Highlights:

- Bitcoin whales offloaded nearly 115K BTC worth $12.7 billion, unsettling short-term prices.

- Analysts warn that large-holder selling may continue, but weekly balance shifts are slowing.

- Long-term charts show resilience, with Bitcoin only 13% down from the August peak.

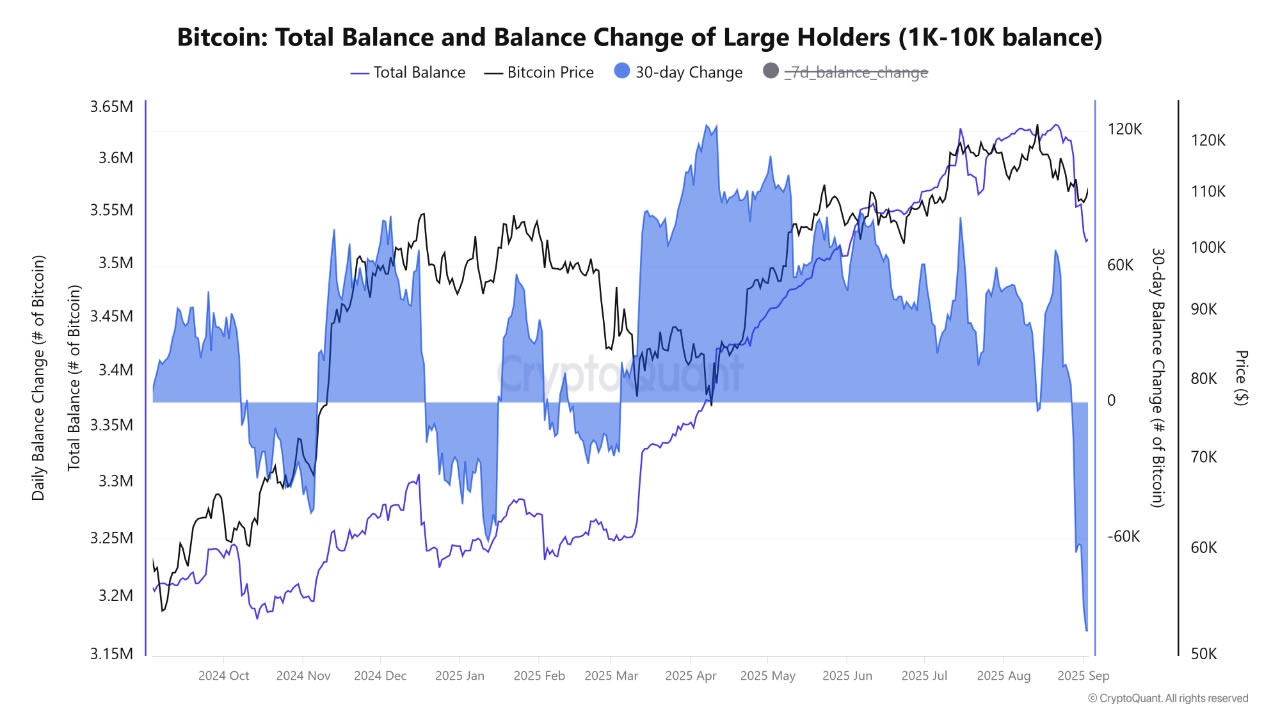

Bitcoin has faced heavy selling from large holders during the past month, sparking fresh volatility across the market. Data from CryptoQuant revealed that around 114,920 BTC, worth nearly $12.7 billion, was sold in just 30 days.

CryptoQuant analyst “caueconomy” commented, “The trend of reducing exposure by major Bitcoin network players continues to intensify, reaching the largest coin distribution this year.” The analyst explained that over 100,000 BTC left whale holdings, showing strong caution from big investors. This heavy selling pushed Bitcoin’s value under $108,000, marking the sharpest whale-driven decline in recent years. “At this time, we are still seeing these reductions in the portfolios of major players, which may continue to pressure Bitcoin in the coming weeks,” the analyst added.

On September 3, the seven-day daily change balance recorded its highest level since March 2021, with more than 95,000 BTC shifted by whales in a single week. CryptoQuant defines whales as holders with 1,000 to 10,000 BTC in their wallets. The selling trend, however, has started to cool slightly. As of September 6, the weekly whale balance shift declined to nearly 38,000 BTC. During the following three days, Bitcoin prices stabilized, moving within a narrow band of $110,000 to $111,000 as selling pressure started to ease.

Strategy and Other Firms Cut Back on BTC Buys

Another trend shows waning institutional appetite. BTC treasuries hold a record 840K BTC this year, but the pace of growth has slowed. CryptoQuant data revealed that Strategy, the largest holder with 637,000 BTC, cut monthly buys from 134,000 in November to just 3,700 in August this year.

Other companies also reduced their Bitcoin buys during this period, with totals reaching only 14,800 BTC, far below the yearly peak of 66,000 BTC. Transactions remain frequent, but the purchase size has shrunk sharply.

Bitcoin treasuries hit a record 840K BTC in 2025.

But growth has slowed sharply, Strategy’s monthly buys collapsed from +134K in Nov 2024 to just 3.7K in Aug 2025.

Smaller, cautious transactions show institutional demand is weakening despite the headline record. pic.twitter.com/rwLsqrz21N

— CryptoQuant.com (@cryptoquant_com) September 5, 2025

This slowdown points to caution and possible liquidity pressure. Institutions continue participating in the market, yet their reduced transaction sizes reflect hesitance in current conditions, even as overall treasury holdings remain at record highs.

Long-Term Bitcoin Trend Stays Strong

Some remain optimistic despite the scale of the dump. Bitcoin entrepreneur David Bailey argued last week that the asset could surge toward $150,000 if two dominant whales end their selling. This view highlights the outsized influence of a few large holders on price direction.

Institutional investors have also played a role in balancing the market. “While recent whale sell-offs have triggered short-term volatility and liquidations, institutional accumulation adding more BTC during the same period has provided a structural counterbalance,” said Nick Ruck, director at LVRG Research.

Long-term charts are showing a healthier base than in earlier corrections. Bitcoin has only corrected 13% from an all-time high in mid-August, a vastly smaller retracement than in earlier cycles. The analyst “Dave the wave” wrote Sunday that the one-year average, which was around $52,000 a year earlier, has now jumped to around $94,000. He continued and added that the level is set to move up above $100,000 in September.

A year ago today, the #btc 1 year moving average sat at 52K. It now sits at 94k. Next month, it will be through 100k.😎 pic.twitter.com/vEZLhYd6To

— dave the wave🌊🌓 (@davthewave) September 7, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.