Highlights:

- IBIT’s first day saw 354,000 contracts traded, totaling nearly $1.9 billion in exposure.

- Options trading boosts Bitcoin’s market dynamics, offering new strategies to manage volatility.

- Bitcoin surpassed $94K, marking a new high and fueling institutional confidence in crypto.

Options trading for BlackRock’s exchange-traded fund (ETF), iShares Bitcoin Trust ETF (IBIT), started on November 19 at Nasdaq, with an impressive 73,000 contracts exchanged in the first hour. As per Nasdaq, early surge ranks IBIT among the most active non-index options, reflecting strong market demand.

James Seyffart from Bloomberg reported that IBIT’s first trading day saw nearly 354,000 contracts traded. This amounted to almost $1.9 billion in notional exposure. Additionally, the breakdown showed 289,000 call options and 65,000 put options, resulting in a call-to-put ratio of 4.4:1. “These options were almost certainly part of the move to the new Bitcoin all-time highs today,” the analyst added.

These options enable traders to buy or sell Bitcoin ETF shares at set prices before expiration. They offer new strategies for managing risk and profiting from Bitcoin’s price fluctuations, and their introduction is expected to boost crypto market dynamics.

UPDATE: Final tally of $IBIT's 1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts. That's a ratio of 4.4:1. These options were almost certainly part of the move to the new #Bitcoin all time highs today pic.twitter.com/IN3s9hajJ2

— James Seyffart (@JSeyff) November 19, 2024

Eric Balchunas, Bloomberg’s senior ETF analyst, noted that IBIT’s $1.9b debut exposure was unusually high for a first day. He compared it to the ProShares Bitcoin Strategy ETF (BITO), which has been around for four years and raised $363 million on its debut. However, he pointed out that it’s still smaller than top ETFs like GLD, which saw $5 billion yesterday.

$1.9b is unheard of for Day One. For context, $BITO did $363m and that's been around for four years. And also this is with 25,000 contract position limits. That said, $1.9b isn't quite big dog level yet tho, eg $GLD did $5b today, but give it a few more days/weeks. https://t.co/nAr2rracjb

— Eric Balchunas (@EricBalchunas) November 19, 2024

Institutional Investors Dive Into Bitcoin Options Trading

The launch of IBIT options gives institutional investors more ways to manage risk and earn income. These options help control exposure to Bitcoin’s price volatility. Other Bitcoin ETFs are also preparing for options trading.

Grayscale announced that contracts for its Bitcoin Trust ETF (GBTC) and Bitcoin Mini Trust ETF (BTC) will be available starting tomorrow. These new offerings will expand the options for trading cryptocurrency assets. Bitwise CEO Hunter Horsley anticipates that options trading for the firm’s BITB will begin on November 20.

Grayscale is thrilled that Options trading on both $GBTC and $BTC will begin tomorrow – further developing the ecosystem around our US-listed #Bitcoin ETPs. pic.twitter.com/i7kFpOiogq

— Grayscale (@Grayscale) November 19, 2024

Spot Bitcoin ETFs See Strong Inflows

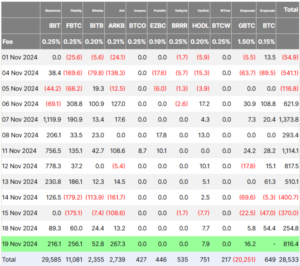

Meanwhile, spot Bitcoin ETFs are also making significant progress. Data from Farside Investors shows that on Tuesday, Bitcoin ETFs saw an inflow of $816.4 million as BTC reached a new all-time high. BlackRock’s IBIT saw $216.1 million in net inflows.

Bitcoin Surpasses $94K Mark

These options launched as Bitcoin surpassed its all-time high of $94,040. This milestone follows a steady rise in the market over recent weeks, driven by institutional inflows. The record-breaking price highlights growing confidence in Bitcoin’s future performance. The recent Bitcoin rally also led to price surges in other altcoins like Ethereum and Solana. At the time of publication, the world’s largest cryptocurrency was priced at approximately $92,778, marking a 0.97% increase in the last 24 hours.

On Nov. 19, Joe Consorti, an industry executive, called the contracts a big deal, noting that listing options on spot BTC ETFs provides access to massive liquidity. On Nov. 20, he commented that the market is optimistic Bitcoin’s price will end the year above $100k.

$IBIT options day 1 so far:

The December 20th, 2024 expiry is seeing its highest volume in $65-strike calls.

With IBIT trading at $52.76, going to $65 reflects a spot bitcoin price of ~$114,339.

TLDR; the market is bullish that bitcoin's price ends the year well over $100k. pic.twitter.com/YPGmtgiITb

— Joe Consorti ⚡️ (@JoeConsorti) November 19, 2024

In a recent report, BCA Research forecasts Bitcoin’s price to reach $200K as it nears the $100K mark. Meanwhile, renowned crypto expert Ali Martinez also made a bullish prediction, suggesting that based on historical trends, BTC could hit $150K next if it follows past cycles.