Highlights:

- Bitcoin price drops 1% to $97,693 following waning crypto sentiment.

- Over 20,000 BTC moved from long-term holders’ wallets in the last four days.

- Coinglass data shows a rise in trading volume despite a drop in open interest, indicating a potential rebound.

Bitcoin price has dropped below the $100k mark, currently exchanging hands at $97,693, 1% down as the crypto market wobbles. With its market cap at $1.93 trillion, BTC has experienced a 6% decline in a week and a 2% gain in a month, indicating a volatile but potential recovery phase. The trading volume has notably surged by 6% to $47.63 billion, suggesting heightened market activity that may result in BTC price rebound.

Meanwhile, a well-known analyst has noted via X that over 20,000 Bitcoins have moved out of long-term holders’ wallets over the past four days, a significant sell-off coinciding with a sharp drop in Bitcoin’s price. Ali has added that such a shift could introduce new opportunities in the market.

Over 20,000 #Bitcoin $BTC have moved out of long-term holders' wallets in the last 96 hours. This shift could introduce new opportunities! pic.twitter.com/RqTqteq5Ed

— Ali (@ali_charts) February 7, 2025

On the other hand, Missouri, Kentucky, and Iowa have introduced bills to establish Bitcoin reserve funds, joining a growing list of states exploring BTC in public finance. These developments coincide with Utah’s House Bill 230, which passed the House on Feb 6 and is now headed to the Senate.

BTC Statistical Data

Based on CoinmarketCap data:

- BTC price now – $97,693

- Trading volume (24h) – $47.63 billion

- Market cap – $1.93 trillion

- Total supply – 19.82 million

- Circulating supply – 19.82 million

- BTC ranking – #1

Bitcoin Price Poised for a Breakout Above $98,719 Resistance

The Bitcoin price has broken below the $100K mark, currently hovering around $97,693. Bitcoin price faces a critical juncture amid a broader bearish market, teetering near a pivotal resistance at $98,719. Immediate resistance is anchored at $98,719, a level aligning with the 50-day MA, which has historically rejected bullish advances. A sustained close above this barrier could ignite a rally toward the $102,563 psychological threshold.

Conversely, failure to hold above $98,719 risks a breakdown toward $96,344, a short-term support zone. A breach here may accelerate selling pressure toward $94,670.

The RSI indicator currently sits at 45.06, indicating neutral momentum. This shows that potential momentum from either direction could swing the RSI. However, there is still room for potential upside movement before it reaches overbought conditions.

Reclaiming the $98,719 mark could invalidate any downtrend, inviting short-term longs. A breakout above the resistance could lead to further upside, while a breakdown below the support could trigger a decline. Traders should monitor these levels closely for potential trading opportunities.

Bitcoin price is currently showing signs of renewed strength, and if the bulls regain dominance, the token could attempt to retest the $98,719 mark. A steady rise in trading volume and consistent higher lows indicate growing investor confidence, potentially paving the way for a rally.

Rising Trading Volume Suggests a Potential Rebound in the BTC Market

Overcoming key resistance levels will be crucial, as past price action suggests that a successful push above these barriers could trigger a stronger rally. However, sustaining this momentum will depend on broader market sentiment.

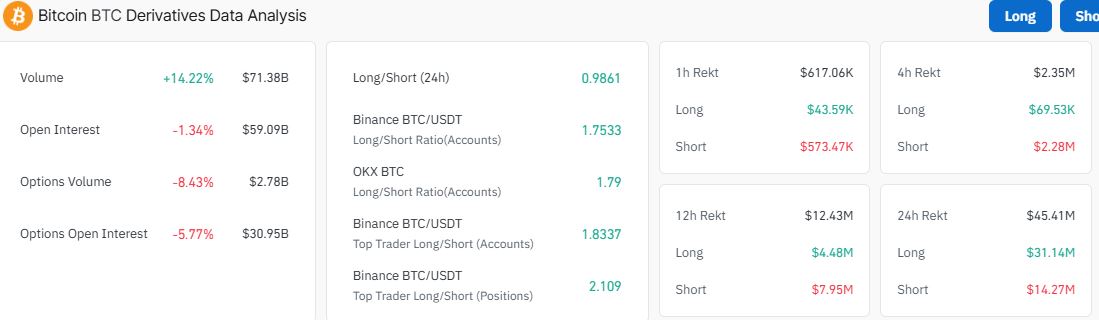

Elsewhere, Coinglass data shows a spike in volume by 14% to $71.32 billion despite a slight plunge of open interest by 1% to $59.08 billion. In other words, traders are actively closing their positions rather than opening new ones. This shows a potential trend reversal, which may see BTC retest the $98,719 mark.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.