Highlights:

- The Bitcoin price is up nearly 1% to $118,522, as trading volume spikes by 11%.

- The recent surge comes as Bolivia recently signed a deal with El Salvador to increase Bitcoin adoption.

- Crypto analyst predicts a rally towards $125,000-$141,000 if the support zone at $115,000 holds.

Bitcoin price has been stuck in a tight range for the past few weeks, currently up almost 1% to $118,522 in the past 24 hours. The trading volume has notably soared 11% to $70.71 billion, indicating rising investor confidence. BTC is now up 11% in a month, indicating increased hype.

Meanwhile, Bolivia recently signed a deal with El Salvador to increase Bitcoin adoption and facilitate its regulation in both territories. This alliance marks a breakthrough in Latin America, where the adoption of Bitcoin in mainstream economies is gaining momentum.

BREAKING: BOLIVIA SIGNS AGREEMENT WITH EL SALVADOR TO REGULATE CRYPTO AND BOOST #BITCOIN ADOPTION

BTC SPREADING GLOBALLY. HUGE 🔥 pic.twitter.com/hfh1x3QF3Z

— The Bitcoin Historian (@pete_rizzo_) July 31, 2025

The partnership aims to accelerate the adoption of cryptocurrencies, particularly Bitcoin, to foster financial inclusion and innovation.

Bitcoin Price May Be Gearing Up for a Bullish Rally

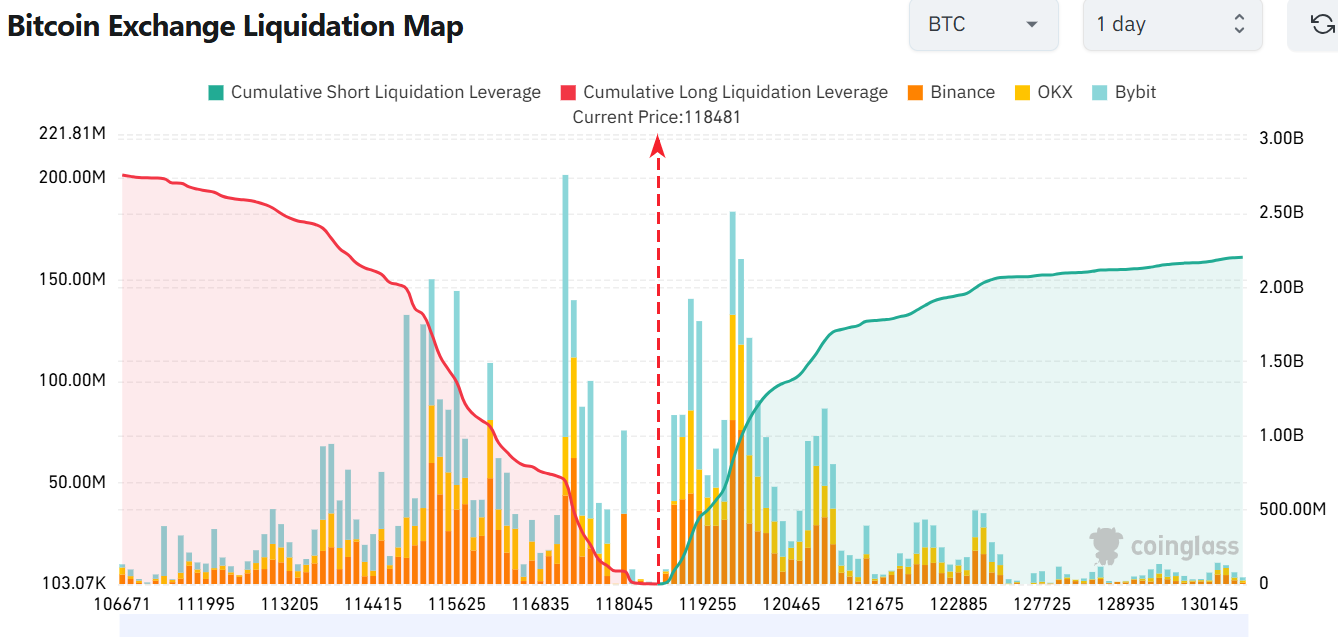

In addition to the cutting-edge deal, the volatility of Bitcoin still dominates the crypto field, and it largely benefits short-term investors. Investors are very attentive to the dynamics of Bitcoin’s price, and the recent liquidation maps hold valuable insights. The Bitcoin Exchange Liquidation Map illustrates the significant leverage of traders. According to the liquidation map, the long positions exceed the short positions, at $2.75 billion and $2.20 billion, respectively.

A closer look at the liquidation map also reveals that the $114,000 to $121,000 zone is a key consolidation level for BTC. This suggests that the Bitcoin price may survive as long as the $105K key support level holds.

Technical indicators are also crucial in determining the price movements of Bitcoin. Currently, the leading altcoin by market cap has been oscillating between the $116,000 and $ 121,000 key levels. This indicates that the token is being pushed into consolidation and may serve as an accumulation period before the bulls strike. The key levels at $111,674 aligning with the 50-day and the $99,041, coinciding with the 200-day SMA, act as the immediate support zone.

The most recent chart reading indicates that the RSI (Relative Strength Index) of Bitcoin is 59.81. This suggests that the market still has room to move higher before becoming overbought, providing bulls with more breathing room.

What’s Next for BTC Price?

In the short term, the Bitcoin price may drop slightly to retest the $117,000–$116,000 support area. However, as long as it remains above that range, the bullish trend remains strong.

Overall, Bitcoin appears poised to continue its ascent toward $130,000 — especially if market conditions remain favorable and investor interest remains high. According to popular analyst, Ali Martinez, the Bitcoin price could be on track for a move to $125,230 and potentially $141,770, based on the Short-Term Holder Cost Basis.

As long as the $105,450 support holds, Bitcoin $BTC could be on track for a move to $125,230 and potentially $141,770, based on the Short-Term Holder Cost Basis. pic.twitter.com/AHk2e3YHT3

— Ali (@ali_charts) July 31, 2025

The 11% monthly surge could signal the start of an intense hype, especially if institutional adoption soars. A break above $120,000 might send the BTC price to $130,000 or higher. However, a drop below $116,000 could trigger a retreat to lower levels. Trading volume is also spiking, with an 11% surge in the last 24 hours, suggesting strong buying pressure that confirms the bulls are having the upper hand.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.