Highlights:

- Bitcoin ETFs record massive rebound with over $180 million in net inflows.

- Ethereum ETFs sustained two days of consecutive back-to-back net outflows with minimal activities.

- In the past 24 hours, Bitcoin registered a price upswing above 3%, while Ethereum’s increment was below 1%.

Bitcoin (BTC) Exchange Traded Funds (ETFs) saw a massive rebound in its September 17 flow data with approximately $186.8 in net inflows. Interestingly, the remarkable commodities flow data coincided with a Bitcoin transient price breakout that saw the token hit $61,000. Unlike BTC, Ethereum ETFs witnessed back-to-back outflows with $15.1 million in losses.

🇺🇸 Spot ETF: 🟢$187M to $BTC and 🔴$15.1M to $ETH

🗓️ Sep 17, 2024👉 The net flow for the BTC ETFs rebounded strongly again as the BTC price broke through $61K yesterday!

👉 The ETH EFTs, on the other hand, saw a heavier net outflow than the previous trading day.

Follow… pic.twitter.com/mxMPTpvFpl

— Spot On Chain (@spotonchain) September 18, 2024

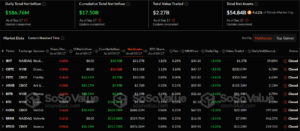

Bitcoin ETFs Record Fourth Consecutive Inflows as it Rebounds Significantly

Bitcoin ETFs’ latest flow data saw heightened commodities’ activities, with seven witnessing inflows, while the remaining four had zero activities. Meanwhile, the positive flow implies that BTC ETFs are on a profitable four-day streak.

Despite being the most profitable ETF commodity, BlackRock Bitcoin ETF (IBIT) was among the entities that saw zero flows. Others include Grayscale Mini BTC ETF (BTC), Valkyrie Bitcoin ETF (BRRR), and Grayscale Bitcoin ETF (GBTC).

In net Inflows, Fidelity Bitcoin ETF (FBTC) and Bitwise Bitcoin ETF (BITB) led the pack with about $56.6 million and $45.4 million, respectively. Meanwhile, ARK 21Shares Bitcoin ETF (ARKB), VanEck Bitcoin ETF (HODL), and Invesco Bitcoin ETF (BTCO) followed closely in third, fourth, and fifth spots, respectively. They witnessed inflows of approximately $42.2 million, $20.5 million, and $10.2 million.

Other Bitcoin ETFs that recorded gains were Franklin Bitcoin ETF (EZBC) and WisdomTree Bitcoin ETF (BTCW). Both commodities registered inflows of roughly $8.7 million and $3.2 million, respectively. Bitcoin’s cumulative net inflow continues to soar, with approximately $17.5 billion in gains. The total value traded reflected $2.27 billion, while total net assets were $54.84 billion.

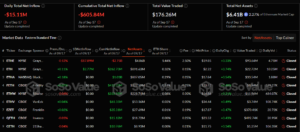

Ethereum ETFs Register Minimal Activities

Unlike its Bitcoin counterparts, Ethereum ETFs registered flows from only two entities, which invariably implies that seven had no activities. Grayscale Mini Ethereum ETF (ETH) witnessed the only net inflow at about $2.8 million. On the other hand, the only net outflow was from Grayscale Ethereum ETF (ETHE). The commodity welcomed roughly $17.9 million in losses.

Consequently, Ethereum’s cumulative netflow has continued to thread in losses at about $605.84 million. The total value traded read approximately $17.26 million, while total net assets reflected $6.41 billion. Notably, the total net assets value represented 2.27% of Ethereum’s $279.33 billion market capitalization.

Bitcoin Revisits Levels Above $60,000

At the time of writing, Bitcoin is changing hands at about $60,300, reflecting a 3.2% upswing in the past 24 hours. Within the same time frame, BTC recorded minimum and maximum values ranging between $58,409.01 – $61,242.97. The price extremes imply that despite the increment, Bitcoin has dropped slightly.

Meanwhile, Bitcoin’s other specific period variable has remained profitable. In its 7-day-to-date data, BTC saw a 7.2% upswing, with minimum and maximum prices ranging between $55,901.74 – $61,231.62. Hence, it underscores a remarkable recovery from the previous week that kept Bitcoin below $60,000 for an extended period.

Moving over to Bitcoin’s 14-day-to-date and 30-day-to-date variables, the pioneer crypto asset equally recorded increments of about 6.5% and 3.0%, respectively. BTC’s 24-hour trading volume also recorded a 39.31% jump with an over $40 billion valuation.

Ethereum Records Slight Upswing in its 24-Hour Price Change Data

Unlike Bitcoin, Ethereum is up by an insignificant 0.8% from the previous day, with its selling price around the $2,300 region. In the past 24 hours, it recorded minimum and maximum prices, ranging between $2,295.70 – $2,413.24.

The past seven days saw declines of approximately 0.3%, with price extremes reflecting $2,271.99 – $2,460.34. Therefore, it underscores the assertion that ETH’s price growth is insignificant relative to Bitcoin’s. Notedly, Ethereum’s 14-day-to-date and month-to-date statistics also recorded declines of about 2.2% and 11.8%, respectively.