Highlights:

- Spot Bitcoin ETFs saw $1.5 billion in outflows over four days.

- BlackRock’s IBIT led Bitcoin ETF outflows with $188.7 million on December 24.

- Spot Ether ETFs gained $53.5 million, with BlackRock’s ETHA leading inflows.

U.S.-based spot Bitcoin (BTC) exchange-traded funds (ETFs) have experienced a significant reversal, losing over $1.5 billion in just four days. This is the longest outflow streak since Donald Trump’s re-election, which had boosted the market.

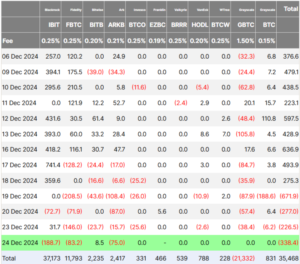

On December 24, spot Bitcoin ETFs saw a daily net outflow of $338.4 million, as per data from Farside Investors. Since December 19, these funds have faced a combined net outflow of $1.52 billion. The outflow streak comes after 15 straight days of inflows, ending December 18, which brought in over $6.7 billion.

BlackRock’s Bitcoin ETF Leads with $188.7 Million Loss

BlackRock’s iShares Bitcoin Trust ETF (IBIT) experienced $188.7 million in outflows on December 24. Fidelity Bitcoin ETF (FBTC) followed, with $83.2 million leaving the fund. ARK 21Shares Bitcoin ETF (ARKB) also experienced significant outflows, logging $75 million in net losses. The only fund to see net inflows was Bitwise Bitcoin ETF (BITB), which gained $8.5 million. Seven other funds reported no activity for the day. Meanwhile, Franklin Templeton’s EZBC remained unreported.

The 12 spot Bitcoin ETFs recorded a total trading volume of $2.16 billion on Tuesday. Their combined total net inflow reached $35.5 billion.

Spot Ether ETFs See Strong Inflows Led by BlackRock’s ETHA

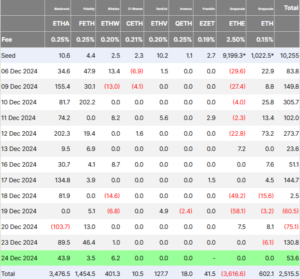

Spot Ether ETFs reported net inflows of $53.6 million on Tuesday. BlackRock Ethereum ETF (ETHA) led the inflows with $43.9 million. Bitwise Ethereum ETF (ETHW) fund followed, recording inflows of $6.2 million. Fidelity Ethereum ETF (FETH) also saw $3.5 million flow into the fund.

Introduced in July, Ether funds initially lagged behind the strong momentum witnessed by spot Bitcoin ETFs after their January debut. Despite the slow start, Ether ETFs gained significant traction from late November. They enjoyed an 18-day streak of inflows, which ended on December 18.

Analyst Predicts Ethereum Could Outperform Bitcoin in January Next Year

Bitcoin was priced at $98,091, reflecting a 4.11% rise over the past 24 hours. Ether, meanwhile, traded at $3,482, marking a 2.76% increase during the same period, according to CoinMarketCap at the time of writing.

TradingView data indicates that the current ETH/BTC ratio stands at 0.0356. Michael van de Poppe, founder of MN Capital, shared in a December 24 X post that he “wouldn’t be surprised if $ETH/$BTC breaks through 0.04 in January.”

The ETH/BTC ratio last reached 0.04 on December 8, when Ether traded just above the $4,000 mark at $4,018. Van de Poppe predicts that Ether will see increased inflows in January next year, while Bitcoin may experience outflows. He believes this could lead to Bitcoin’s price consolidating and trigger an “altcoin run.”

Wouldn't be surprised if $ETH / $BTC breaks through 0.04 in January.

Inflow in $ETH, outflow in $BTC.

Consolidation in Bitcoin –> #Altcoin run in Ethereum ecosystem.

— Michaël van de Poppe (@CryptoMichNL) December 24, 2024

Some analysts believe that spot Ether exchange-traded funds could outperform Bitcoin ETFs in 2025. In a December 20 X post, ETF Store President Nate Geraci highlighted that net inflows into ETH ETFs are currently on pace with gold ETFs. He also expects inflows to accelerate moving forward.

Pseudonymous crypto trader Brent expressed a similar sentiment. On X, he said ETH is the most under-owned asset globally.

ETH is the most underowned asset in the world

study what happens to a ball forcibly held under water

— Brent (@Brentsketit) December 24, 2024

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.