Highlights:

- Bitcoin whales have increased by about 0.8%, while retailers dropped by 0.3% in February.

- Santiment stated that whales are accumulating Bitcoin despite the volatile nature of the crypto market.

- The new trend was associated with a favorable future prognosis for Bitcoin and the crypto space.

According to the analytical intelligence platform Santiment, Bitcoin (BTC) whales are currently on the rise, evidenced by massive token accumulations. The tremendous procurements are happening amid tremendous crypto market volatility that has elicited significant selloffs among retail investors.

Quantifying the new trend, Santiment stated, “Overall, February has seen a growth of 135 more 100+ BTC wallets and a plummet of 138,680 <100 wallets.” Per the shared chart that accompanied the tweet, the increment in 100+ wallets reached 0.8%, with just a few days gone in February. On the other hand, within the same timeframe, retailers have dropped by about 0.3%.

Still, in the same tweet, the analytical intelligence firm noted that most of the liquidated retailers invested in the token in the past six months. The liquidation implies that they have probably lost a considerable amount of their investment funds. Hence, to prevent further losses, they withdrew the remaining money.

Implications of the New Trend

While the latest trend might appear unfavorable for retailers and whale investors, the longer-term impacts will undoubtedly be profitable for large spenders. This is because only whales tend to have sufficient capital to help them survive the price declines that are often associated with an unstable market.

Aside from owning sufficient funds to help them survive the crypto market slumps, most big spenders capitalize on price drops to accumulate cryptocurrencies while they wait for the right time to sell for profits. Per Santiment, the prevailing condition has always been the best period for crypto market cap appreciation. However, it added that the timeline before the generalized market rally sets in might run into weeks or even months. Therefore, only patient investors will reap rewards from such ventures.

🐳 In a tale as old as time, Bitcoin whales are stacking up more coins during crypto's mid-sized drop and major volatile conditions.

🐟 For small retail traders, especially the ones who first entered the markets in the past 6 months, the volatility is causing them to liquidate.… pic.twitter.com/IT1ONrF6Ia

— Santiment (@santimentfeed) February 6, 2025

Bitcoin Supply Shock Appears Imminent

Corroborating the above claims from Santiment, another on-chain analytical firm, CryptoQuant, has hinted at the possibility of a Bitcoin supply shock happening soon. According to one of its research, CryptoQuant stated that during Bitcoin’s price surge, one of the most notable indicators is a reduction in circulating supply. “This trend is clearly reflected in the exchange reserve chart, which tracks the amount of BTC held on trading platforms,” CryptoQuant added.

Describing the chart attached to its tweet, the analytical firm noted that the exchange supply slump is happening aggressively, signifying that market participants are moving their BTC holdings from exchanges to self-custody. It added that while these actions already elicited price increments, they still possess significant tendencies for more price rallies.

Bitcoin Exchange Reserves Plunge

“As shown in the chart, Bitcoin’s exchange reserves have been on an aggressive decline, signaling an accumulation phase by investors.” – By @ShayanBTC7

Full post 👇https://t.co/xxyCDSg3Vw pic.twitter.com/ntVY7AuDpD

— CryptoQuant.com (@cryptoquant_com) February 6, 2025

BTC Shows Subtle Recovery Signs

Relative to the past few days’ market slumps, Bitcoin’s price suggests that the token is making concrete recovery efforts. At the time of writing, the general crypto market is down by about 2.6% in the past 24 hours. Similarly, BTC has plummeted by about 1.2% within the same time frame.

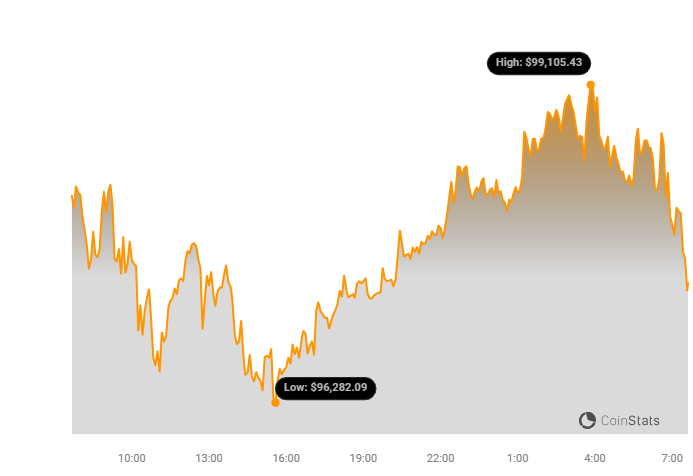

Additionally, Bitcoin is worth approximately $97,270, with minimum and maximum prices in a daily timeframe, reflecting $96,282.09 and $99,105.43, respectively. In other relevant statistics, BTC’s market capitalization has a valuation of $1.928 trillion. Its 24-hour trading volume is down by 21.93% and is worth roughly $46.17 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.