Highlights:

- The price of Bitcoin has reclaimed the $105K, rising 2% in 24 hours.

- On-chain data shows negative netflow since March 10, 2025, with 3,600 BTC daily withdrawn from exchanges, indicating accumulation.

- The derivatives market shows a slight volume decrease but a bullish long-to-short ratio near 1.02, reflecting growing institutional optimism.

The Bitcoin price has shown a splendid bullish muscle, as it has reclaimed the $105K mark, currently up 2% in the past 24 hours. Moreover, various institutions, including Blockchain Group, have purchased 624 BTC. This has boosted confidence in the crypto market, accompanied by rising trading volume by 5%, indicating intense market activity.

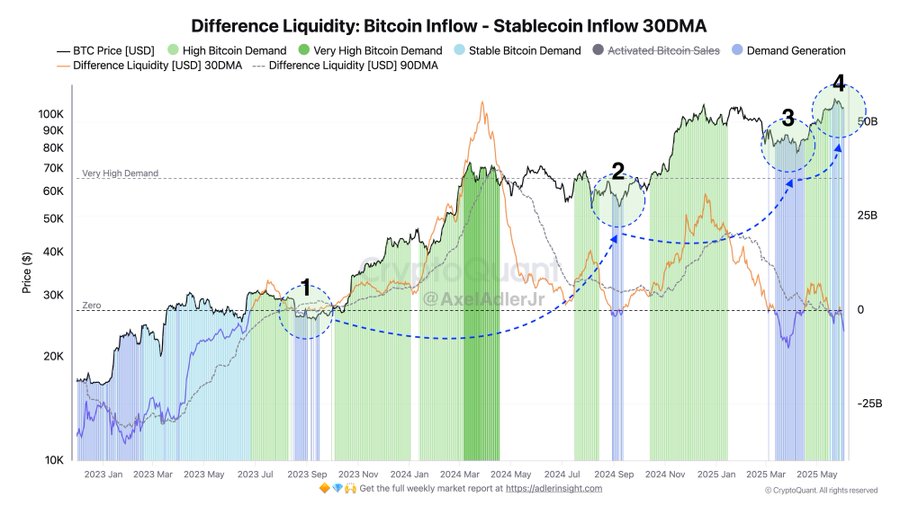

Recently, there has been a major change in Bitcoin on-chain demand, reflected by the combination of average demand creation and stablecoin inflows. According to Axel Adler Jr., the market is currently strong and lines up very well with on-chain models. Beginning on March 10, 2025, Bitcoin’s average netflow had a negative number, which means BTC withdrawals from exchanges were occurring more frequently than deposits.

So, less Bitcoin goes back to exchanges than comes out, pointing to more investors and companies holding it. The 3,600 BTC being transferred out daily is in line with a good market mood, giving some support to an increase in price.

Technical Analysis Reveals Bitcoin Trading Within an Upward Channel

Bitcoin is currently trading within a rising range as its price reclaims $105,859. Both the 50-day and 200-day moving averages are acting as support, which suggests that prices will go up further if the bulls keep showing momentum. Its Relative Strength Index (RSI) at 54.88 is not overbought or oversold, indicating moderate strength. However, the RSI-based moving average is at 61.53, suggesting that we be a little careful and optimistic.

Even so, bearish momentum has started to decrease on 8-hour, 12-hour, and daily candles, according to a renowned trader, James Wynn. Weakened bearish pressure creates conditions for faster price rises in Bitcoin. This usually happens when the market changes direction. Investors should be ready for unexpected changes in the market.

Bearish momentum is weakening on the 8hr, 12hr and daily candles for $BTC.

Everyone will be caught off guard. The pumps will be ferocious. When bitcoin moves it moves hard and fast.

— James Wynn (@JamesWynnReal) June 3, 2025

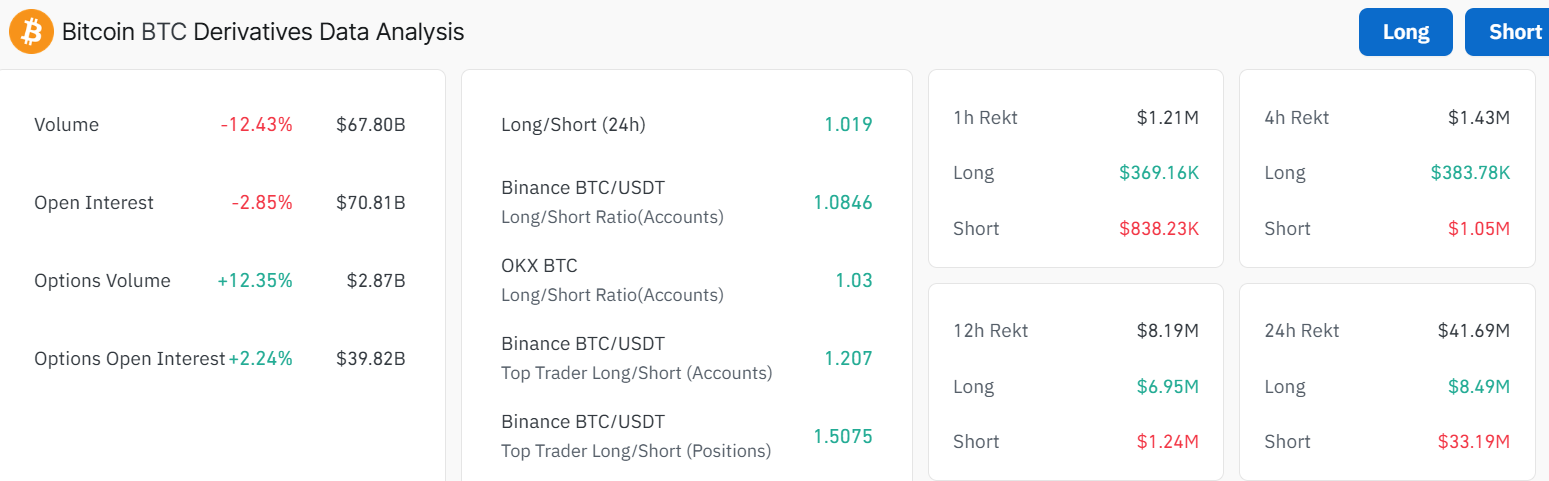

Derivatives Market Data Highlights Stable Liquidity and Slight Bullish Tilt

Bitcoin derivatives markets report a small fall in trading activity (-12.43%) and open interest (-2.85%). However, BTC’s options volume and open interest show an increase, proving that options continue to be popular. On main exchanges, the long-to-short ratio remains near 1.02, indicating that established traders continue buying more than selling. This commonly indicates a strong sentiment of optimism among institutional investors.

Less liquidation of long positions is taking place, which matches a general trend towards a more optimistic market view. On the whole, the derivatives market reveals stable liquidity and slight encouragement to buy, which shows that the bullish cycle is growing stronger.

What’s Next in Bitcoin Price

When Bitcoin has net outflows and accumulates regularly, people holding it tend to accumulate more, which helps increase its value. The use of technical chart patterns and moving averages adds support to a cautiously confident view since Bitcoin stays within an upward pattern.

Many timeframes point to weakening bearish trends, which might cause Bitcoin to rebound strongly soon. Investors need to keep an eye on key support at $104,000. If the bulls portray intense strength, Bitcoin price could surge towards $108K, $109K, and $112K resistance zones. In short, the recent market situation in mid-2025 shows that Bitcoin is set for a potentially significant price rise shortly.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.