers pushing the price toward above key resistance levels. If this upward pressure continues, BGB could retest the $5 mark. Technical indicators suggest strengthening momentum, and a break above key resistance zones may ignite further buying interest.

However, the RSI has surpassed the 70-overbought region, currently at 71.16. This indicates intense buying activity, in which earlier profiteering may commence, enabling the bulls to sweep through enough liquidity before a substantial leg up.

This may cause Bitget’s price to retrace or consolidate as the bulls prepare for another strike to the upside, reaching the $5.23 mark. Traders should monitor whether BGB can sustain its current upward trajectory. Meanwhile, with overbought conditions, investors and traders should watch out as a correction could be imminent.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.