Highlights:

- Bitcoin price reclaims the 3-month high mark of $100K.

- Michael Saylor says one can still buy BTC for less than $0.2M.

- Technical indicators show overbought conditions, calling for traders to be cautious.

The Bitcoin price has reclaimed the $100K mark, as the Fed rate cut remains unchanged. The king coin boasts a bullish muscle, 4% to the $100,458 mark. Accompanying the explosive move is the surging daily trading volume, which has increased by 53% to 58B. The bulls have taken complete reins in the market, as they have reclaimed the 3-month high level of $100K.

What’s Behind the Recent Spike in the Crypto Market?

The recent rebound has seen the crypto market surge from $5.17% to $3.14 trillion. This follows the Federal Reserve’s decision to keep the rate cuts unchanged. The Fed rate cut has remained steady at 4.25%-4.5%.

Meanwhile, the US president has said that the United States is still doing well even without the Fed rate cut. He has further compared the rate cuts to jet fuel, stating that ‘’if the Fed Chair lowered the rates, it’d be like jet fuel.’’

TRUMP: "Better buy stocks now—market’s about to rally big! US is doing well even without Fed cuts. If Powell lowered rates, it'd be like jet fuel. Maybe he's not in love with me!" pic.twitter.com/F7agnQB9Co

— BigBreakingWire (@BigBreakingWire) May 8, 2025

The crypto market is blazing with major altcoins such as Ethereum reclaiming the 2,000 mark and XRP reclaiming the key support levels. How high can the crypto market reach, led by Bitcoin?

Bitcoin Price Outlook

The Bitcoin price has reclaimed its 3-month high of $100K, as the bulls show intense strength. The bulls have flipped the 50-day and 200-day MAs into major support levels, growing hind wings towards the 100K mark. This has triggered major investor confidence, as various companies have been stacking BTC.

Ali Martinez said BTC has established a strong support floor at $94,719, where 195,320 Bitcoins were accumulated. On the upside, a key resistance wall is $101,673, with 81,910 BTC accumulated at that level.

#Bitcoin has established a strong support floor at $94,719, where 195,320 $BTC were accumulated. On the upside, a key resistance wall stands at $101,673, with 81,910 #BTC accumulated at that level. pic.twitter.com/PRFCKAeDFY

— Ali (@ali_charts) May 8, 2025

If the bullish sentiment dominates the BTC market, the Bitcoin price could continue surging. In such a case, the bulls could target $102,717 in the short term. Meanwhile, Michael Saylor, Strategy Executive Chairman, has hinted via X that,’’ you can still buy BTC for less than $0.2 million.’’

You can still buy $BTC for less than $0.2 million.

— Michael Saylor (@saylor) May 8, 2025

This has hinted at a more bullish picture in the BTC market, as various investors foresee a surge to higher levels in the long term.

BTC Technical and Derivatives Outlook

A quick look at the BTC Relative Strength Index shows it is sitting at 72.03, in overbought territory. This calls for caution among traders. The bulls may sweep through liquidity, causing a slight retracement in the market. In such a case, the traders should carefully evade the bull trap.

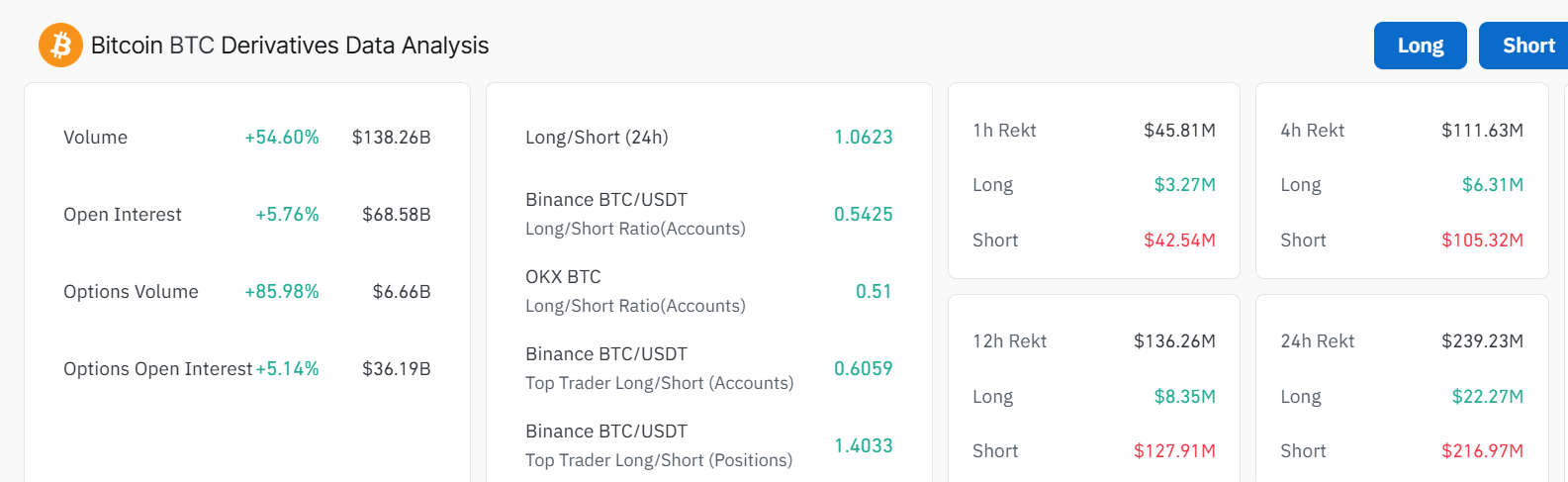

Meanwhile, Coinglass data shows a positive sentiment, as the volume and open interest have spiked 54% and 5%, respectively. This indicates heightened investor confidence, as new money flows into the market.

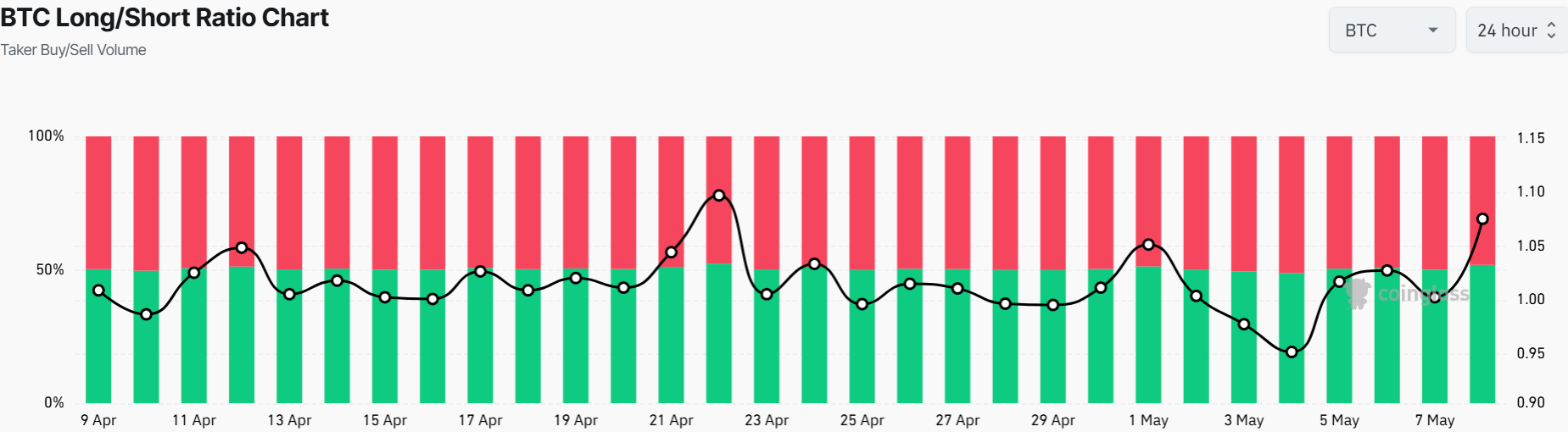

On the other hand, the long-to-short ratio has spiked above 1 to 1.08, indicating a bullish grip. In other words, more traders and investors are betting on Bitcoin’s price surge, potentially to $102 level.

However, in the case of a reversal due to severe overbought conditions, the $97,105 safety net will provide immediate support. If this level gives way, the $96 and $95K support regions will offer immediate support.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.