Highlights:

- The price of Bitcoin has soared 2% in a week, despite a short-term correction below the $108K mark.

- The BTC price remains in a bullish channel, with a strong RSI reading, pointing to a potential price spike toward $112K.

- Bitcoin derivatives indicate strong market interest and future growth potential, with key levels to watch at $105K and $112K.

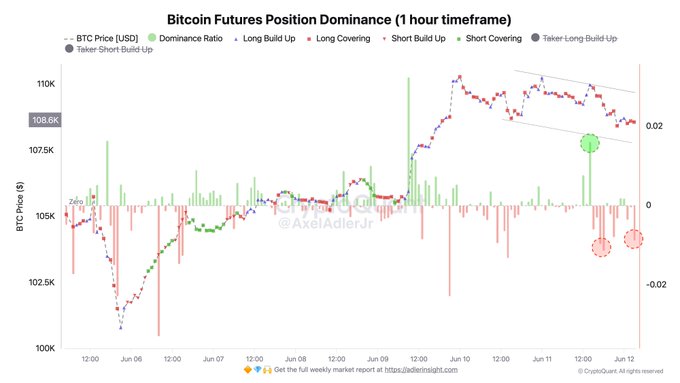

The Bitcoin price is up about 2% in the past week, despite a slight plunge of 1.75% in the past 24 hours to $107K. Meanwhile, a popular analyst, Axel Adler Jr. has pointed out a troubling development in the futures market of Bitcoin today. Long positions are closed clearly, and the short volume is aggressive, forming a “soft reversal point.” Based on Adler’s analysis, funding remains positive, but open interest is decreasing, suggesting that Bitcoin may undergo short-term corrections or consolidation below the $ 108,000 level.

Axel Adler Jr. emphasizes that following a sharp decline in the market, the price of Bitcoin has recovered well, touching nearly $110K.

After the April trough, when the 4-year CAGR fell to around 7% and holders’ margins were extremely compressed, the market revived by May–June 2025 BTC’s price had approached $110K and the CAGR recovered to roughly 31% (Strong zone).

Although this remains well below historical… pic.twitter.com/8Fz4w9uutB

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) June 12, 2025

The 4 yrs CAGR has recovered to approximately 31%. As the market fundamentals are favorable and the impulse in the futures markets is still quite strong, Bitcoin might as well be worth $168K in October of 2025.

The Bullish Channel and RSI Indicate a Potential Bitcoin Price Spike

Overall, the performance of Bitcoin in recent times has been quite good, despite a temporary setback. The BTC price is currently trading at $107,634, with a robust bullish channel indicating a potential upward trend. The Relative Strength Index (RSI) is also at 55.46, which means that Bitcoin is not overbought and may continue to rise. Moreover, the price is comfortably placed above the 50-day MA and 200-day MA, further propelling the bullish aspect.

The trend of BTC remains unchanged, as it continues to show signs a potential surge that could take it to the resistance level of $112K. The volatility of the market that exists, particularly after the short-term dip, is, however, something that traders should observe in the current market. The RSI direction indicates that there may still be a chance for Bitcoin to rally to its target. Close attention will be required to monitor the overall market and Bitcoin’s trading volumes.

Institutional and Retail Engagement Drives Bitcoin’s Future Growth

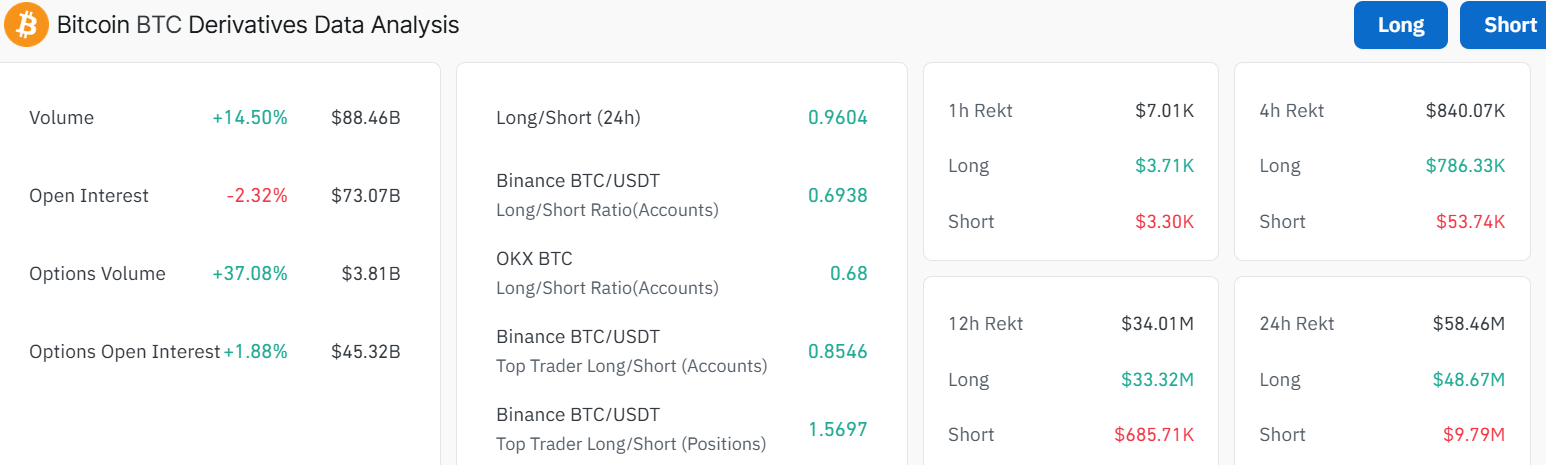

Retail traders and institutional investors are driving the future price movement of Bitcoin aggressively. The derivatives exchange BTC market is also exhibiting high levels of participation, as the volume has gone up by 14.50%. This represents a rise in interest regarding the future performance of Bitcoin, with open interest currently standing at $ 73.07 billion. However, a decline in open interest suggests cautiousness in the market, despite increasing volume.

The long/short ratio of 0.96 indicates a marginally higher preference for long positions. However, the prevalence of short positions suggests that caution may be advisable while Bitcoin remains in consolidation.

This involvement in the market, along with activity in the futures market, creates the impression of continued interest on the part of both institutional and retail traders. Support and resistance levels of $105K and $112K will be the next critical levels in Bitcoin. Traders should monitor these levels to determine further price movements of Bitcoins.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.