Highlights:

- Bitcoin price has soared 2% to the $86,000 mark amid spiking trading volume.

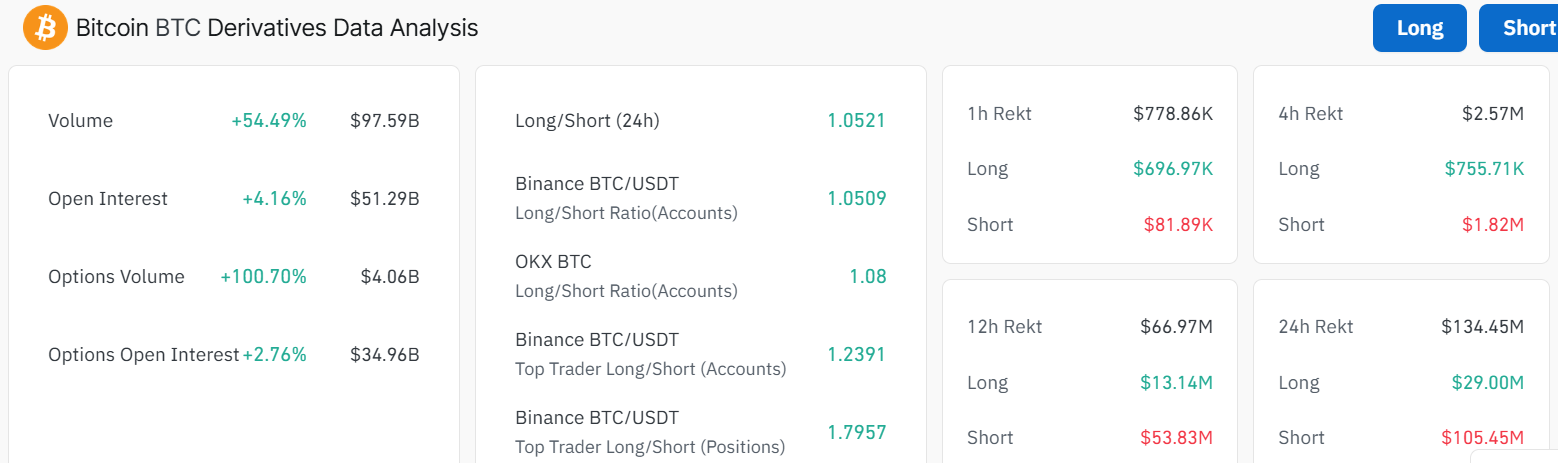

- Coinglass data shows increased open interest and volume, suggesting renewed investor confidence.

- Ark Invest CEO Cathie Woods maintains the $1.5M price target for 2030 in the BTC market.

The Bitcoin price has breached the $85,000 mark, rallying 2.47% to $86,086. Accompanying the price movement is its daily training volume, which has soared 56% to $36.64B, indicating renewed investor confidence in the market.

Despite recent pullbacks, Ark Invest’s Cathie Wood remains bullish on Bitcoin, insisting that BTC is still in a bull cycle. She maintains her $1.5M price target for 2030 and highlights U.S. deregulation as key for institutional adoption.

Cathie Woods maintains Bitcoin $BTC price target of $1 million by 2030

— Barchart (@Barchart) March 19, 2025

Other major altcoins, such as Ethereum and XRP, boast significant gains today. Meanwhile, Bitcoin has seen a volume and open interest spike by 54% and 4%, respectively. The recent spike shows that new money could flow into the BTC market, which could stir a potential recovery to the $91,000 mark.

BTC Price Outlook

Bitcoin price has shown resilience with a 2.87% increase, currently trading at $86,086. The price remains within a volatile range, testing key levels of support and resistance. Bitcoin could challenge the immediate resistance at $91,589 if bullish momentum continues, with further upside potential toward the $95,000 mark.

A breakout above this level may lead to a retest of the $100,000 high. However, the price is still hovering near the falling wedge pattern, suggesting a possible period of consolidation before a decisive move.

On the downside, BTC faces critical support at $84,508, which aligns with the 50-day MA. If bears step in, the selling pressure could mount, as the next level to watch is $80,986, a key historical low that may act as a strong demand zone.

A break below this level could push BTC into deeper correction territory, with $78,303 emerging as a last line of defense. Market participants should closely observe volume dynamics and momentum shifts, as a resurgence of buying interest could prevent further declines and reignite a push toward the $91,000 mark.

Can Bitcoin Price Reclaim the $91,589 Mark?

Bitcoin price has shown promising signs of recovery, sparking optimism about a potential move back to the $91,589 barrier. The recent price action above the $85,000 mark suggests buyers are gradually regaining control, with BTC finding stability above key support levels. If bullish momentum strengthens, a push past the nearest resistance zone at $91,589 could pave the way for a retest of this critical level.

However, sustained upward movement will require increased trading volume and positive sentiment in the broader crypto market. A decisive break above $91,589 could signal the start of a stronger rally, drawing in more investors eager to ride the trend.

The RSI indicator shows a surge in buying interest as it has hurtled from the 30-oversold region, currently reading at 48. Increased buying pressure at this level will stir a spike above the 50-mean level, tilting the odds towards buyers.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.