Highlights:

- Bitcoin’s price drops over the past week, but long-term growth remains positive.

- Ali Martinez and Van de Poppe advise waiting for better Bitcoin entry points before investing.

- Over 70,000 BTC withdrawn from exchanges signals growing investor confidence and potential rally.

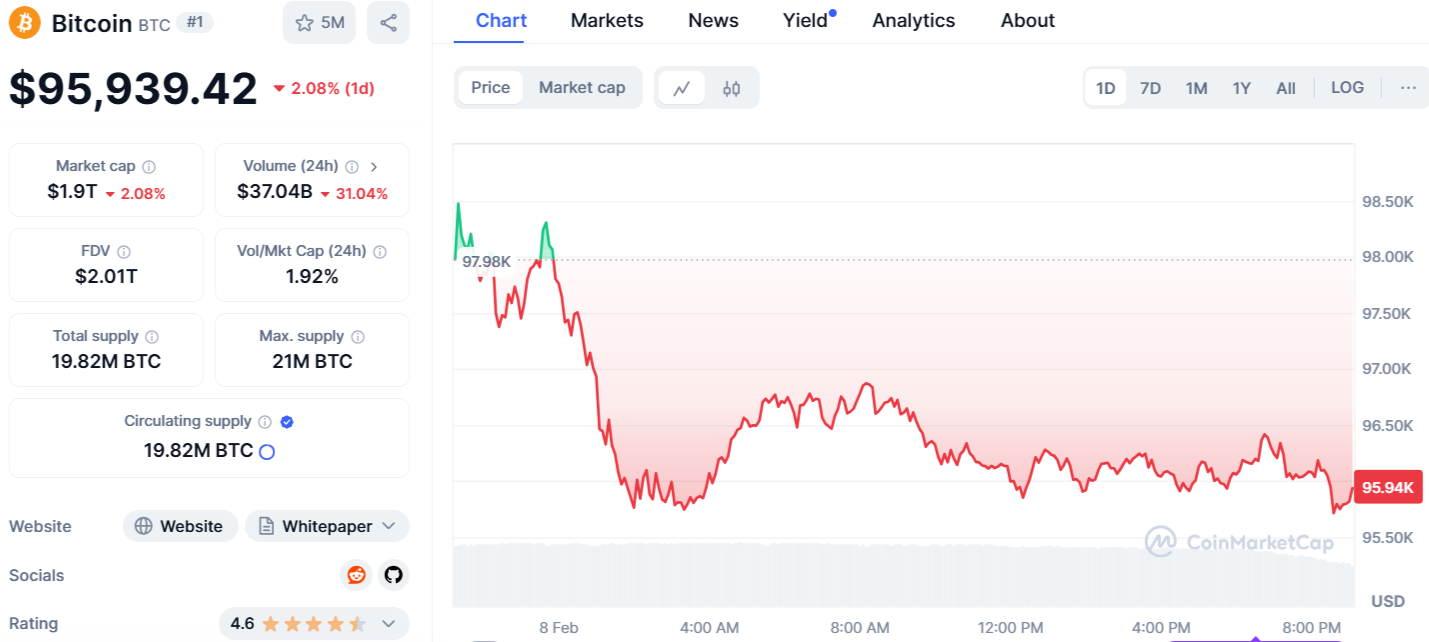

Bitcoin is currently priced at $95,939, showing a 2.08% drop in the last 24 hours and a 6.14% decline over the past week. With a market cap of $1.9 trillion and 21 million BTC in circulation, Bitcoin remains a market leader. Although it’s experiencing short-term declines, long-term forecasts remain positive.

Bitcoin’s price has remained between $90K and $100K for a while, influenced by macroeconomic concerns and other factors that have weakened market sentiment. Trump’s tariff dispute with China and Canada triggered a drop in BTC at the start of February. Bitcoin Reserve plans sparked a price surge in January, but with no updates, the market responded negatively. Pro-crypto initiatives from the US Senate Banking Subcommittee failed to boost Bitcoin prices.

Despite the current turbulence, top market experts expect further declines in Bitcoin’s price, suggesting more buying opportunities for investors.

Ali Martinez Advises Traders to Wait for Better Bitcoin Entry Points

Analyst Ali Martinez recommends traders hold off on major investments and wait for more advantageous entry points. Historically, the best buying opportunities for Bitcoin have come when traders are facing a 12% loss. However, current data shows a 0.21% profit, suggesting there is still room for a decline before a significant uptrend.

The best buying opportunities for #Bitcoin $BTC historically come when traders are at a -12% loss. Right now, they’re still sitting at 0.21% in profit, suggesting there may still be room for a better entry! pic.twitter.com/7yp1pmqp9k

— Ali (@ali_charts) February 8, 2025

Van de Poppe Foresees Bitcoin Price Dip to $90K Before Major Rally

Martinez’s caution ties into Michael van de Poppe’s recent analysis, where he highlighted $90,000 as a key buying zone for Bitcoin. Van de Poppe also notes that Bitcoin is currently in a “place of boredom,” with little price movement, but expects a dip to the lower boundary to present an excellent entry point for investors. His analysis also shows $104K as a key resistance level. If Bitcoin surpasses this, it could trigger a rally toward a new all-time high. “Test the highs again = likely new ATH on the horizon.” van de Poppe said.

#Bitcoin is currently in a place of boredom.

Drop to lower bound = entry

Test the highs again = likely new ATH on the horizonIt's not that hard. pic.twitter.com/awnav8vs7o

— Michaël van de Poppe (@CryptoMichNL) February 8, 2025

70K BTC Withdrawals Signal Investor Confidence and Rally Potential

Short-term predictions suggest a decline, but on-chain data shows growing confidence from investors. Ali Martinez recently reported that over 70,000 BTC were withdrawn from exchanges in the past week. Large withdrawals often signal that investors are shifting their holdings to private wallets, which reduces selling pressure. This trend has frequently been followed by significant Bitcoin price rallies.

Over 70,000 #Bitcoin $BTC have been withdrawn from exchanges in the past week, signaling long-term confidence! pic.twitter.com/d0KfDTud2M

— Ali (@ali_charts) February 8, 2025

In a recent interview, Fred Thiel, CEO of Marathon Holdings Inc., forecasted that Bitcoin could more than double in value by the end of the year. He expects the price to range between $150,000 and $200,000, driven by rising demand from institutional investors and a more favorable regulatory environment. He also pointed out that significant Bitcoin sales typically spark strong buying interest, helping to maintain prices within the $95,000 to $100,000 range.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.