Highlights:

- Bitcoin ETFs see net outflows for the first time after eight successive days of recording inflows.

- ARKB led the massive Outflows in Bitcoin ETFs with over $100 million in losses.

- Ethereum ETFs continue to reflect losses, as the trend sustained for the ninth consecutive day.

After eight consecutive days of inflows, Bitcoin (BTC) ETFs have recorded losses as ARK 21Shares (ARKB) Bitcoin ETF witnessed over $100 million in losses. On the other hand, Ethereum (ETH) ETFs sustained their outflow trends, summing the unimpressive pattern to nine successive days. Interestingly, there were minimal activities in Bitcoin and Ethereum ETFs. However, BTC’s losses were more pronounced because it only had commodities registering losses.

🚨 US #ETF 27 AUG: 🔴$127M to $BTC and 🔴$3.4M to $ETH

🌟 BTC ETF UPDATE (not final): -$127M

• Yesterday’s net outflow ended an 8-day-inflow steak.

• #21Shares (ARKB) saw a massive outflow of $102M, its largest ever recorded.

• The above figure does not include Valkyrie… pic.twitter.com/Ih3iyOJgvc

— Spot On Chain (@spotonchain) August 28, 2024

Bitcoin ETFs See Net Outflows as ARKB Led Losses Chart

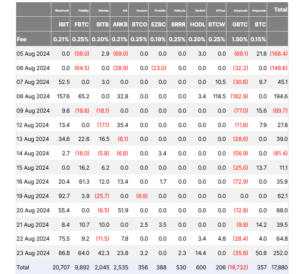

As earlier stated, ARKB saw the highest outflows among Bitcoin ETFs, with about $102 million in losses. ARKB’s over $100 million outflows appear massive and could impact Bitcoin’s price actions. Per Farside data, between August 9 and 27, the highest ever recorded outflows before ARKB’s $102 million was $77 million.

The $77 million losses on August 9 happened on the Grayscale Bitcoin (GBTC) ETF, renowned for leading most outflows. Therefore, it underscores the uniqueness of the latest flow trend, which investors would want to envisage as a transient occurrence. In the Bitcoin ETFs losses chart, GBTC followed ARKB as a wide margin exited between both entities. GBTC witnessed $18.3 million in losses, while Bitwise Bitcoin ETF (BITB) followed closely with approximately $6.8 million in outflows.

Aside from the three ETFs that registered losses, every other Bitcoin ETF had zero activities. Meanwhile, Valkyrie Bitcoin ETF (BRRR) data was pending at the time of drafting. However, chances are high that it could also reflect zero flows, considering its consistent zero activities pattern. Notably, between August 9 and 22, BRRR displayed zero flows until August 23, when it witnessed $2.3 million in gains. Subsequently, it returned to its zero flow pattern, underscoring why another zero activity appears Imminent.

Overall, Bitcoin ETFs August 26 cumulative outflows were roughly $127.1 million. The total flow for BTC ETFs since it graced the crypto market remained positive at about $17.956 billion. Other relevant statistics revealed that the total traded value of Bitcoin ETFs was about $1.2 billion. The total net assets were roughly $57.08 billion, representing 4.67% of Bitcoin’s market cap.

Ethereum ETFs Record Losses for Nine Consecutive Days

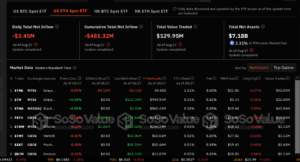

Contrary to Bitcoin ETFs breaking an 8-day successive inflow, Ethereum ETFs sustained outflow streak trends, summing up to nine days. The August 26 statistics revealed that Ethereum ETFs recorded minimal activities. Two registered inflows, while one witnessed outflows, culminating in about $3.4 million in losses. Fidelity Ethereum ETF (FETH) topped the inflow charts with $3.9 million. Bitwise Ethereum ETF (ETHW) followed closely with $1.9 million in inflows.

For losses, Grayscale Ethereum ETF (ETHE) recorded the only outflows with about $9.2 million. Hence, the cumulative net inflow has remained largely negative at approximately $481.32 million. The total value traded on Ethereum ETFs was $129.95 million. Meanwhile, in total net assets, the value recorded was $7.18 billion, representing 2.31% of Ethereum’s market cap.

BTC and ETH Prices Record Downtrends as the Crypto Market Plummets

At the time of press, the overall crypto market is down by 7% in its 24-hour price change variable. Consequently, Bitcoin, Ethereum, and several other cryptocurrencies have dropped considerably. BTC is changing hands at about $59,200, reflecting a 5.8% downtrend in the past 24 hours. Similarly, Ethereum is down, but by a higher margin. The last 24 hours saw the ETH price plunge by about 7.9% with a $2,460 market valuation.