Highlights:

- The price of Bitcoin has soared 3% to $105K amid stabilizing geopolitical tensions and positive market sentiment from Trump’s announcements.

- Bitcoin enters a consolidation phase with support at $96K, poised for potential breakouts to $107K or $109K.

- A shift in liquidation dynamics suggests growing bullish sentiment in the Bitcoin market.

On 24 June 2025, Bitcoin portrayed a mild bullish rally, surging 3% to %$105K mark. Moreover, the daily trading volume soared 12% indicating surging trading activities. This comes as the geopolitical tensions stabilize, and President Trump revealed that Israel will not attack Iran. Moreover, the US president has announced via Truth Social that China could buy oil from Iran. He also hopes that China will buy oil in the U.S and underlines his contribution in the arrangement coming through.

The increase in the uncertainty in the region resulted in oil prices rising before, and poses further pressure on the energy-importing countries like India. With the de-escalation, though, the cost of oil has also softened, which has helped in creating a positive upside in the global market, including Bitcoin.

Bitcoin Price Enters a Consolidation Channel

Following the easing geopolitical tensions, Bitcoin price has rebounded to the $105K mark, entering a consolidation phase. The king-coin has so far been trading between significant resistance areas at $105,000 and $112,000. The daily chart outlook shows a potential breakout in the BTC market. Further, the bulls have established strong support around the $96,016 and $105296, aligning with the 50-day and 200-day MAs, respectively. This could open the door towards further upside, potentially $107K – $109K mark.

The Relative Strength Index (RSI) is at the level of 51.67, which means that the market is neutral (it is neither oversold nor overbought). However, the RSI has surged above the 50-mean level, from the 41-level, suggesting growing bullish sentiment.

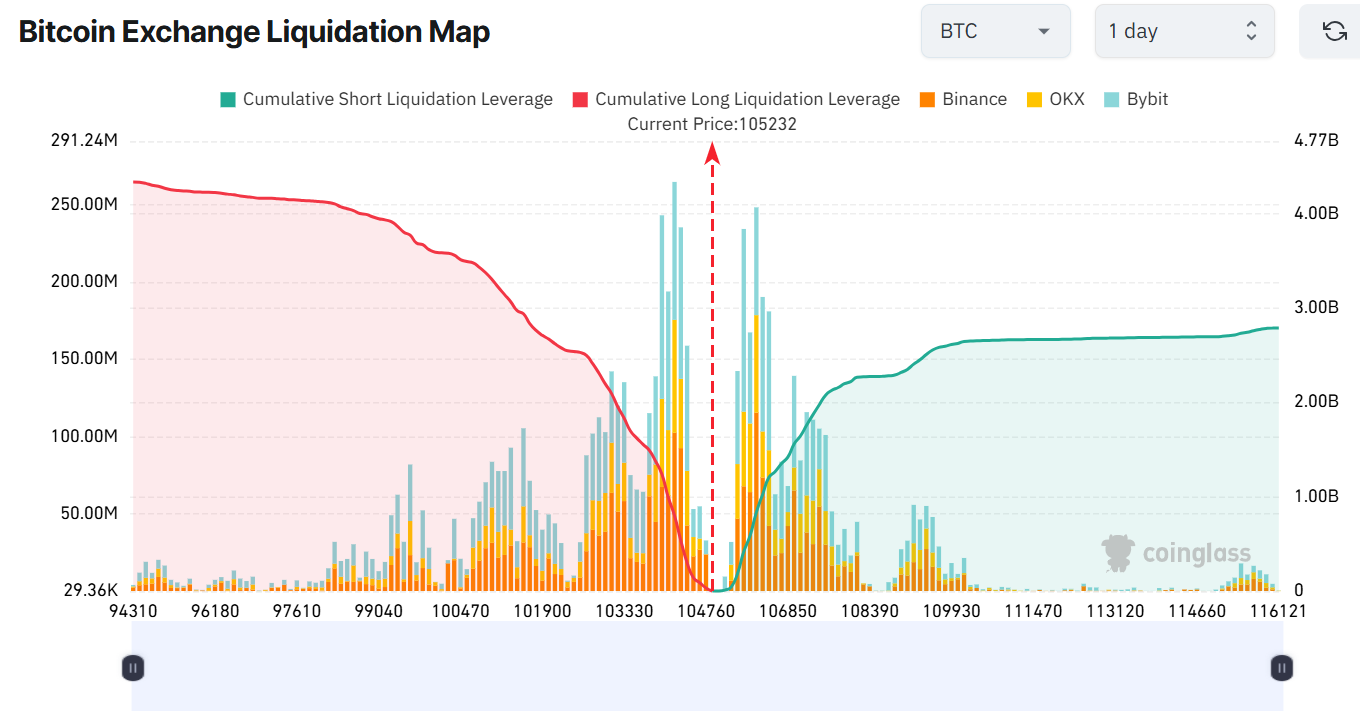

The Bitcoin liquidation map has a curious formation in the market, with the major accumulation level of the liquidation around the price of the 105,000 price range. There is more cumulative long liquidation leverage ($4.33 billion) compared to shorts ($2.79 billion) in the last 24 hours.

This imbalance suggests that some bullish sentiment is building in the Bitcoin market, which may cause a surge to $109K in the short term.

BTC Gears for a Breakout Above the Consolidation Channel

Based on the recent developments, Bitcoin price is showing signs of a potential breakout. If the support zones hold strong, a rally towards $107K and $108K may be plausible. In a highly bullish case, bolstered by the ceasefire, China’s agreement to purchase oil from Iran will spike further upside. In such a case, the $109K- $110K mark could be imminent in the near term.

On the downside, a possible pullback may be imminent if the support zones don’t hold. In such a case, the Bitcoin price will revisit the $105,296 support. A highly bearish case will cause further downside towards $104K, $103K, and $102K regions.

Meanwhile, major geopolitical developments, Bitcoin has been displaying signs of recovery as an RSI of neutrality indicates that it is stable. The traders are looking forward to a break above the $110K -$112K to give an indication of upside gains. Nevertheless, speculations and trends in support levels and liquidation of Bitcoin in the market are still fueling its current short-term rally.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.