Highlights:

- BTC soars 2% to $105k as trading volume soars.

- This comes despite the Bank of Japan raising interest rates for the second time in 17 years.

- With recent developments, the Bitcoin price may reach $110K in the short term.

The Bitcoin price has surged 2% to exchange hands at $105,234 at press time. The spike in interest has seen the trading volume increase 41% to $93.52 billion. BTC now boasts a 2% spike in a week, 6% in a month, and 163% in a year.

Bitcoin’s price remains unfazed despite the recent Bank of Japan raising interest rates for the second time in 17 years. The previous hike in August 2024 caused an immediate 14% drop in Bitcoin’s value, while altcoins faced even steeper losses. The crypto market was shaken, and many feared further rate hikes would trigger another wave of panic. However, despite the hike, Bitcoin and the broader crypto market have shown remarkable resilience this time.

THE BANK OF JAPAN RAISES RATES BY 0.25%, NOW TO THE HIGHEST LEVEL IN 17 YEARS.

The last time this happened in August of 2024, we had the Yen-Carry trade which spiked the $VIX up 600% in a day and caused equities to fall from 20-30%.

The reason for this was because traders were… pic.twitter.com/qs7kAY71uS

— amit (@amitisinvesting) January 24, 2025

On the other hand, US President Donald Trump signed an executive order on Thursday to promote the advancement of cryptocurrencies in the US and to work toward potentially developing a national digital asset stockpile. This has also contributed to Bitcoin’s price surge and other altcoins such as Ethereum and Solana. With the recent developments, various crypto analysts are optimistic about BTC’s next big rally.

#Bitcoin breakout is coming?

BTC has been moving inside a range for the past 3 months.

Right now, the price is back near the range high. Meanwhile, RSI has already broken out, which could mean the price might break out next. pic.twitter.com/dfo7UeVAoA

— Mags (@thescalpingpro) January 24, 2025

BTC Statistical Data

Based on CoinmarketCap data:

- BTC price now – $105K

- Trading volume (24h) – $93.52 billion

- Market cap – $2.08 trillion

- Total supply – 19.81 million

- Circulating supply – 19.81 million

- BTC ranking – #1

Bitcoin Price Enters a Consolidation Phase

The BTC/USD 1-day chart demonstrates a consolidation phase, with the bulls aiming for a breakout. After defending the critical support at $98,795, the price climbs to $103K, aligning with earlier predictions of testing the $100K—$110K range.

The daily chart suggests a consolidation phase within a narrowing range, with the price currently at $105,234. The 50-day Moving Average and the 200-day MA offer immediate support at $98,795 and $76,002, respectively, tilting the odds toward the buyers.

However, a decisive breakout above the $$107,347 region, where the upper channel boundary aligns, could push the price toward the $109,356 ATH and above. Meanwhile, the volume activity suggests increasing momentum, which might cause a significant price move. Moreover, traders should watch for increased volatility near the breakout levels to confirm the next direction, with moving averages serving as dynamic indicators of trend strength.

On the other hand, a failure to break higher could see BTC retrace to the support zone near $100,171 and below, corresponding to the lower channel boundary.

BTC Bulls Poised for More Upside

The Relative Strength Index (RSI) sits at 61.19, indicating intense buying activity. Moreover, there is still more room for the upside before BTC is considered overbought. If the buying appetite surges at this level, it could validate a breakout in the Bitcoin price.

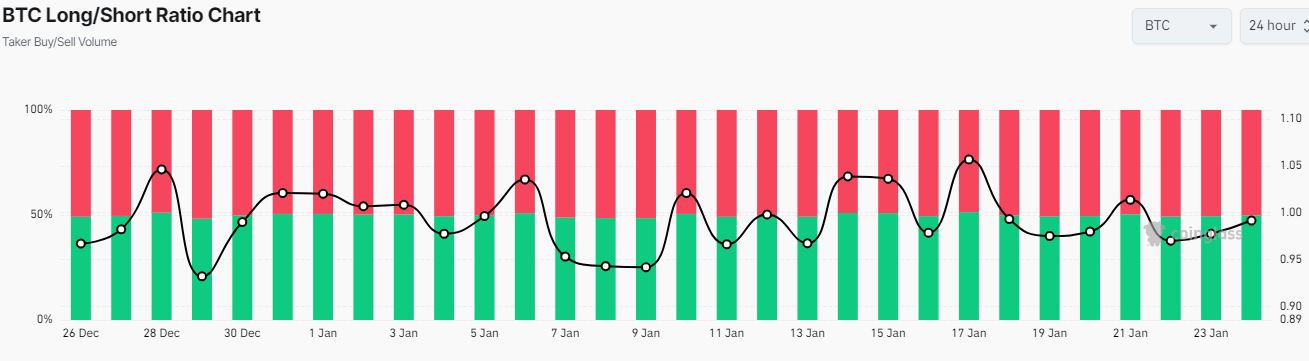

Elsewhere, the BTC Long/short positions suggest some cautious optimism. In a daily chart outlook, BTC’s long/short ratio showed 49.79% long positions versus 50.21% short positions.

Despite the market’s indecision, BTC displays resilience, with buyers gradually gaining control. If the buyers gain momentum at this level, they could spike a rally, reclaiming the $109K ATH or above to $110K.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.