Highlights:

- Bitcoin fell below $80k amid economic uncertainty over Trump’s proposed tariffs.

- Analysts warn Bitcoin may drop to $70k if it fails to reclaim $90k.

- Dip-buying sentiment is high, but analysts caution against overly bullish expectations.

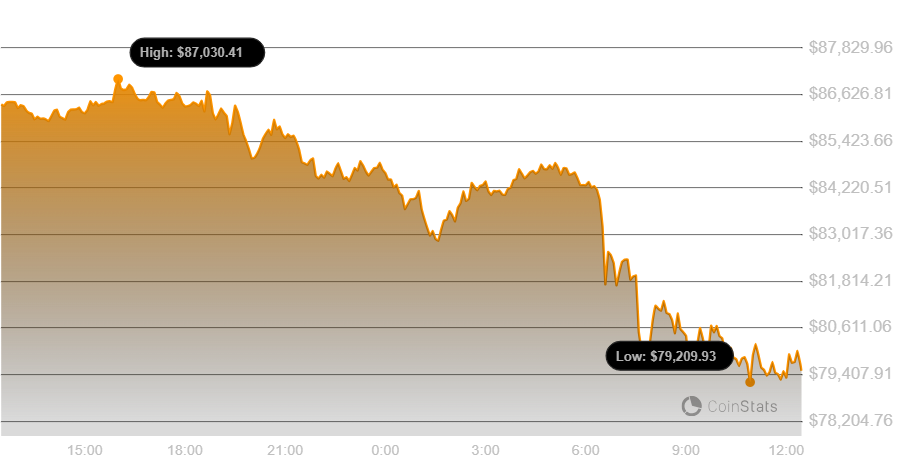

Bitcoin has fallen below $80,000 for the first time since November amid growing macroeconomic uncertainty over US President Donald Trump’s proposed tariffs. According to the data, Bitcoin price dropped below $79,300 on February 28, marking its lowest level since November.

CoinGlass data showed that BTC long liquidations exceeded $371 million, while short liquidations were around $39 million. In the last 24 hours, the crypto market saw $866 million in total liquidations, with long positions accounting for over $762 million. Since Trump’s inauguration on January 20, when BTC hit an all-time high of $109,000, the cryptocurrency has dropped nearly 26%.

Bitcoin fell below $90,000 on Feb. 25, a day after Trump confirmed his 25% tariffs on Canada and Mexico. At the time of writing, Bitcoin was at $79,546, down 7.7% in 24 hours.

Bitcoin Eyes $70k as Traders Expect Further Decline

Market sentiment is now tilting toward a possible drop to the $70,000 range. Crypto trader dmac stated in a Feb. 27 X post, “Dip buyers are getting smoked. I still see $70k as the target.” Bitcoin last traded at $70,000 on Nov. 5, following favorable election polling results for Trump.

Bitcoin is pulling up to $80K and the 50% retracement. $BTC Dip buyers are getting smoked. I still see $70k as the target. pic.twitter.com/WVLKdQsP64

— dmac (@dana_marlane) February 28, 2025

Arthur Hayes planned to buy Bitcoin but changed his mind. He expects another drop below $80,000, likely over the weekend, before the market stabilizes.

We are making lower lows in this current wave. I was tempted to add risk this morning, but looking at this price action I think we have one more violent wave down below $80k, most likely over the weekend, then crickets for a while. Hold on to your butts! pic.twitter.com/e6nshZejAb

— Arthur Hayes (@CryptoHayes) February 28, 2025

Crypto trader Mandrik commented, “If you liked $80k Bitcoin, then you’re gonna love $70k Bitcoin.” Meanwhile, pseudonymous trader Rager stayed calm, telling followers that a drop to the mid or low $70Ks would be normal. “Pretty normal in prior cycles, even during bull markets, for Bitcoin to drop -30% to -40%,” Rager said.

In a note on Wednesday, Wolfe analyst Read Harvey said Bitcoin price might drop to $70,000 if it fails to reclaim $90,000. He also warned of a possible decline to the mid-$70,000s.

Harvey stated:

“$91,000 acted as the floor over the past several months. With that level now decisively taken out, anything less than another V-shaped oversold response would send a very bearish message. So far not so good.”

If bearish sentiment grows, Harvey expects prices to return to pre-election levels. Trump’s tariffs on Mexico, Canada, and China have sparked concerns about an economic slowdown. Despite earlier optimism from the election, inauguration, and crypto order, uncertainty is rising. Harvey noted that during economic uncertainty, investors reduce risk, affecting stocks, commodities, and crypto.

Crypto Dip-Buying Hits Peak as Bitcoin Price Drops, But Caution Remains

Since last July, crypto dip-buying mentions have surged to their highest level as Bitcoin dropped below $80,000. According to Santiment, discussions across X, Reddit, and Telegram on Feb. 25–26 reflect strong confidence among traders that this dip presents a buying opportunity. The platform shared these insights in a Feb. 28 post on X.

However, the analytics platform warns that high dip-buying interest isn’t always a buy signal. The market can often move against expectations.

🤷 Traders are showing a very high level of confidence that this dip is 'the one to buy', according to the spike in discussions across X, Reddit, Telegram, 4Chan, BitcoinTalk, and Farcaster. Ideally, we are waiting for this crowd enthusiasm to die down as a signal that enough… pic.twitter.com/nM99sLw4v3

— Santiment (@santimentfeed) February 28, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.