Highlights:

- The Bitcoin price has formed a green channel breakout, indicating a possible major move observed in the early stages of 2024.

- Demand from institutional investors rises as Bitcoin ETFs experience $900 million in inflows, improving market sentiment on BTC.

- BTC bounces back from the $92k support level with bullish technical signals aiming for a break above $100k.

The leading asset Bitcoin is back on track again after dropping to $92k during the last week of December. The bullish momentum has been observed on the broad market as most of the coins trade in green. Moreover, the global market cap surged to $3.49 trillion despite the 24-hour trading volume decline of 4%.

Bitcoin Price Action

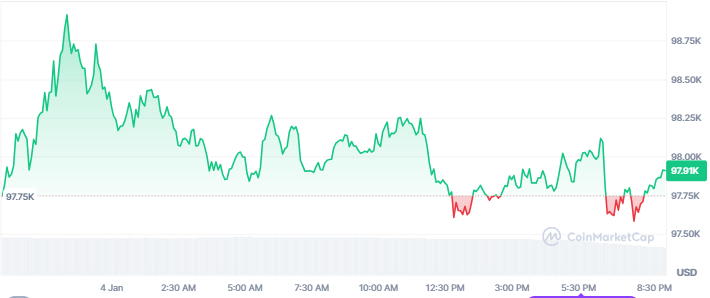

As of this writing, BTC is exchanging hands at $97,910 recording a mere gain of 0.05% in the past 24 hours. After rising steadily during the early trading session, BTC faced a stiff rejection at the $98k mark which has led to a pullback.

Over the past week, BTC has surged by 3% on the weekly charts despite the monthly decline of 5$. BTC is pushing to recover the $2 trillion market cap mark at $1.93 trillion with the recent bullish momentum. However, the 24-hour trading volume has dropped to $30.90 billion.

Bitcoin Price Eyes Major Surge After Channel Breakout

Bitcoin price trajectory displays a break-out of a green channel, indicating a possibility of a surge observed at the beginning of 2024. Crypto analyst Trader Tardigrade noted that the pattern resembles the consolidation phase from early last year.

#Bitcoin is breaking out of the green channel 🟢

This pattern mirrors the last consolidation phase from early 2024.$BTC is ready to spike 🚀 pic.twitter.com/xJuKD3WYyF— Trader Tardigrade (@TATrader_Alan) January 4, 2025

The chart analysis suggests that this current movement out of the channel could propel Bitcoin price higher. This trend, based on historical movements, indicates that Bitcoin may be gearing up for a huge price increase.

Bitcoin ETFs Rebounds Amidst the Rising Interest: Will BTC Reclaim the $100k Mark?

Bitcoin ETFs in the U.S. experienced a big turnaround with $900 million in inflows on January 3. The surge was led by Fidelity’s Bitcoin ETF (FBTC), which collected $357 million. BlackRock’s IBIT and Ark Invest’s ARKB followed with $252 million and $222 million, respectively.

After weeks of outflows, this dramatic inflow indicates renewed institutional confidence in Bitcoin. In addition, according to Ali Martinez on X, the Coinbase Premium Index dropped to -0.23%, its lowest in two years. The recovery shows that demand among institutional investors is growing. This trend could support Bitcoin’s bullish momentum as interest increases.

The Coinbase Premium Index recently hit -0.23%, a two-year low, but it's now rebounding quickly. This signals growing institutional demand for #Bitcoin $BTC from US-based investors! pic.twitter.com/dpPqwuNIRw

— Ali (@ali_charts) January 3, 2025

These recent developments suggest that Bitcoin price may soon reclaim the $100,000 key mark. The rising institutional demand correlates with the surge in ETF inflows pointing to a stronger belief in Bitcoin’s future potential, considering the market is recovering.

BTC/USD Technical Analysis: BTC Rebounds on a Strong Support Zone

Technical indicators on the daily chart display a strong rebound from its key support at the $92k mark. The bulls have shown robust momentum forming a steady upward pattern despite facing resistance at the $98k region. Should the bullish sentiment hold, BTC could break above the current resistance at $98k, paving the way for a break above the $100k mark.

In addition, the Moving Average Divergence Convergence (MACD) indicator suggests that BTC is gearing up for a fresh rally as the MACD line climbs up above the signal line. Moreover, the histogram is shifting from negative to positive momentum as the red bars fade away indicating an imminent rally.

The Relative Strength Index (RSI) indicator is hovering above the neutral region at 53 index. Recently, the RSI has been steadily climbing from the oversold region suggesting that the price has a long way to go before reaching the overbought region.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.