Highlights:

- Eric Trump backs Bitcoin, calling it a great time to invest.

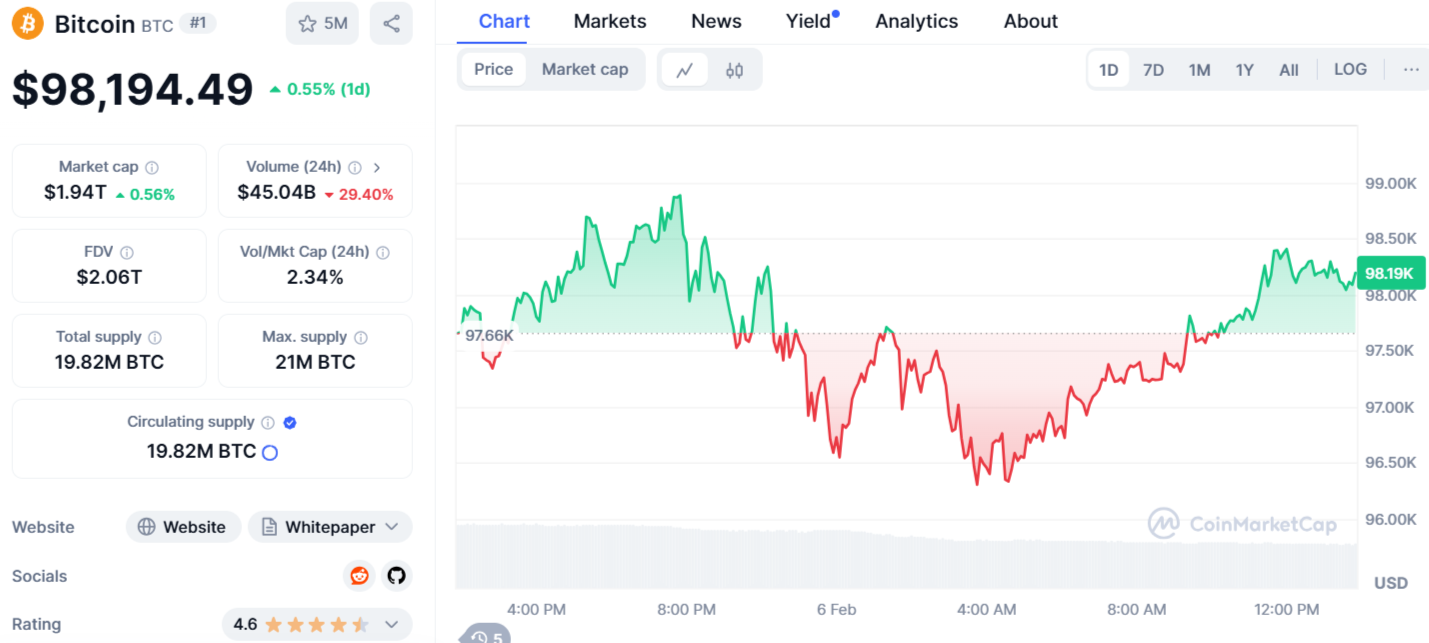

- Bitcoin prices surged past $98,000 following Eric Trump’s encouragement.

- His recent tweet follows a previous one urging the community to focus on Ethereum.

Eric Trump, son of Donald Trump, expressed renewed confidence in Bitcoin (BTC) today via a tweet. He stated, “Feels like a great time to enter #BTC,” and tagged World Liberty Financial (WLF), a Decentralized Finance (DeFi) project linked to his family. Eric’s remark suggests World Liberty Financial may soon purchase Bitcoin.

Feels like a great time to enter #BTC! 🚀 @worldlibertyfi

— Eric Trump (@EricTrump) February 6, 2025

The comment briefly drove Bitcoin above $98,000, marking a modest 0.55% daily gain. Eric’s statement arrives as Bitcoin faces challenges amid tariff-related economic uncertainty.

It was not the first time the president’s son made bullish statements about Bitcoin. In a December interview with Benzinga, Eric said he was holding Bitcoin, Ethereum, Solana, and Sui.

Moreover, during his keynote at the Bitcoin MENA conference in Abu Dhabi that month, Eric projected that Bitcoin could hit the $1 million mark, underscoring its ability to upend traditional financial systems and reshape the global economy.

Throughout his speech, he pointed out the distinct advantages of Bitcoin compared to conventional assets like real estate and gold. He highlighted Bitcoin’s capped supply of 21 million coins as a key factor in its value, contrasting it with gold, which can have its supply increased if prices surge.

So far, World Liberty has not made any Bitcoin transactions, but its portfolio includes a range of crypto assets such as ETH, TRX, and LINK, among others.

Ethereum’s Market Volatility and Eric Trump’s Influence

The response contrasts with Eric Trump’s earlier tweet on Ethereum, which coincided with a significant market shift. On February 1, Ethereum was already facing struggles following President Donald Trump’s tariff announcement, which sparked a broader market sell-off.

By February 3, Ethereum had dropped 37% from its peak on January 31, experiencing one of its steepest declines in recent history. On February 4, Eric Trump followed up with a post stating, “It’s a great time to add ETH.” In less than 18 hours after reaching its lowest point, Ethereum surged more than 35%, climbing from roughly $2,300 to over $2,900. By February 6, the price stabilized around $2,820.

In my opinion, it’s a great time to add $ETH.

— Eric Trump (@EricTrump) February 3, 2025

World Liberty Financial Moves Crypto Holdings Amid Market Correction

Ahead of Trump’s inauguration, the team acquired over $70 million in crypto assets, increasing the entity’s total crypto holdings to $325 million. On Tuesday, the project transferred the majority of its crypto holdings, including significant amounts of ETH and WBTC, to Coinbase, as per data from Arkham Intelligence. World Liberty’s crypto portfolio has significantly diminished, dropping by more than 90% to approximately $34 million.

Although it’s common for projects to move digital assets to exchanges before selling, World Liberty Financial stated that they are not liquidating their assets despite the market correction.

The firm noted:

“We’re making routine movements of our crypto holdings as part of regular treasury management, and payment of fees and expenses and to address working capital requirements. To be clear, we are not selling tokens – we are simply reallocating assets for ordinary business purposes.”

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.