Highlights:

- The price of Bitcoin rises 1% to $ 107,000, as trading volume surges 11% amid increased global liquidity.

- The Global liquidity surge fuels Bitcoin’s bullish momentum, suggesting an imminent breakout to $110K-$112K.

- Technical indicators suggest potential upside as long liquidations surpass the short liquidations.

As of 2 July, the Bitcoin price crawled back to the $107K mark, up 1% in the past 24 hours. Its daily trading volume is also up 11%, indicating growing investor confidence. Meanwhile, a new all-time high in global liquidity has triggered a period of high volatility and a significant price movement for Bitcoin.

As the latest charts demonstrate, the correlation between Bitcoin and global liquidity suggests that a significant breakout for Bitcoin is imminent. World liquidity reached record heights, and on each occasion the liquidity hit an all-time high, Bitcoin accompanied it with violent upside surges.

Global Liquidity just broke out to a new all-time high.

That’s not noise. That’s fuel.

Every time liquidity hit ATHs, $BTC followed with violent upside.The chart says it’s showtime.

Bitcoin’s next leg is loading. pic.twitter.com/d0T8GS3juR

— Merlijn The Trader (@MerlijnTrader) July 2, 2025

According to a chart presented by renowned analyst Merlijn The Trader, liquidity is considered the driving force behind the next leg of the Bitcoin market. This could result in its price moving higher as the liquidity dynamic continues to accumulate. Provided that Bitcoin maintains its tendency for price increases based on its liquidity level, the next notable price surge may not be far away.

Bitcoin Price Continues Its Consolidation Phase

The king coin (Bitcoin price) is still maintaining a bullish outlook, as it continues to oscillate between the $105,000 and $107,000 levels. Currently, the bulls have rebounded from the $105,380 lows to $107 830, marking a 1% rise in the past 24 hours.

The strong support levels at $96K and $106K levels further give the bulls strength to aim for higher levels in the coming days. Moreover, the consolidation channel may act as an accumulation period, in which a breakout might see the Bitcoin price surpass the $112K ATH.

The technical indicators, such as the Relative Strength Index (RSI), which currently stands at 55.71, suggest that Bitcoin is not yet overbought. Moreover, there is potential room for the upside, as the bulls hold above the 50-mean level.

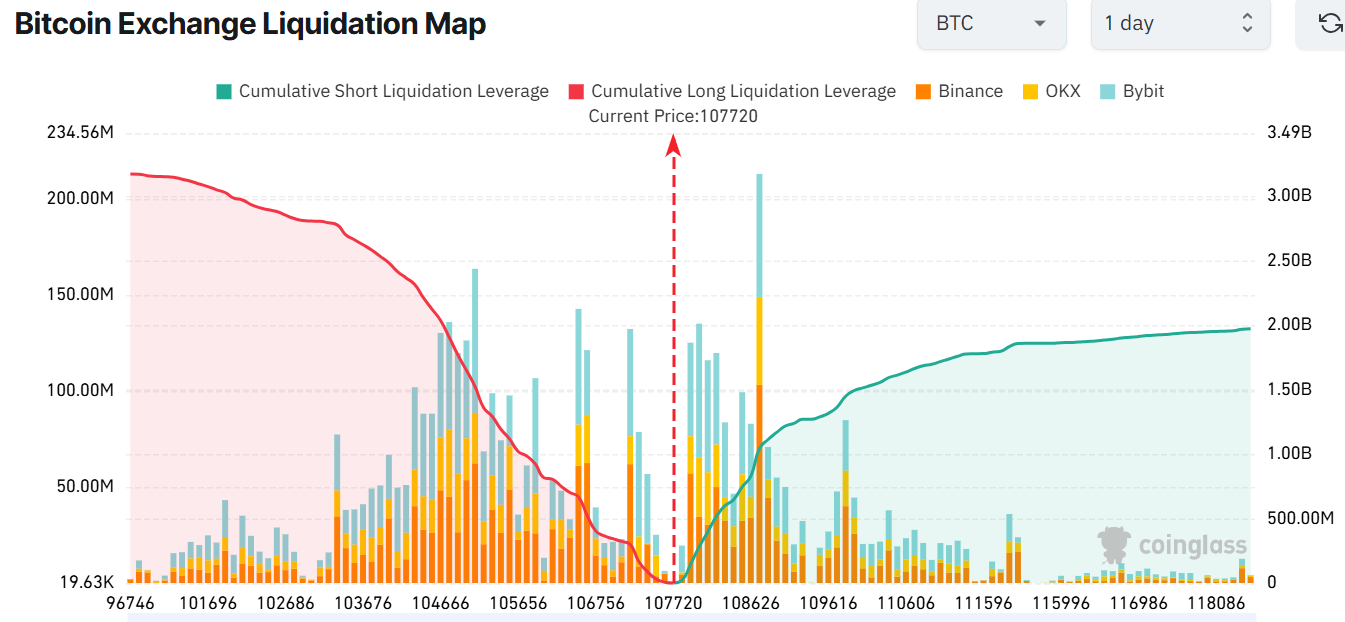

On the liquidation map, a steady increase in long liquidations has occurred over the last 24 hours. Based on the chart, there is a significant discrepancy in liquidations between long and short positions. The position of long liquidation leverage ($3.17 billion) is significantly higher than that of short liquidations ($1.97 billion).

This implies that there could be a sudden surge in the price of Bitcoin once it overcomes the present resistance. This imbalance suggests a high likelihood of a short squeeze, which could lead to a faster appreciation of the Bitcoin price.

Bulls Eye $110K Once Resistance Keys Give Way

Given the bullish outlook in the BTC market, the bulls may be poised for a breakout towards the $ 110,000 mark. If the support levels hold steady, the bulls could gain momentum, breaking out of the consolidation channel to reach the $108K-$110K levels. The increased buying appetite and the recent global liquidity surge could see the Bitcoin price reclaim the $112,000 ATH.

On the downside, the lower support zone at $106K-$105K has held strong, acting as a safety net for slight dips in the market. In the long term, the Bitcoin bulls could eye the $125,000 mark. In the meantime, traders should closely monitor the support and resistance zones to determine the next move.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.