Highlights:

- The price of Bitcoin has increased by 1% in the past day to $103,700.

- Kyledoops has highlighted that over 3.1B BTCÐ options are expiring today, which may result in volatility.

- Bitcoin market is indicating a positive outlook, which could lead to $106K soon.

The Bitcoin price is still upholding a bullish outlook. The altcoin exchanges hands at $103K, marking a 1.89% surge. Its daily trading volume has notably increased 18% to $51.91B, as its market cap rises 1% to $2.09T. This recent surge indicates that the traders and investors are highly confident of a potential rise in BTC.

Meanwhile, over $3.1 billion worth of options expires on Deribit today at 04:00 ET, according to crypto analyst Kyledoop. This could cause increased market volatility. The market is balanced as determined by the $2.66 billion BTC current position size, a put/call ratio close to 1.0, and the $100,000 max pain price.

Massive Options Expiry Today 🚨

Over $3.1B in $BTC & $ETH options are set to expire on Deribit at 04:00 ET.

BTC: $2.66B in notional, Put/Call ratio ~0.99, Max Pain at $100K

ETH: $525M in notional, Put/Call at 1.24, Max Pain around $2,200

BTC looks balanced. ETH puts are… pic.twitter.com/Av8xDioDv1

— Kyledoops (@kyledoops) May 16, 2025

Currently, ETH is worth $525 million in notional terms, has a put/call ratio of 1.24, and experiences the most calls around $2,200, meaning the market is trending downwards. Since many investors’ positions will be closing at once, traders should plan for quick market price changes on the expiry day.

Bitcoin Price Outlook

The daily chart on Bitcoin shows that the bulls are still in dominance. The buyers have flipped the 50-day and 200-day at $90K and $92K into immediate support zones. Meanwhile, the Bitcoin market shows a rounding bottom pattern, as the bulls attempt to reclaim the $109 ATH. The king coin is currently oscillating between $101K and $105, as this may act as an accumulation phase. If the bulls break out of the consolidation channel, the next target could be $106K.

However, Ali Martinez, a well-known crypto analyst, has highlighted that the Bitcoin whales have booked profits, selling over 30,000 BTC in the past 72 hours.

#Bitcoin whales have booked profits, selling over 30,000 $BTC in the last 72 hours! pic.twitter.com/TVDplzEJLF

— Ali (@ali_charts) May 16, 2025

Moreover, the technical indicators are showing a slight retracement from overbought conditions. The Relative Strength Index has retraced from the 76-overbought territory to 69.23. This is essential to allow the bulls to sweep through liquidity, hence the booked profits according to Martinez.

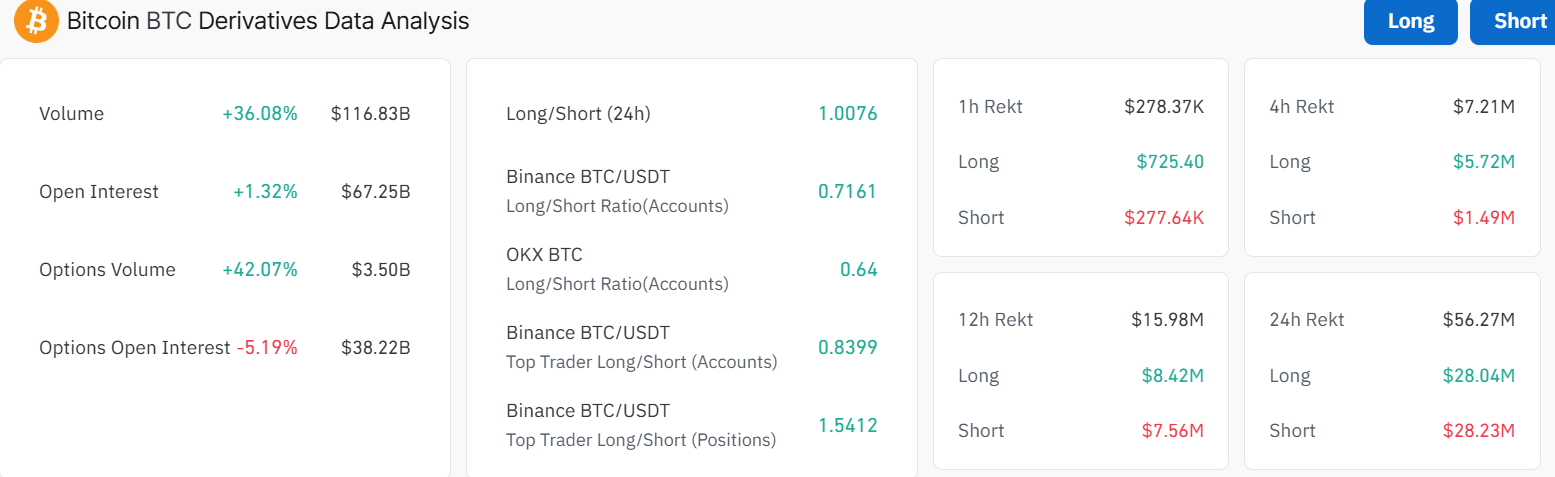

BTC Derivatives Data

On the other hand, the bulls are still dominating, according to Coinglass data. The volume has increased by 36% to $116B, as the open interest increased to $67B, marking a 1% surge. This shows intense market activity in Bitcoin, as investor confidence is high. Moreover, the long-to-short ratio has hit 1, indicating some bullish grip in the market. As new money keeps flowing into the BTC market, there is a high chance of a Bitcoin price spike in the coming days.

On the downside, if the early profit booking continues, the Bitcoin price could drop further. According to Ali, the most important support floor for Bitcoin lies at around $95,440.

The most important support floor for #Bitcoin $BTC lies at $95,440! pic.twitter.com/2RH4ZCFb8X

— Ali (@ali_charts) May 16, 2025

If the bulls keep sweeping off liquidity, the altcoin could plunge towards $101,633. Increased selling pressure could cause a deeper correction towards $96,875 and $96,035. In the meantime, only a breach below $92,314 would invalidate the bullish bias in the BTC market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.