Highlights:

- Bitcoin price surged as Trump announced a strategic crypto reserve.

- BTC faces resistance at $95K, with $100K as a key target.

- Crypto market cap hit $3.01T, marking a 6.25% daily increase.

Bitcoin’s (BTC) price has rebounded after a week of market consolidation. The broader crypto market has also experienced a surge, boosting optimism. BTC is holding above a key support level after a strategic crypto reserve was announced. This development has strengthened market sentiment, leading to renewed bullish momentum.

Analysts are watching whether this rally will continue or remain temporary. The market is eyeing further gains as traders anticipate BTC’s next move. A return to $100K remains a key point of speculation.

Bitcoin Price Surges to $92K After Trump’s Crypto Reserve Plan

Bitcoin rose to exceed $92,000 when Donald Trump made the announcement regarding a strategic crypto reserve. Trump backed Bitcoin alongside Ethereum as well as XRP, Solana, and Cardano according to his proposal.

Through his Truth Social post, he announced that the United States would establish a “Crypto Strategic Reserve” as part of its crypto leadership advancement. The aggressive market purchases drove Bitcoin prices up by 10% during times with limited market activity.

Bitcoin achieved a brief moment at $95,000 when market volatility reached its peak. Market activity over weekends propelled the price development by intensifying the impact on gains which reflected the rising attention toward Trump’s crypto support.

Trump mentioned XRP, SOL, and ADA first, then brought up BTC and ETH two hours later.

Can I interpret his tweets this way?

“BTC and ETH, show me your strategic value—for me and the USA. I just closed a deal with XRP, SOL, and ADA.” pic.twitter.com/WRMxu5No97

— Ki Young Ju (@ki_young_ju) March 3, 2025

Crypto Market Surges as BTC and Altcoins Gain Momentum

The cryptocurrency marketplace experienced rapid expansion, which resulted in a $3.01 trillion value in its combined market capitalization while demonstrating a 6.25% rise from yesterday. The trading volume skyrocketed to reach $203.61 billion while the market experienced a 192.93% increase during the period.

The market values of Bitcoin currently reach $1.82 trillion as it increases by 6.80% alongside its daily trading volume jumping 184.07% to $69 billion. ETH, SOL, and XRP mirror the market’s momentum through noticeable gains after recent market trends. Currently Bitcoin exists 15.94% below its peak level of $109,114.88 which it achieved during January 20, 2025.

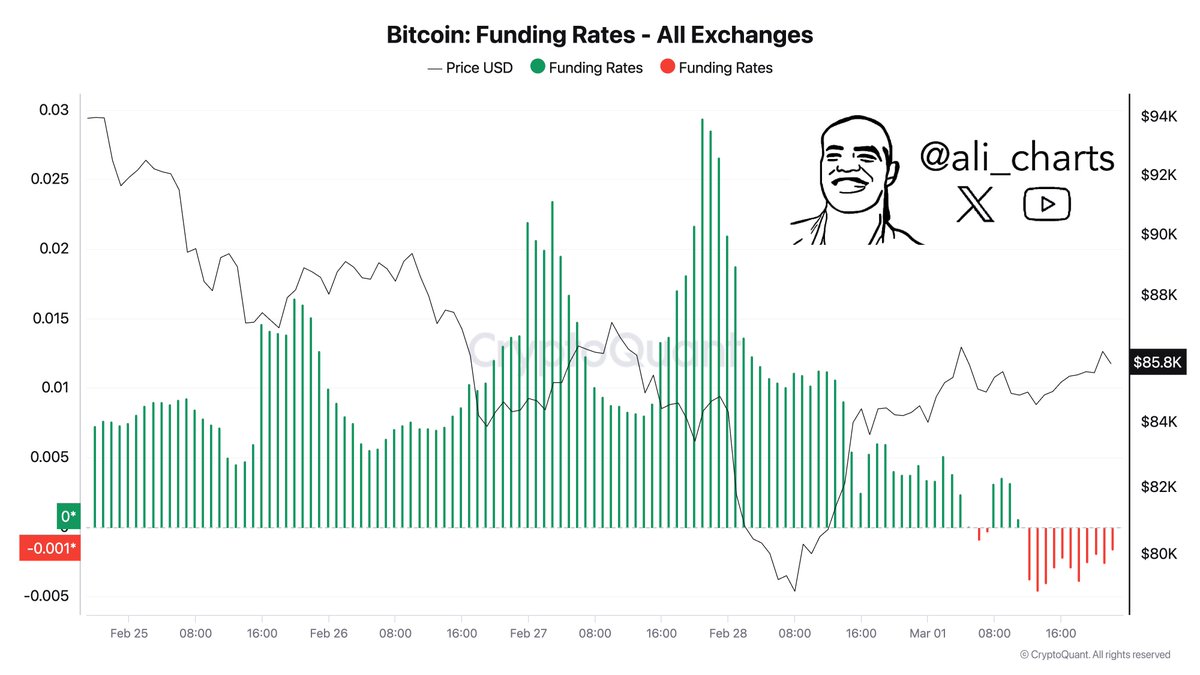

Market conditions point toward a chance to buy Bitcoin because its funding rates have decreased to -0.001 for every exchange. When negative funding rates occur between short and long positions, the market tends to reverse direction.

Such market changes are actively monitored by traders since they signal potential future price increases that make it advantageous for new investors to join.

Will BTC Price Rally Above $100K in March?

As of the reporting time, the Bitcoin price has seen a recovery, reaching $92,018 after a sharp drop. The BTC price has surged by more than 10% in the past 24 hours, fueling the market rally. The cryptocurrency bounced from the below $90k level, where it found strong support. However, resistance at $95,000 halted further gains, leading to a pullback.

The Relative Strength Index (RSI) stands at 61.82, showing that Bitcoin is nearing the overbought region. The Moving Average Convergence Divergence (MACD) indicator on the 4-hour chart remains bullish. The MACD line has moved above the signal line, indicating continued momentum. If this trend sustains, Bitcoin may target the $95,000 resistance again, with a breakout opening the path toward $100,000.

Conversely, if selling pressure increases, Bitcoin could retest $90,000. A drop below this support may push prices lower, with the next significant level near $88,000.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.