Highlights:

- An expert has revealed when Bitcoin will attain a new ATH, citing past U.S. election year trends.

- This year’s ascent to a new peak price will record significant spikes.

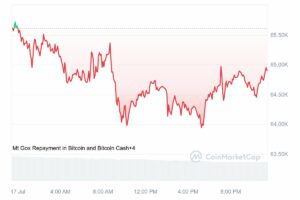

- Bitcoin registered a 2.29% decline in the past 24 hours, trading around the $64,000 region.

A renowned analyst has explained the relationship between Bitcoin’s (BTC) all-time highs (ATHs) and the U.S. presidential election years. According to the expert, Bitcoin has sustained the tradition of attaining new price peaks in three consecutive U.S. presidential elections.

The market expert noted in his post that this year’s election will not be an exception. Hence, market participants should anticipate a new Bitcoin ATH in this year’s Q4. This insight shall cover a precise and detailed description of the analyst’s insight on BTC’s price trends.

BTC’s Past Trends Explaining Why a New ATH is Likely in Q4

Taking to his verified X handle, Ash Crypto outlined three previous U.S. election years and their impacts on BTC’s price. The market expert explanations spanned the 2012, 2016, and 2020 elections. With 2024 gradually elapsing, a new election is almost upon the United States citizens. Therefore, it explains why Ash Crypto’s recent tweet emerged during this period.

Bitcoin’s Price Ascent in the 2012 Election Year

Ash Crypto noted that in 2012, BTC consolidated for five months between July and November. He added that the token breakout happened in December, culminating in a new ATH attainment. On BTC’s price chart, the breakout in 2012 resulted in a price peak around the $13 price region in December. Notably, Bitcoin started in 2012 at a $4.85 selling price. Therefore, concluding the year at an ATH of $13.7 implies an impressive upswing of roughly 182.5%.

Bitcoin’s Price Ascent in 2016

According to the analyst, Bitcoin’s consolidation was shorter in 2016. It lasted for four months, between July and October. He added that BTC’s breakout in 2016 occurred in November, resulting in a new peak price. On the Token’s price chart, the price surge in November culminated in a $975 price peak in December. For context, Bitcoin began 2016 at a $433 selling price. Therefore, it appreciated by roughly 125.2% on its path to attaining a former ATH.

Bitcoin’s Price Ascent in 2020

The United States’ most recent presidential election happened in 2020. Per Ash Crypto, a consolidation similar to what transpired in 2016 played out in 2020, resulting in BTC hitting a new ATH in 2020’s Q4. Meanwhile, on BTC’s price chart, the coin began 2020 at a $7,220 market worth and concluded at a previous $29,000 price peak. The price ascent implies a 301.66% upswing in 2020.

Bitcoin’s Current State in a New Election Year

With the United States Presidential election scheduled for November 5, 2024, Ash Crypto is confident that history could repeat. According to him, Bitcoin is already in a consolidation phase, which could extend till October 2024.

“Something similar will happen again, but with a bigger magnitude, as probably for the first time, the U.S. will have a Bitcoin and crypto-friendly president,” Ash Crypto confidently asserted to conclude his analysis.

BITCOIN WILL MAKE A NEW ATH IN Q4

Let's go through history to see Bitcoin's

performance in election years 👇

2012

➜ 5 months of consolidation from July

to November

➜ Breakout in December, which

resulted in a new ATH

2016

➜ 4 months of consolidation from July

to… pic.twitter.com/YU8nC9Hlvg— Ash Crypto (@Ashcryptoreal) July 17, 2024

Bitcoin’s Market Actions Today

At the time of press, Bitcoin is changing hands at about $64,400, mirroring a 2.29% decline. It boasts a market cap of about $1.27 trillion with a 24-hour trading volume of approximately $30.76 billion. Notedly, the entire crypto market is displaying a 2.27% decline, with Bitcoin dominance at 53.93%.