Highlights:

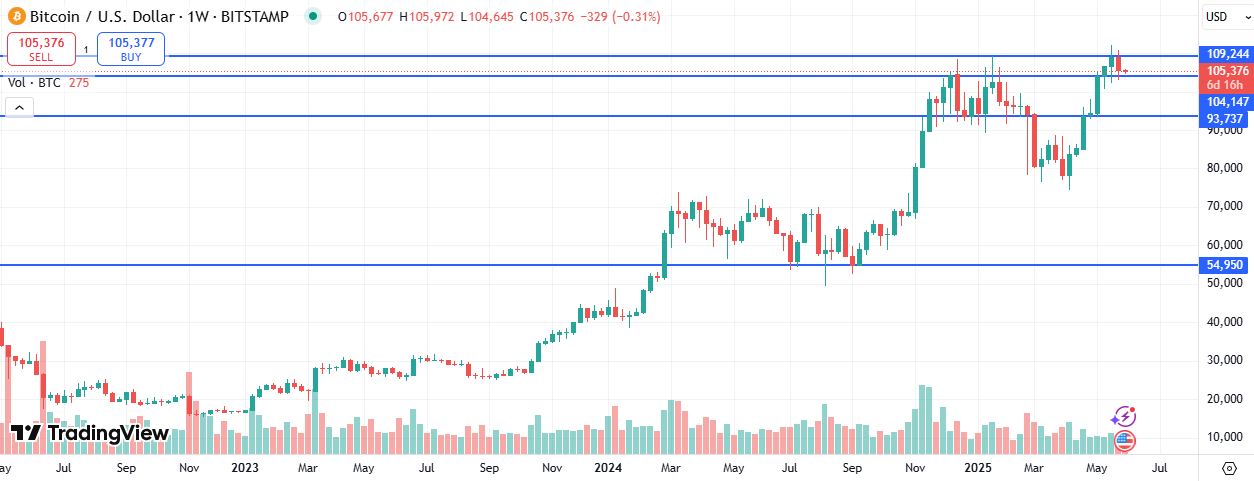

- Bitcoin now consolidating with firm resistance at $109,244

- Rally through $109,244 could see Bitcoin hit highs of $120k in the short term

- Policy support for Bitcoin is likely to draw in more capital into Bitcoin

Bitcoin (BTC) continues the relatively slow price action that it has experienced since late last week. At the time of going to press, Bitcoin was trading at $105,554, up by 1.20% in the day. Bitcoin trading volumes are also up by 8.64%, an indicator that bullish confidence is on the rise after what appeared to be fear crept in last week. The fear was evident in that Bitcoin ETFs recorded some of their most significant outflows. It signaled the growing fear that the Bitcoin top may be in.

Bitcoin Price Stalling Amid Fears That the Top Is In

Multiple factors are creating fears that the Bitcoin top may be in. One of them is that Bitcoin’s weekly chart looks like that of 2021 before the market crash started. Due to the heavy corrections that the markets have experienced in past bear markets, investors may be cautious until there is a clear signal that the uptrend is set to continue. This may explain the sudden surge in outflows despite Bitcoin’s new all-time highs.

Fears about the top being in are likely compounded by companies like Meta, among other large corporations, choosing not to add Bitcoin to their reserves. Microsoft and Amazon were among the first whose shareholders rejected the idea. Meta’s shareholders have joined in this bandwagon, choosing to reject buying Bitcoin as part of Meta’s reserves. Given that Meta CEO Mark Zuckerberg controls 61% of the company’s voting power, there is a good chance he was one of those who rejected the idea.

🚫META SAYS NO TO BTC TREASURY!

Over 99% of shareholders just rejected a proposal to explore adding Bitcoin to Meta’s $72B treasury. 💰

It was the least supported item on the entire agenda.

Is Big Tech really not buying the Bitcoin hype? 👎 pic.twitter.com/8w5qOk6YsH

— Coin Bureau (@coinbureau) May 31, 2025

More Companies Buying Bitcoin – A Positive Indicator for Bitcoin

While moves by Meta and the recent outflows from ETFs could trigger FUD, there are multiple indicators that Bitcoin is only getting stronger. One of them is that, as a whole, more companies are adding Bitcoin to their reserves, which is happening globally. The most recent one is Metaplanet, a Japanese company that has been heavily accumulating Bitcoin for a while now.

The company has added 1088 Bitcoin to its existing holdings and now puts its total reserves at 8888 Bitcoin, worth close to $1 billion. The move comes when several other companies have been buying Bitcoin, with some even issuing bonds to buy Bitcoin.

Metaplanet buys another 1,088 bitcoins worth $114 million 🔥

They now own 8,888 $BTC worth $930 million dollars. pic.twitter.com/99WDR7gRuH

— DanDatMan (@drichdench) June 2, 2025

JD Vance Keynote Address Inspires Confidence in Bitcoin

Bitcoin will also likely get a boost from the recent keynote address by the US Vice President at the Bitcoin Conference. Vice President JD Vance pointed out that the current US administration was pro-crypto. He particularly pointed to the shakeup in the SEC to give it a more pro-crypto approach. He also pointed out that the administration was making policies to make the US a leader in the fast-emerging cryptocurrency space.

These remarks are reassuring and will likely see more investors, especially institutions, invest more in Bitcoin. It’s a factor that could invalidate a possible end of the bear market and pave the way for a rally to new highs.

JD VANCE: “The value proposition of Bitcoin is digital money—secure, fraud-resistant, and built for the modern age.” 🔥

America’s Vice President just explained why the critics are wrong, and why Bitcoin wins. 🇺🇸 pic.twitter.com/R9l7pTQSFd

— Swan (@Swan) May 30, 2025

Technical Analysis – Bitcoin Price Entering A New Consolidation Phase

According to the charts, Bitcoin is entering a consolidation phase between $109,244 resistance and $104,147 support. If bulls are strong enough to push Bitcoin through the $109,244 resistance, a rally to new highs, potentially above $120k, could follow.

On the other hand, if bears take control and push Bitcoin through the $104,147 support, then a correction to prices below $100k could follow. With all the positive news coming out of the Bitcoin ecosystem, the odds are high for continuing Bitcoin’s bullish momentum, which has recently built up.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.