With June behind us, the Bitcoin price underwent a rollercoaster in the past month, jumping as high as $73,000 and sinking as low as $58,000. However, Bitcoin is attempting a recovery, with the BTC/USD trading at 62,749, 0.2% up from the past day. This has notably pushed its weekly performance to the green zone by around $2.9%.

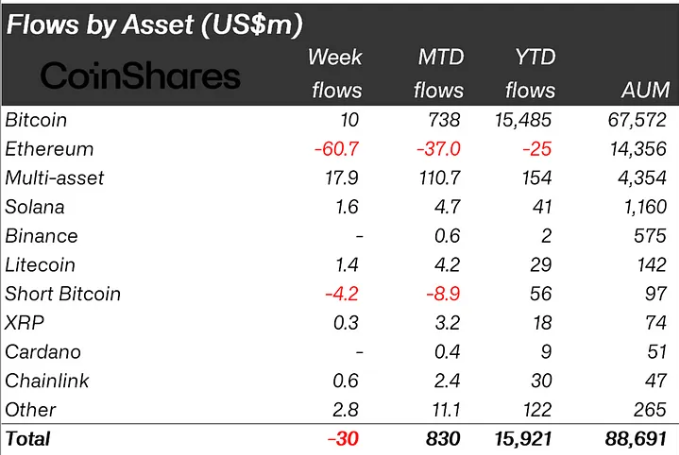

This performance by Bitcoin follows a report that outflows from digital investment products continued last week, stretching their three-week run to a cumulative $1.23 billion outflows, according to data from CoinShares.

James Butterfill, Coinshare’s head of research, noted:

‘’ Digital asset investment products saw a third consecutive week of outflows totaling US$30m, with last week indicating a significant stemming of the outflows.”

Notably, the report has revealed that the weekly trading volumes across ETFs increased by 43% to $6.2 billion but remained below the year’s $14.2 billion weekly average. The reducing volumes indicate decreased investor appetite for risk-on assets, attesting to BTC’s price action.

Moreover, Eric Balchunas, the senior ETF Analyst at Bloomberg, has taken to the X platform, commenting on Bitcoin ETF’s positive flows despite the BTC price plunge.

He said:

”I was expecting worse, given btc price fell $10k. During that stretch, YTD net flow held steady at +14.6b. Good sign that number held strong during a ‘step back’ phase.’’

Was surprised to check in on the bitcoin ETFs and see they actually had net positive flows for 1D, 1W and 1M. Was expecting worse given btc price fell $10k. During that stretch YTD net flow held steady at +14.6b. Good sign that number held strong during a 'step back' phase. pic.twitter.com/0YnRbD9W8g

— Eric Balchunas (@EricBalchunas) July 2, 2024

Bitcoin Statistical Data

Based on Coinmarketcap data:

- BTC price now – $62,749

- BTC market cap – $1.23 trillion

- BTC total supply – 19 million

- BTC circulating supply – 19 million

- BTC ranking – #1

In the last month, the Bitcoin price has dropped from the $72,077 resistance, with the bulls finding support at around the $60,140 mark, forming a bullish pennant. The bulls seem to be gathering steam as they intend to potentially use the $60,140 support level to propel the price past the technical barrier.

Based on the technical outlook, the BTC price is subdued below the 50-mean level, tilting the odds toward the sellers. The RSI has rebounded from the 30-oversold region, currently at 43. Increased buying pressure could see the RSI jump toward the 70-overbought zone, intensifying the bullish thesis.

Moreover, Bitcoin price is trading well above the 200-day SMA( Simple Moving Average), affirming the bullish rally in the coming days. However, BTC must overcome the 50-day SMA level at $66,434, which acts as the immediate resistance level.

On the other hand, the Moving Averages Convergence Divergence (MACD) portrays bullish signals. This is evident as the blue average line has currently crossed above the orange signal line at the neutral level, indicating a shift toward bullish momentum.

Bitcoin Price Prediction

In a daily timeframe chart analysis, the Bitcoin price is gearing up for a sustained bullish stance over the bullish pennant pattern as the bulls target its previous resistance level of around $72,077. However, increased bullish momentum could see Bitcoin bulls aim for a long-term target of around $84,000.

In a dire case, if the bears take control and the crypto market outlook turns negative, a breach below the $60,140 support level would invalidate the bullish thesis. Moreover, if sellers step in, the BTC price could slump to around $58,317, coinciding with the 200-day SMA.

Read More

- Cardano (ADA) Price Prediction: Bullish or Bearish

- Best Meme Coins to Watch Closely in July 2024

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins

- Best Metaverse Coins to Invest – Next Metaverse Coins