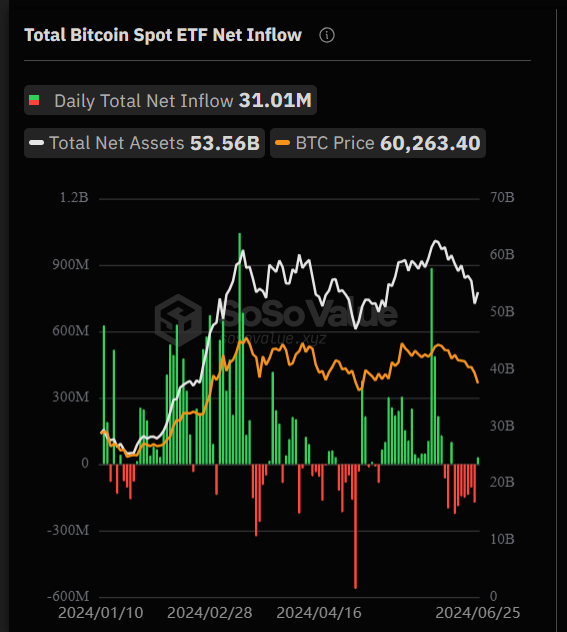

Following a week of net outflows, U.S. Bitcoin spot exchange-traded funds (ETFs) recorded a significant net inflow of $31 million this Tuesday. According to SoSoValue data, this change marks a reversal from the previous trend affecting the 11 Bitcoin spot ETFs, which saw continuous outflows over seven trading days.

Spot Bitcoin ETFs Attract Investors Amidst Regulation

Fidelity’s FBTC led the charge with a substantial $49 million in net inflows, followed by Bitwise’s BITB with $15 million, and VanEck’s HODL added $4 million. Despite this positive shift, Grayscale’s GBTC experienced a decrease, with $30.3 million flowing out, and Ark Invest and 21Shares’ ARKB also reported $6 million in net outflows. Despite these mixed results, the total net inflows for these funds since their January debut reached $14.42 billion, underscoring sustained investor interest.

The Financial Conduct Authority (FCA) has recently approved the first crypto ETPs for trading on the London Stock Exchange, signaling a significant step towards integrating digital assets into mainstream financial markets. Additionally, the FCA initiated a regulatory sandbox that allows companies to test digital securities trading with real customers in a controlled environment, addressing the rapid technological advancements in financial markets.

Ethereum ETFs Expected to Launch Soon

With the crypto focus expanding, U.S. issuers are actively preparing to launch spot Ethereum ETFs following tentative approval from the Securities and Exchange Commission (SEC). Last week, firms filed amended S-1 registration statements, with industry experts predicting that the launch could happen next week. Matt Hougan, Chief Information Officer at Bitwise, expects these Ether ETFs to attract around $15 billion in net inflows within the first 18 months of their U.S. introduction.

WHAT‘S NEW‼️📢

💰 Bitwise CIO predicts spot Ethereum ETFs will attract $15 billion of net inflows in 18 months

Bitwise CIO Matt Hougan predicted that spot Ethereum exchange-traded funds will attract $15 billion of net inflows in their first 18 months, once launched in the U.S.… pic.twitter.com/yvzFB8M99l

— DefiLabs (@defilabs_farm) June 26, 2024

German Government Sells Seized BTC

Meanwhile, the German government has started liquidating Bitcoin seized from the movie piracy website Movie2k.to, selling about $325 million last week and planning to sell more. Additionally, the upcoming distribution of Bitcoin owed to former customers of the now-defunct cryptocurrency exchange Mt. Gox could introduce up to 140,000 BTC, valued at $9 billion.

Also, the German government transferred 200 BTC to Coinbase, and simultaneously, an identical amount was sent from the same wallet to Kraken.

🔔 Breaking News: The German government has just transferred 200 BTC to Coinbase. Simultaneously, this wallet also moved 200 BTC to Kraken. This could lead to significant market fluctuations! 🚀📉#Bitcoin #CryptoNews #MarketUpdate #BTC #Germany pic.twitter.com/ImCwX3fHoT

— BoKuBu (@atrungbs87) June 25, 2024

The digital asset investment products experienced a second consecutive week of outflows, totaling $584 million, amidst investor pessimism about potential interest rate cuts by the Federal Reserve. Last week also marked the lowest trading volumes on ETPs globally since the launch of U.S. ETFs in January, totaling just $6.9 billion.

Read More

- SLUMBO Price Prediction As The Project Hints At A Collaboration With BlackRock

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins

- Best Metaverse Coins to Invest – Next Metaverse Coins