Highlights:

- Bitcoin ETFs witnessed third consecutive outflows for the week with $120.76 million in losses.

- Ethereum ETFs registered slight net inflows with gains of about $3.06 million.

- Bitcoin and Ethereum prices were below crucial levels following slight declines in the past 24 hours.

According to SosoValue’s statistics, Bitcoin (BTC) Exchange-Traded Funds (ETFs) suffered net outflows in their most recent flow data. Notably, the recently incurred losses imply that the BTC ETFs have registered net outflows for the third consecutive day.

Consequently, like the previous week, chances abound that the commodities might conclude this week in losses. On the other hand, Ethereum ETFs saw net inflows to record their first-ever profits for the week after seeing zero flows on two occasions.

On October 10, the total net outflow of Bitcoin spot ETF was $121 million, and the net inflow of Ethereum spot ETF was $3.06 million. https://t.co/59u0BnEqLG

— Wu Blockchain (@WuBlockchain) October 11, 2024

Bitcoin ETFs Record Activities from Six Entities

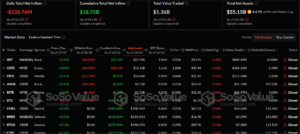

On October 10, Bitcoin ETFs witnessed approximately $120.76 million in net outflows from six commodities. Notably, the remaining five entities saw zero flows, as none saw inflows. Fidelity Bitcoin ETF (FBTC) topped the Bitcoin ETF losses chart with about $33.79 million in outflows. Meanwhile, ARK 21Shares Bitcoin ETF (ARKB) and Grayscale Mini Bitcoin ETF (BTC) followed closely, with losses of about $30.3 million and $21.16 million, respectively.

Other Bitcoin entities that recorded profits include Grayscale Bitcoin ETF (GBTC), with $18.52 million, BlackRock Bitcoin ETF (IBIT), with $10.83 million, and Bitwise Bitcoin ETF (BITB), with $6.16 million. Following its recent flow data, Bitcoin ETFs cumulative net inflow dropped slightly to about $18.55 billion. The total value traded was $1.36 billion, while total net assets reflected $55.15 billion, representing 4.67% of Bitcoin’s market capitalization.

Ethereum ETFs Record Net Inflows with Over $10 Million Contribution from ETHA

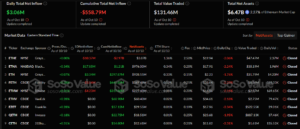

Unlike Bitcoin, Ethereum ETFs registered net profits as five commodities witnessed activities, while four recorded zero flows. Notedly, two entities saw inflows, which include BlackRock Ethereum ETF (ETHA) and Grayscale Mini Ethereum ETF (ETH). Both commodities saw profits of about $17.85 million and $3.34 million, respectively.

Three other entities registered losses. They include Grayscale Ethereum ETF (ETHE) with $10.37 million, Bitwise Ethereum ETF (ETHW) with $4.23 million, and Fidelity Ethereum ETF (FETH) with $3.54 million. Consequently, ETH ETFs daily total net inflow amounted to about $3.06 million. Overall, the cumulative net inflow has continued to wallow in losses of about $558.79 million. The total value traded reflected $131.46 million, while total net assets were $6.47 billion. Interestingly, the total net assets represent 2.27% of Ethereum’s

Bitcoin’s Price Recovers Slightly After Yesterday’s Drop

At the time of writing, Bitcoin is changing hands at approximately $61,000, reflecting a subtle 0.1% decline in the past 24 hours. Within the same timeframe, the flagship crypto saw minimum and maximum prices, ranging between $58,935.06 – $61,247.12. The price extremes reflect how well Bitcoin has recovered within a short time interval.

Meanwhile, in its other specific periods’ price change variable, BTC saw declines apart from its 30-day-to-date variable, which saw a 7.8% upswing. For context, the 7-day-to-date and 14-day-to-date statistics saw drops of approximately 0.5% and 7.3%, respectively. Its 24-hour trading volume is up by 9.23%, with a $30.68 billion valuation.

Ethereum Stabilizes Around $2,400

After several attempts to break above $2,500, ETH seems to stabilize around the $2,400 price region. At the time of writing, ETH has a market valuation of about $2,410, reflecting a 0.7% upswing in the past 24 hours. In its 7-day-to-date and 30-day-to-date variables, ETH saw upswings of 1.5% and 3.7%, respectively. However, its 14-day-to-date statistics reflected a 9.1% decline.