Highlights:

- On January 31, Bitcoin ETFs had their fourth net inflows of the week.

- The profits raised the BTC funds’ cumulative net inflows above the $40 billion landmark.

- If sustained, the new trend can renew Bitcoin’s price surge optimism.

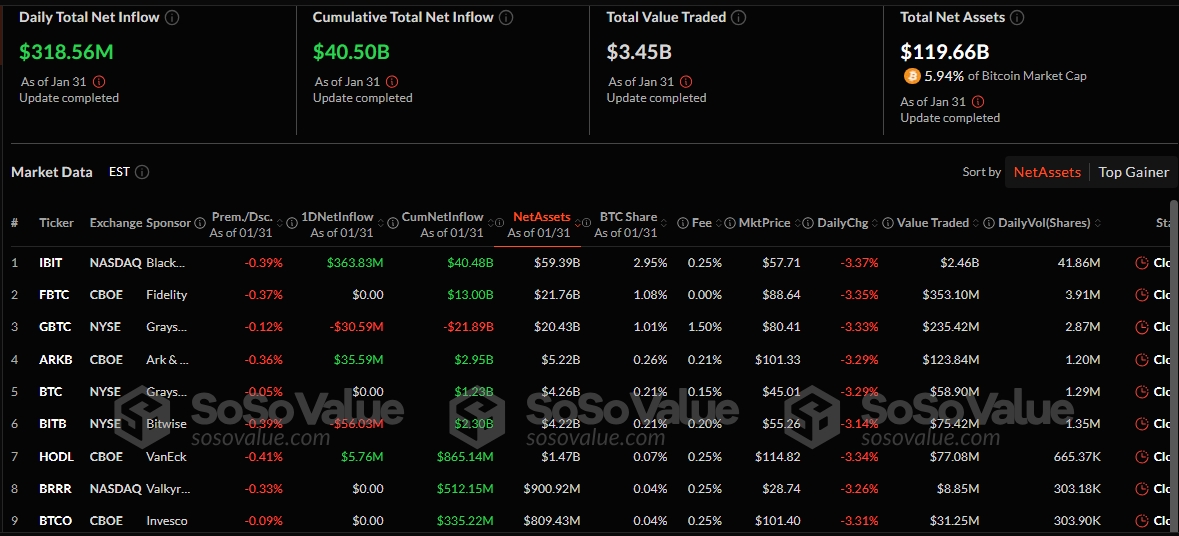

Bitcoin (BTC) Exchange Traded Funds (ETFs) had profits of about $318.56 million on the last day of January, extending their net inflows to four consecutive days. With the latest gains, Bitcoin ETF’s cumulative net inflows broke above $40 billion. It is worth approximately $40.5 billion, sparking optimism for the future.

Moreover, yesterday’s gains implied that Bitcoin ETFs recorded profits on their last trading of the week. In addition, the funds had net inflows in four out of five days. Overall, the gainful week resulted in the ETFs attracting $559.84 million in net weekly profits. The weekly figure implies that the profitable streak has extended into a fifth consecutive day.

💥BREAKING: Yesterday the Spot #Bitcoin ETF saw $318.6 MILLION inflow! pic.twitter.com/Ic9tCDrwDP

— Crypto Rover (@rovercrc) February 1, 2025

BlackRock Continues to Display Impressive Figures

Since its inception, BlackRock Bitcoin ETF (IBIT) has remained at the fulcrum of the funds’ remarkable statistics. The trend was evident in yesterday’s outing, which saw IBIT attract $363.83 million in gains. Notedly, the profit skyrocketed IBIT’s cumulative net inflows to about $40.48 billion, cementing BlackRock’s position as the most valuable Bitcoin ETF.

Fidelity Bitcoin ETF (FETH), which ranks as the second most profitable fund, saw zero activity yesterday. Its cumulative net inflows remained fixed at about $13 billion, highlighting a significant margin relative to IBIT. Aside from IBIT, five funds were active yesterday. Two ETFs, Grayscale Bitcoin ETF (GBTC) and Bitwise Bitcoin ETF (BITB), had losses worth $30.59 million and $56.03 million, respectively.

Other profitable funds were ARK 21Shares Bitcoin ETF (ARKB) and VanEck Bitcoin ETF (HODL). Both brought in about $35.59 million and $5.76 million, respectively. Unlike the cumulative net inflows, the total value traded and net assets dropped. The value traded depreciated from $21.26 billion to $16.68 billion, while the net assets valuation decreased from $123.06 billion to $119.66 billion.

Bitcoin Price Drops Slightly

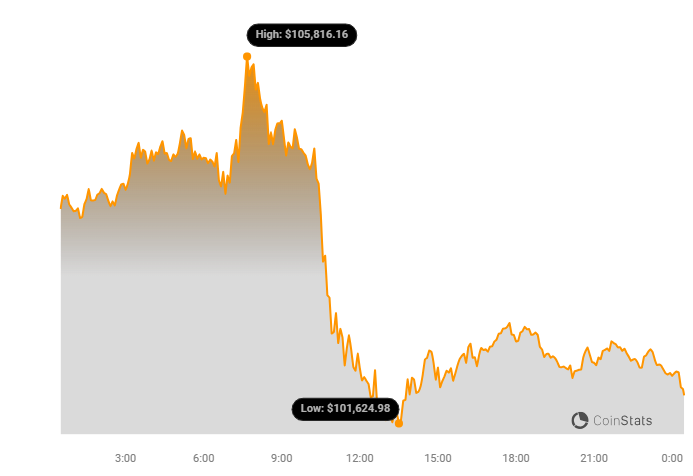

At the time of writing, Bitcoin is changing hands at approximately $102,000, reflecting a 2% decline in the past 24 hours. Within a daily timeframe, BTC oscillated between price extremes ranging from $101,624 – $105,816.

This shows that despite its price struggles, the token managed to sustain prices above $100,000. Therefore, if market conditions remain favorable, like the positive ETF flow, BTC could be on a journey to attaining greater heights.

Following the slight price declines, Bitcoin’s market capitalization dropped to approximately $2.025 trillion. Despite the price drops, Bitcoin’s 24-hour trading volume is up by about 15.59% and has a $43.36 billion valuation. The raised trading volume signifies a potential spiking network activity.

Strategic Bitcoin Reserves Steps Up Among States in the US

While investors continue to display faith in BTC via investment in the token through ETFs and private procurements, States in the US are making efforts to establish state-owned Bitcoin reserves. In a tweet, a verified X user, Kashif Raza, shared a detailed pictogram of some US states and how they have progressed in the push for strategic Bitcoin reserves.

In the shared image, fifteen states had already begun and completed public endorsement for the asset class. Among these fifteen states, eleven had introduced bills for the reserves, while the remaining four are still in the process of bill introduction.

Out of the eleven states that have successfully introduced bills – two, including Arizona and Utah, have commenced and concluded committee approval. Presently, these two states are in the process of finalizing House or Senate approval before the final stage that entails signing the reserves into law.

Bitcoin, The Asset Everyone Wants 🔥

From governments to individuals, everyone is racing to secure BTC.

🇺🇸America is stepping up for Bitcoin

[ @Eric_BIGfund ] pic.twitter.com/WhmZgBjPht

— Kashif Raza (@simplykashif) February 1, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.