Highlights:

- Bitcoin rallied as the tariff delay boosted market confidence and increased demand for crypto.

- Traders are watching $91,500 as Bitcoin nears a key resistance level for further gains.

- Crypto-related stocks also rebounded, followed by a shift in U.S. trade policy.

Bitcoin price surged past $91,000 on Thursday after U.S. President Donald Trump postponed imposing 25% tariffs on auto imports from Canada and Mexico. According to a Mar. 6 report from Reuters, the decision grants U.S. automakers a one-month exemption, easing fears of trade war effects on domestic manufacturing. The move pressured the dollar while increasing demand for risky assets like cryptocurrencies.

White House Press Secretary Karoline Leavitt stated that Trump made the decision after meeting with Ford, General Motors, and Stellantis executives. Investors believe the delay suggests the tariffs may not cause as much economic disruption as expected.

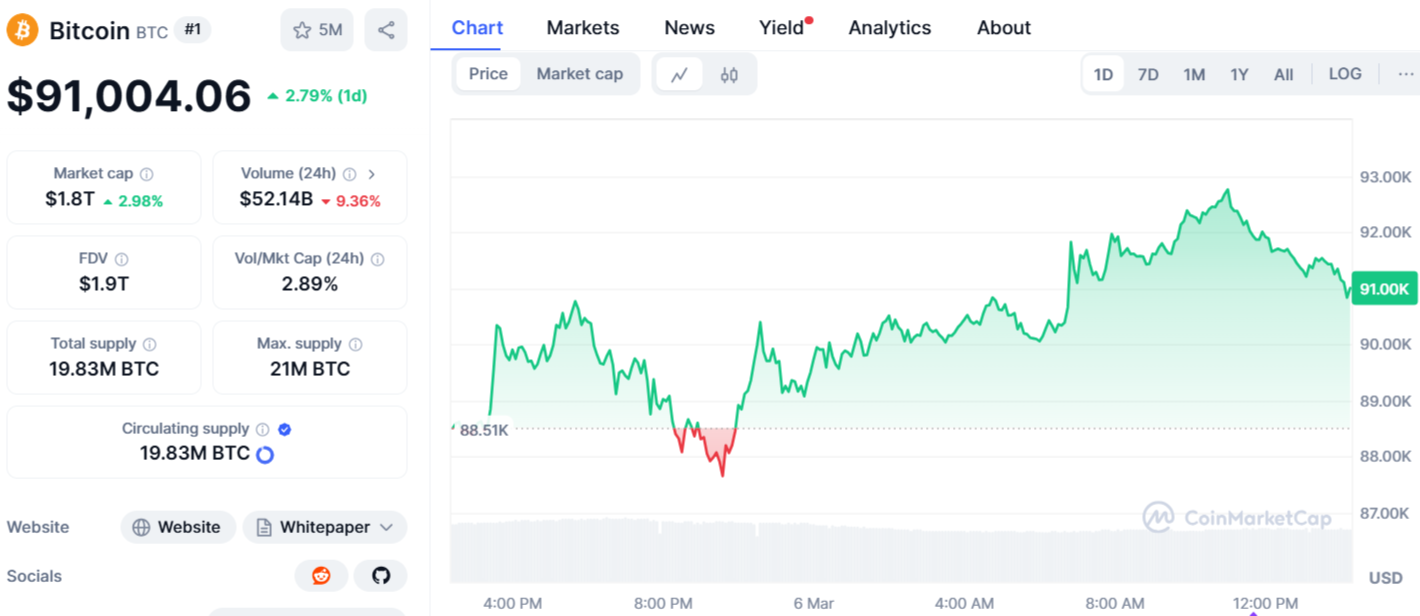

Bitcoin is currently trading at $91,004 after surging 2.79% in the last 24 hours, according to CoinMarketCap data. Despite this price increase, the Crypto Fear & Greed Index, which measures overall market sentiment, remains in the “Extreme Fear” zone at a score of 25.

Moreover, the Nasdaq and S&P 500 rose 1.2% and 1.5%, respectively, during the afternoon session. Crypto-related stocks rebounded from early-week declines. Coinbase (COIN) gained 3.5%, while the largest corporate Bitcoin holder, MicroStrategy, saw nearly a 10% increase.

Tariff Uncertainty Remains as Bitcoin Price Surges on Delay

Despite the temporary relief, the tariff dispute remains unresolved. Trump’s administration has cautioned that additional tariffs, particularly on auto imports, may take effect as soon as April 2. These tariffs are meant to push trade partners to renegotiate deals. However, they could also cause problems with major global economies.

On Wednesday, White House Press Secretary Karoline Leavitt stated:

“Reciprocal tariffs will still go into effect on April, 2, but at the request of the companies associated with USMCA, the president is giving them an exemption for one month so they are not at an economic disadvantage.”

The tariff delay quickly impacted financial markets, leading to a Bitcoin surge. Analysts believe traders see this as a sign of economic stability. Reduced uncertainty has boosted investor confidence, increasing demand for crypto assets.

🚨 @PressSec announces a "one-month exemption on any autos coming through USMCA. Reciprocal tariffs will still go into effect on April 2nd." pic.twitter.com/89xVjOMJRM

— Rapid Response 47 (@RapidResponse47) March 5, 2025

Traders Eye $91,500 Resistance for Potential Bitcoin Gains

The price surge has reached a key level for traders who see it as essential for confirming further gains. MN Trading founder Michaël van de Poppe noted in a March 5 X post that $91,500 is a “crucial resistance.”

He explained that if Bitcoin price surpasses this level, it could re-enter its previous range and potentially move toward a new all-time high. Bitcoin’s current record stands at $109,000, which was briefly reached before Donald Trump’s inauguration on Jan. 20.

#Bitcoin continues to crawl upwards.

The crucial resistance is $91.5K.

Basically if that flips, we're back in the range and we'll go to the other side of the range, which is a new all-time high. pic.twitter.com/5X068WcXQm

— Michaël van de Poppe (@CryptoMichNL) March 5, 2025

Some believe the upcoming US Crypto Summit could influence the short-term movement of Bitcoin price. “People are unsure and waiting to see what happens next, e.g. US Crypto Summit,” said crypto analyst Bitcoin Malaya on March 5. The White House Crypto Summit, set for March 7, will feature over 25 participants, including officials from the Presidential Working Group on Digital Assets.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.