Highlights:

- The Bitcoin price has rebounded from the $111K level, currently up 0.38% to the $113,300 mark.

- Ali Martinez has noted that about 120 million in profits is locked in by long-term BTC holders.

- The CoinGlass Liquidation heatmap suggests that bullish sentiment is emerging, potentially driving BTC to $130K.

The Bitcoin price has rebounded strongly from the $111k levels, currently at $113,300, marking a 0.38% surge. Meanwhile, Bitcoin is seeing one of the quietest periods in years, according to many analysts.

According to CryptoQuant data, Bitcoin has entered a phase of low volatility due to a drying exchange supply, tight investor positioning, and calm derivatives markets. In terms of market sentiment, funding rates across exchanges have remained steady, with slight fluctuations. The funding rate chart indicates that Bitcoin’s price action has shown relatively smaller swings compared to the “extreme volatility” periods.

Bitcoin’s Calm Before the Storm

“These three signals paint a consistent picture: exchange supply is drying up, investors are sitting tight, and derivatives markets are calm. While implied volatility points to one of the quietest phases in years.” – By @xwinfinance pic.twitter.com/e5aGBbcpb0

— CryptoQuant.com (@cryptoquant_com) September 24, 2025

Since traders do not expect volatility, the options premium is low. The calmness in the market is making many speculate that this phase won’t last long and a storm is on the way. A storm is a rapid uptrend or correction triggered by external factors or market events.

Additionally, Ali Martnez’s recent data suggests that long-term Bitcoin holders have pocketed profits over the last few weeks. The most recent figures indicate that long-term whales are taking profits of approximately $120 million.

This suggests that the current price levels have been useful, but implies a concern about them potentially dumping on future volatility. The chart of recently realized profits indicates a disparity between the price and the profits locked in by long-term holders, suggesting that the market is at a crossroads.

$120 million in profits locked in by long-term Bitcoin $BTC holders! pic.twitter.com/VdmCvqzaVE

— Ali (@ali_charts) September 24, 2025

Bitcoin Price Moves Into Consolidation

The BTC/USD daily chart indicates that the altcoin has entered a consolidation channel. Currently, the bulls have established a strong support at $103,877, aligning with the 200-day SMA. However, the immediate resistance at $114,338 cushions the bulls against further upside.

The current Relative Strength Index (RSI) is 47.03, indicating a neutral zone. This indicates that Bitcoin is neither overbought nor oversold, which supports the idea of a consolidating market. However, there is still more room for the upside if the bulls regain momentum.

Can BTC Overcome $114K Resistance Mark?

If the market dips, the bulls might hold the line around the $110,000 level, which marks the lower boundary of the channel. A drop below 110,000 could spell trouble and could send the BTC price to $108K.

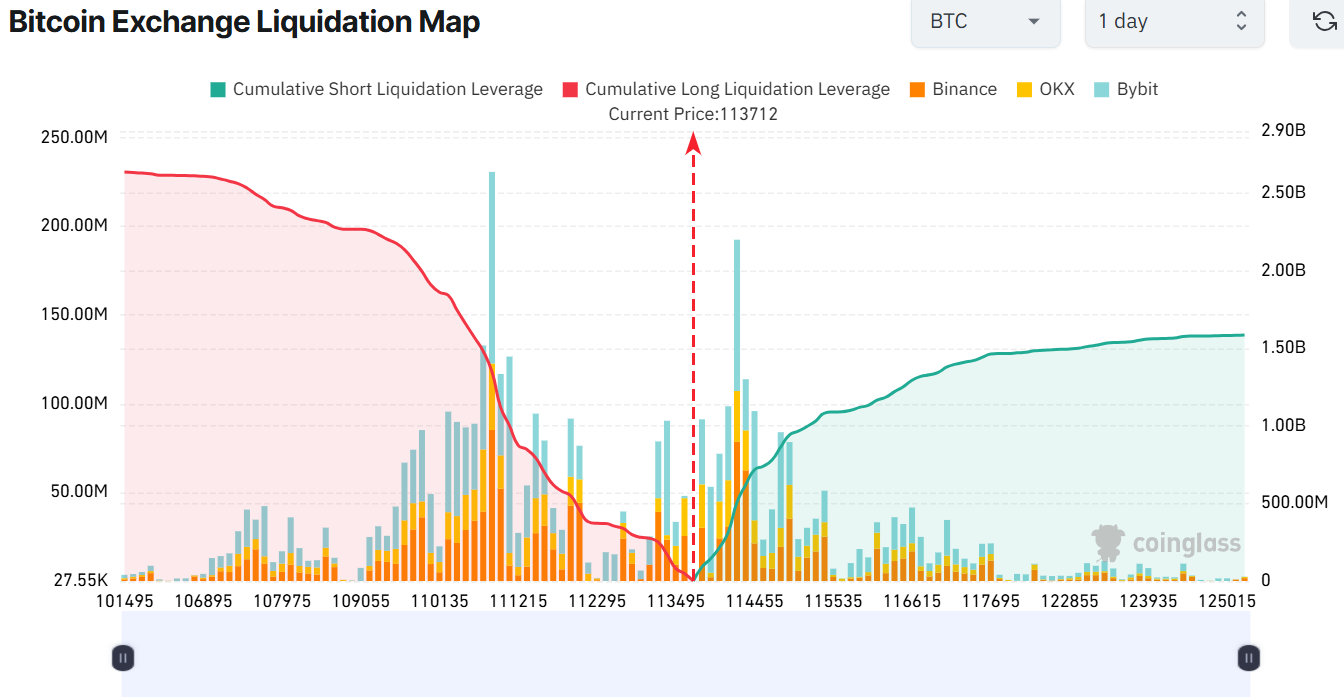

Data from the Coinglass Liquidation Map shows that there was more cumulative long liquidation leverage ($2.64 billion) compared to shorts ($1.59 billion) in the last 24 hours. This imbalance suggests that bullish sentiment is creeping back in the current BTC market. This is because traders anticipate the price may rise further in the coming weeks.

Meanwhile, in the short term, traders can expect volatility. The support at $110K could be tested if panic selling sets in. If the level holds, there might be a bounce back to above $114k resistance, aligning with the 50 SMA. In the long term, if markets stabilize, Bitcoin price could rally to the $ 130,000 mark, but sentiment is the key factor now. For the high-risk appetite investor, this is a “buy the dip” moment.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.