Highlights:

- Bitcoin price drops 2% to $94,104 as trading volume spikes to $57.37.

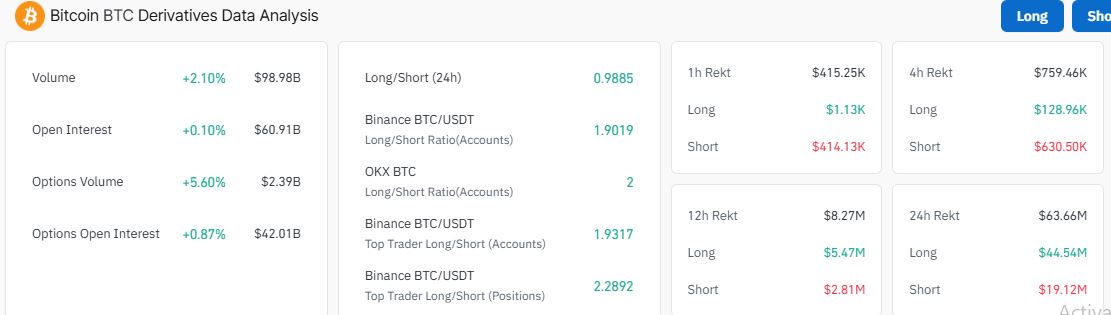

- Coinglass data shows rising open interest and volume in the BTC market.

- Crypto analyst says Bitcoin still enjoys positive momentum despite the recent price correction based on the MVRV.

The Bitcoin price has dwindled 2% to $94,104, suggesting waning bullish sentiment. Despite the drop, its daily trading volume has soared 1% to $57.37 billion, indicating renewed investor confidence. BTC is now down 11% in a week3% in a month but has risen 115% in a year.

Meanwhile, according to on-chain metrics data, recent indications hint that the pioneering cryptocurrency is setting up for a significant rally soon. Coinglass data shows rising open interest and volume in the BTC market, suggesting that new money flows into the market.

Elsewhere, Ali-charts, a renowned crypto analyst, has noted that Bitcoin still enjoys positive momentum despite the recent price correction based on the MVRV.

#Bitcoin $BTC still enjoys positive momentum despite the recent price correction, based on the MVRV. pic.twitter.com/Mi6wYnYW3x

— Ali (@ali_charts) December 24, 2024

With new money flowing into the BTC market and the altcoin enjoying positive momentum, is a rebound above $100K soon? Let’s dive into the technical analysis and decrypt more.

Bitcoin Statistical Data

Based on CoinmarketCap data:

- BTC price now – $94,104

- Trading volume (24h) – $57.37 billion

- Market cap – $1.88 trillion

- Total supply – 19.8 million

- Circulating supply – 19.8 million

- BTC ranking – #1

Bitcoin Price to Rally Above $100K If Support Levels Hold

Bitcoin price is still struggling to reclaim the $100,000 mark as the bears entirely take the reins. The pioneering cryptocurrency has plunged below the ascending parallel channel, currently trading at $94,104, a 13% drop from its ATH at $108,364. However, the support levels are still intact, suggesting that the bulls may gain momentum and rally above the $100K mark.

Bitcoin is trading above all key moving averages, including the 50-day Simple Moving Average (SMA) and the 200-day SMA. This tilts the odds towards the upside, giving the bulls the upper hand. The buyers have established immediate support at $93,985, coinciding with the 50-day SMA, and $70,566, coinciding with the 200-day SMA. If the bulls gain momentum at this level, the altcoin will rebound to the $99,802 mark. In a highly bullish case, the Bitcoin price would rally to the $102,860 mark.

Moreover, despite the correction in the BTC market, renowned analyst @ali_charts on X says that the Accumulation Trend Score indicates strong buying interest in Bitcoin, signaling elevated accumulation levels. This might trigger a rebound as soon as possible, sending the Bitcoin price above the $100,000 mark.

The Accumulation Trend Score indicates strong buying interest in #Bitcoin $BTC, signaling elevated accumulation levels. pic.twitter.com/9A9XpFbIyJ

— Ali (@ali_charts) December 24, 2024

The Relative Strength Index (RSI) is below the 50-mean level at 43.01. This suggests waning bullish momentum, tilting the odds in favor of the sellers. The southbound RSI shows momentum falling. Increased selling pressure will cause the Bitcoin price to drop.

If the $93,985 support gives way, the Bitcoin price could fall through. Nevertheless, the bullish sentiment for the BTC price would only be invalidated below that support. Such a move would also indicate a change in market structure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.