Highlights:

- The price of Bitcoin is stuck at $107,000, with a 14% increase in trading volume to $ 37.28 billion.

- Strategy acquires 4,980 BTC, totaling 597,325 BTC with a 19.7% YTD reward.

- Bitcoin shows consolidation, with $96K and $106K as support zones, while the bulls eye $110K.

The Bitcoin price is still stuck at $107K levels, currently down 0.44% over the past 24 hours. Its daily trading volume has, however, rallied 14% to $37.28 billion, showing growing market activity. Meanwhile, Strategy has purchased a substantial amount of 4,980 BTC, which costs around $531.9 million, averaging to $106,801 per Bitcoin. This purchase represents an excellent 19.7% YTD BTC reward as of 29 June 2025.

Moreover, it is an addition to its expanding collection, which now totals 597,325 BTC, valued at $42.40 billion. As Bitcoin gains institutional traction, Strategy is positioning itself at the forefront of this bull trend cycle.

Strategy has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 $BTC acquired for ~$42.40 billion at ~$70,982 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/xvWnSkfukS

— Michael Saylor (@saylor) June 30, 2025

BTC Remains Stuck in Consolidation

A zoomed-out view of the Bitcoin price daily chart timeframe reveals that BTC remains stuck in a consolidation channel. Currently, the BTC price oscillates between $110K and $107K levels. This consolidation move may act as an accumulation period, potentially pushing BTC towards the $110K key levels.

Further, the bulls are having the upper hand, reinforced by the $96K and $106K support zones, coinciding with the 50-day and 200-day MAs. If these levels hold strong, the Bitcoin price could be poised for a rally to reclaim the $110,000 mark.

With an RSI of 56.22, the asset is neither overbought nor oversold, indicating a neutral zone. However, according to a well-known crypto analyst, Ali Martinez, the Stock RSI is flashing a death cross. He has further noted that a move towards the $100,000 mark is plausible, unless the Bitcoin price closes above the $ 109,000 mark.

#Bitcoin $BTC is facing a key rejection while the Stoch RSI flashes a death cross on the daily chart. A move back to $100,000 is possible unless we get a sustained close above $109,000. pic.twitter.com/H78AfRQrFw

— Ali (@ali_charts) June 30, 2025

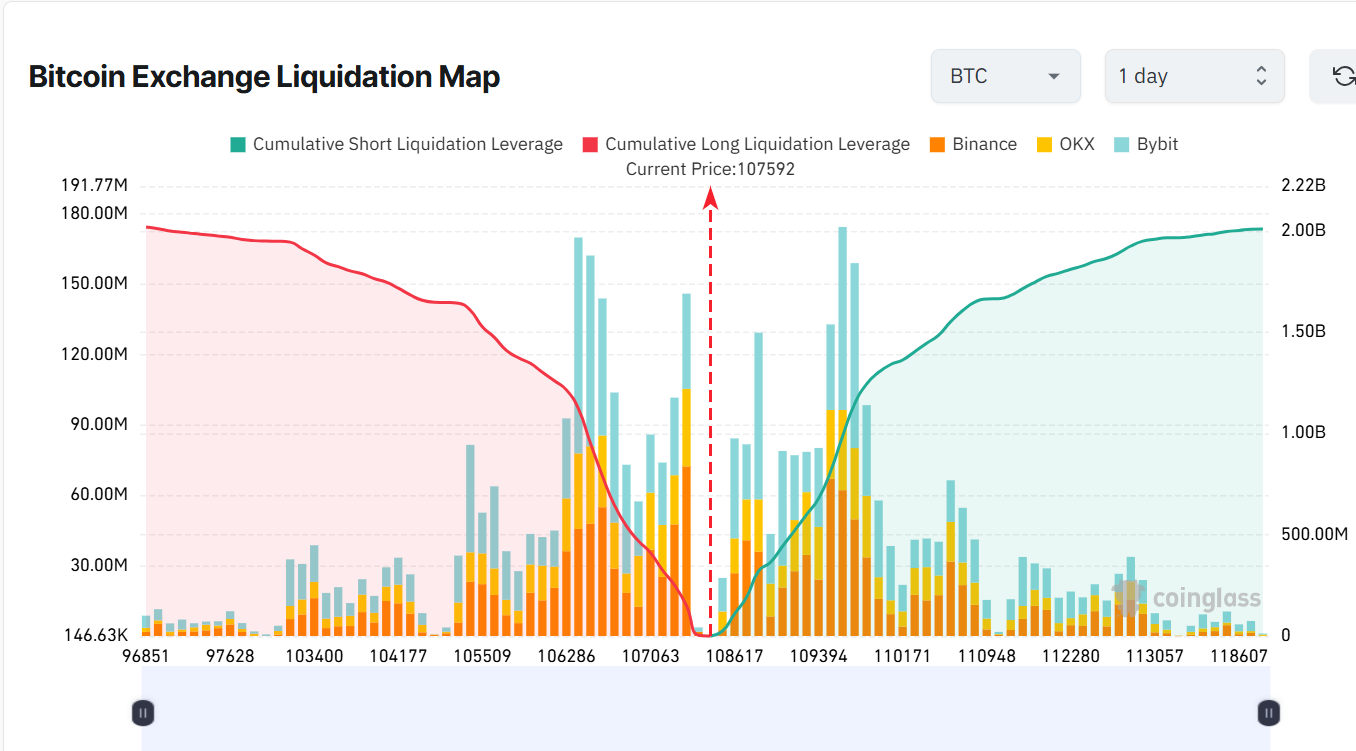

On the other hand, the liquidation map of the Bitcoin exchange indicates significant market activity, with the current value of BTC at $107,592. According to the liquidation map, the short positions are almost in equilibrium with the long positions, at $2.01 billion and $2.02 billion, respectively.

A closer look at the liquidation map also reveals that the $106 to $110,000 zone is a key consolidation level for BTC. This suggests that the Bitcoin price may survive and remain above the $105K key support level.

Bitcoin Price at Crossroads as Bulls Eye $110K Mark

Bitcoin bulls and bears are in a tight tug-of-war, with neither giving in. However, the bulls have a slight upper hand, as they have established strong support around the $ 96,000 and $ 106,000 marks. If these levels hold, the RSI will continue its upward movement. A rally towards $110K could be plausible. Moreover, if the consolidation channel acts as the accumulation phase, a breakout towards the $112K mark is imminent.

On the downside, if the bears prevail in the struggle and take the upper hand, BTC will risk a downward movement towards the $100K mark. In that case, if the $106K support gives way, the safety net at $100K-$105K will provide immediate support. In the meantime, traders and investors should pay close attention to the RSI and the increasing trading volume to determine the next move in the BTC market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.