Highlights:

- Bitcoin growth continues and looks to push above $108,000 or a bit lower with some brief retracement risks.

- The growth is driven by institutional demand and spot Bitcoin ETFs, with Metaplanet aiming for 10,000 BTC.

- Bullish momentum remains but could be followed by a consolidation period before the next leg up.

Bitcoin (BTC) continues to demonstrate its dominance within the digital currency ecosystem, showing remarkable growth into the new year. Following a 120% surge in 2024, Bitcoin Price reached a record high of $108,353 on December 17. Despite experiencing a brief 16% retracement, the market’s enthusiasm returned, pushing Bitcoin back toward the $100,000 threshold.

On the last day, the Bitcoin price went up by 1.29% to trade at $98,900, while its market capitalization hit $1.95 trillion. Trading volume rose, with the 24-hour volume up by 47.21% to stand at $29.22 billion. These figures give evidence of the increased market transactions and the continuing interest.

Bitcoin’s Strong Start in January 6.32% Gain in Just Six Days

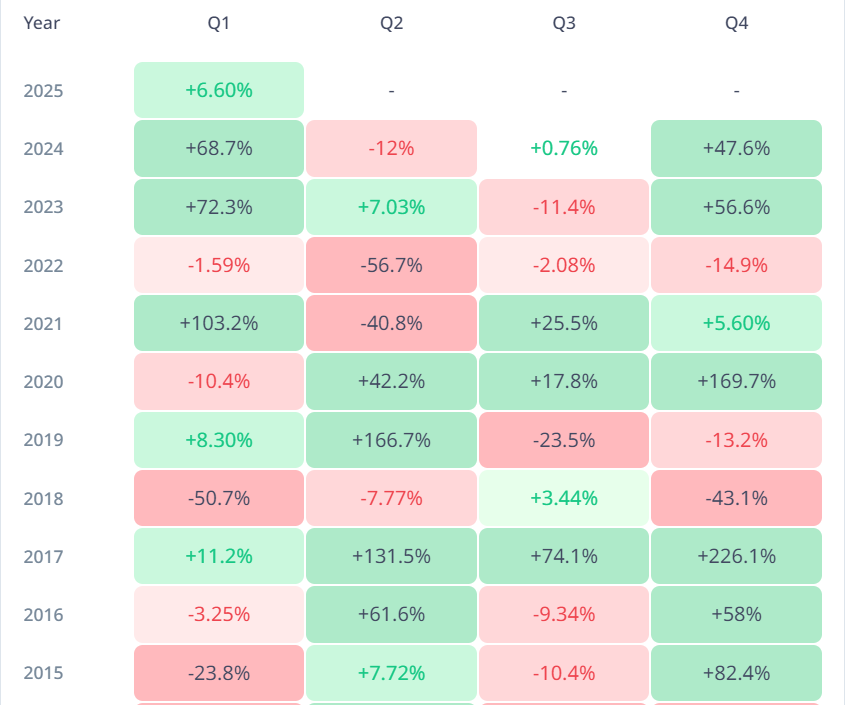

According to Cryptorank, January is moderately bullish for Bitcoin, with an average rate of 9.55%. It has taken only six days for Bitcoin to rise by 6.32%, which indicates that the bullish trend is still intact. Analysts expect this momentum to continue and if this trend continues, history may very well be repeated again.

However, analyst reveal that major actions will get underway on January 6 or 7. They expect Bitcoin to touch and cross $100,000 and reach $105,000-$108,000, alongside a dominance of 57.5%. A retest of $102,000 – $104,000 is seen before dominance plummets to 50%, which may lead to an “AltSeason” where alternative cryptocurrencies outperform Bitcoin. If Bitcoin can’t recover and stay above $100k, a drop down to $88k could trigger buying opportunities in altcoins.

I think it starts from today🚨🚨🚨

Like i said 6/7th January 👁️👁️👁️#Bitcoin breaks 100k , goes strong 105-108k , dominance rises one last time to 57,5%…

Btc retraces 102-104k…

And then #btc dominance starts to collapse from 57% to 50% in weeks.

Starting the #AltSeason 💥💥💥… https://t.co/Ka9YPWs6z5 pic.twitter.com/ORy28odwlO— ***BitElite*** S. V. (@BitElite17) January 6, 2025

Institutional Demand Drives Bitcoin Growth

Various factors, including increased adoption of spot Bitcoin ETFs and demand from institutional players, drive Bitcoin’s growth. While MicroStrategy aims to expand its holdings, concerns persist about potential overbought conditions. Pessimists caution against a possible pullback in Bitcoin’s price

Moreover, the Japanese investment firm Metaplanet has outlined plans to increase its Bitcoin reserves. CEO Simon Gerovich announced the company’s goal to accumulate 10,000 BTC by 2025. Currently holding 1,762 BTC, Metaplanet must purchase an additional 8,238 tokens to meet this target.

Technical Signals $108,000 Bitcoin Price as the Key Target

Bitcoin trades around $98,919, with resistance levels near $100,000 and $105,000. Support lies at approximately $97,000, indicating range-bound movement. The MACD indicator signals bullish momentum as the MACD line crosses above the signal line. Green histogram bars reinforce the likelihood of upward movement.

Additionally, the RSI at 55.93 suggests Bitcoin price has room to grow without being overbought. If Bitcoin secures a daily close above its current range, reclaiming the all-time high of $108,000 could be achievable in the near term.

In the near future, Bitcoin price could retest its $108,000 all-time high (ATH) if it records a positive daily close around this range. However, it looks like the market is heading towards a period of consolidation before resuming the move higher. Bulls and bears alike should remain on guard, however, for both of these things offer opportunities and risks in the changing market world.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.