Highlights:

- The US government transferred 3,940 Bitcoin to Coinbase, originally seized from Silk Road’s Banmeet Singh.

- The price of Bitcoin has slipped in response to the large Bitcoin transfer.

- Governments’ Bitcoin sales and Mt. Gox repayment plan have raised concerns in the crypto community.

According to the on-chain data from Arkham Intelligence, a wallet linked to the United States government sent approximately 3,940 Bitcoin (BTC), valued at about $240 million, to a Coinbase Prime wallet on June 26, 2024. The transferred assets were originally seized from Silk Road narcotics trafficker Banmeet Singh earlier this year.

Update: US Government Sends $240M BTC to Coinbase Prime

The US Government just moved 3,940 BTC ($240M) to Coinbase Prime.

This BTC was originally seized from narcotics trafficker Banmeet Singh, and forfeited at trial in January 2024.

Transaction: https://t.co/hZ1CwqWCmF pic.twitter.com/9t6k8Wdizq

— Arkham (@ArkhamIntel) June 26, 2024

Authorities Seized 8,100 BTC from Singh

In 2019, Singh, an Indian National, was arrested in London on drug distribution charges and extradited to the US last year. The US Department of Justice (DOJ) revealed that from 2012 to 2017, Singh operated a narcotics smuggling network with distributors in several states, including New York, North Dakota, Maryland, Washington, Ohio, North Carolina, and Florida.

As part of his judgment, Singh had to surrender over 8,100 Bitcoin, worth about $150 million, to US agencies in January. The DEA called it their largest cryptocurrency seizure ever. Singh was sentenced to 5 years in prison in April 2024 but was given credit for time served and has reportedly been released by the government.

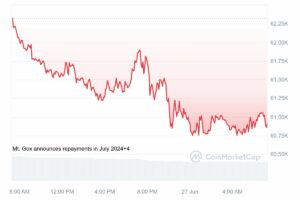

Bitcoin Price Drops After the Transfer

Following the news of the transfer, Bitcoin slipped back below $61,000. As of now, Bitcoin is trading at $60,896, marking a 2.29% decrease. Over the past 30 days, BTC has seen a 12% decline. BTC’s market cap has reached the $1.2 trillion mark following the recent drop.

In a post on Wednesday, CryptoQuant founder Ki Young Ju argued that selling the transferred Bitcoin would not affect the market. The analyst pointed to the sell-side volume usually managed by Coinbase Prime.

US gov't sold 4K #Bitcoin today, but less likely to impact the market.

Coinbase Prime handled 20-49K BTC in sell-side liquidity daily during high spot ETF inflows and 6-15K daily during low spot ETF inflows.

Posting this because I'm tired of "gov't selling" FUDs. pic.twitter.com/4IrO1aBGO6

— Ki Young Ju (@ki_young_ju) June 26, 2024

US Government Holds Bitcoin Worth $13B

The US government also holds substantial amounts of Bitcoin obtained through seizures and asset forfeiture. According to Arkham data, the US government currently holds about 214,000 BTC, worth $13 billion at the time of this writing. This makes it one of the largest Bitcoin holders globally. The German government closely follows as the world’s fourth-largest sovereign holder of BTC, with 45,263 coins, trailing behind China and Great Britain.

Casa co-founder and Bitcoin educator Jameson Lopp has tracked US government Bitcoin sales and found that it has seized and sold at least 195,091 BTC since 2014, earning over $366 million. This shows governments’ proactive management of seized assets, which substantially impacts the cryptocurrency ecosystem. The ongoing involvement of the US and German governments in the cryptocurrency market remains a pivotal factor in shaping BTC and other digital currencies’ market dynamics.

Fear of Government Sell-off

Following rumors that the German government was liquidating its Bitcoin holdings, estimated to be worth $2.76 billion, market players have become fearful. The crypto community believes that government sell-offs could negatively affect the Bitcoin market. The most recent transaction from the German government occurred on June 26, 2024. It involved sending 345 Bitcoin to a wallet labeled “Flow Traders.”

Selling pressure from the Mt. Gox bankruptcy estate has also raised investor concerns about a BTC price drop. The former exchange plans to unload 140,000 BTC to compensate those affected by the infamous 2014 Mt. Gox incident.

Learn More

- Altcoins’ Rally Unlikely Until After February 2025, Analysts Warn

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins

- Best Metaverse Coins to Invest – Next Metaverse Coins